2024 Benchmarking Metrics For Bootstrapped Saas Companies Saas Capital

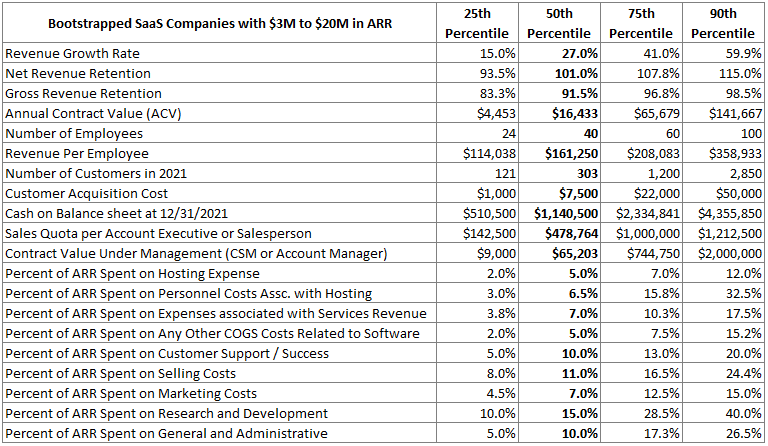

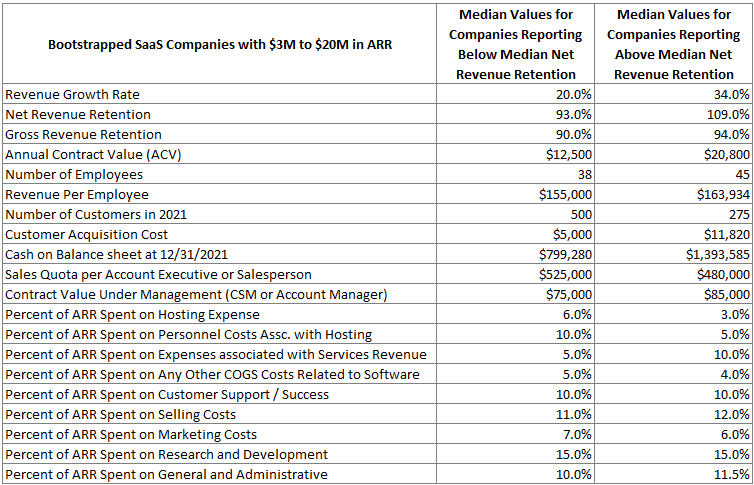

Benchmarking Metrics For Bootstrapped Saas Companies Saas Capital New data for 2024. from saas capital’s 13th annual survey of private b2b saas companies benchmarking metrics for bootstrapped saas companies. Over the 12 years that saas capital has been conducting its annual survey of private, b2b saas company metrics, many patterns have emerged. one is that there is a clear difference between the metrics of vc backed and bootstrapped companies.

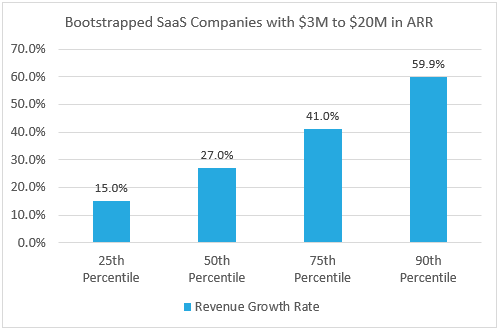

Benchmarking Metrics For Bootstrapped Saas Companies Saas Capital Access key saas metrics, data, and insights from the 8th annual saas benchmarks report — covering everything from arr and ai to retention, efficiency and more. We see this in the 2024 saas benchmarks data alongside public saas growth, vc funding activity as well as real time data from the profitwell by paddle b2b saas index. on the public saas side, median year on year growth rates have come down from 30 40% in 2021 2022 to 15% in 2024. Based on saas capital’s 13th annual b2b saas 1 company metrics survey, growth across most revenue brackets (arr categories) growth has decreased or remained stable from 2022 to 2023. bootstrapped companies faced a decline in growth rates across all revenue brackets, particularly at higher arr levels. Saas performance metrics benchmarking research uncovered that “growth at any cost” has been replaced with “lower growth at reduced efficiency”. the above statement is based upon the insights uncovered from the performance metrics data provided by ~ 1,000 b2b saas.

Benchmarking Metrics For Bootstrapped Saas Companies Saas Capital Based on saas capital’s 13th annual b2b saas 1 company metrics survey, growth across most revenue brackets (arr categories) growth has decreased or remained stable from 2022 to 2023. bootstrapped companies faced a decline in growth rates across all revenue brackets, particularly at higher arr levels. Saas performance metrics benchmarking research uncovered that “growth at any cost” has been replaced with “lower growth at reduced efficiency”. the above statement is based upon the insights uncovered from the performance metrics data provided by ~ 1,000 b2b saas. Saas spend rebounded by 9% across all company sizes in 2024. but here's the kicker: companies with fewer than 500 employees led the charge with a whopping 59% increase. it seems like the little guys are realizing that sometimes you need to spend money to make (or save) money. I’m excited to share saascan’s 2024 saas metric benchmarks report with you. it reflects fy 23 data from 936 respondents on 7 key metrics: arr growth rate, nrr, grr, burn multiple, cac payback period, gross margin, and arr per fte. In q1 of each year, saas capital conducts a survey of b2b saas company metrics. this year marked our 13th annual survey, and it continues to grow with more than 1,500 private b2b saas companies responding, making it the largest survey of its kind.

Comments are closed.