401k Contribution Strategies Front Loading Getting Let Go Bonus Heavy

Front Loading 401k Contributions Us Personal Finance What is a 401 (k)? a 401 (k) is a convenient way to save for your retirement because contributions can be automatically deducted on a pretax basis from your paycheck. if your employer offers a 401 (k) match, you can use this perk to get even more out of your retirement savings. Named for the tax code section that created it, a 401 (k) is an employer sponsored retirement savings plan with special tax benefits. (the exact tax advantages depend on which kind of 401 (k) contributions you make—more on that later.) employers typically offer 401 (k)s as part of a benefits package to attract and retain workers.

401k Maximum Contribution Strategies For Employees Employee Benefit News Named after a section of the u.s. internal revenue code, the 401 (k) is a defined contribution plan provided by an employer. the employer may match employee contributions; with some plans, the. In the united states, a 401(k) plan is an employer sponsored, defined contribution, personal pension (savings) account, as defined in subsection 401(k) of the u.s. internal revenue code. [1] periodic employee contributions come directly out of their paychecks, and may be matched by the employer.this pre tax option is what makes 401(k) plans attractive to employees, and many employers offer. Learn about internal revenue code 401 (k) retirement plans and the tax rules that apply to them. With a traditional tax deferred 401 (k), the money is taken out of your paycheck before federal income taxes are figured, providing you the chance to reduce your taxes today. you pay ordinary income taxes on the pre tax contributions and growth when you make a withdrawal in retirement.

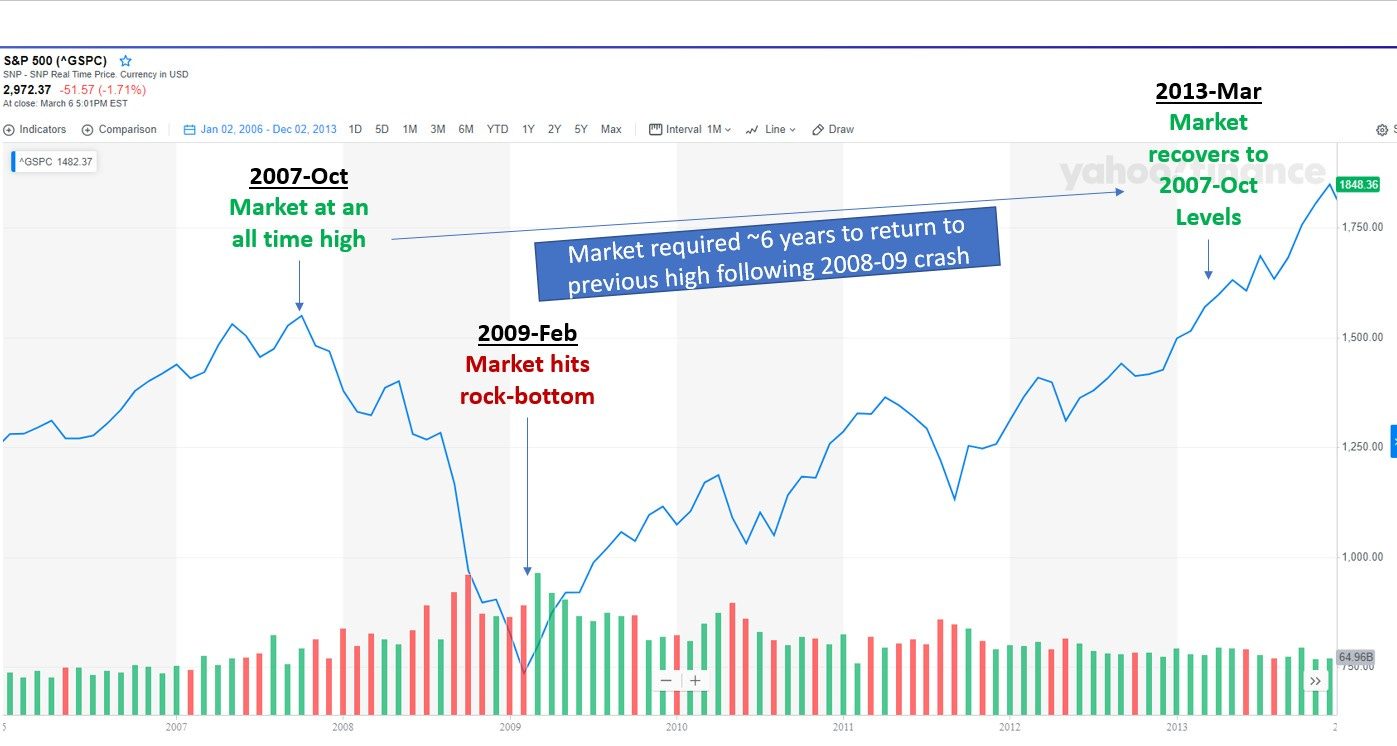

Three Perspectives On Contributing To The 401 K Dollar Cost Averaging Front Loading And Back Learn about internal revenue code 401 (k) retirement plans and the tax rules that apply to them. With a traditional tax deferred 401 (k), the money is taken out of your paycheck before federal income taxes are figured, providing you the chance to reduce your taxes today. you pay ordinary income taxes on the pre tax contributions and growth when you make a withdrawal in retirement. What is a 401 (k)? the 401 (k) is one of the most popular retirement savings tools. many employers offer this type of plan, helping their workers save for the future in a tax advantaged way. In general, a 401 (k) is a retirement account that your employer sets up for you. when you enroll, you decide to put a percentage of each paycheck into the account. these contributions are placed into investments that you’ve selected based on your retirement goals and risk tolerance. If your employer offers benefits through fidelity, log in to fidelity netbenefits to see your 401(k), 403(b), health benefits, stock plans, and more. For u.s. employees, your username (up to 15 characters) can be any customer identifier you've chosen or your social security number (ssn). if you use your ssn to log in, please create a personalized username for added security.

Three Perspectives On Contributing To The 401 K Dollar Cost Averaging Front Loading And Back What is a 401 (k)? the 401 (k) is one of the most popular retirement savings tools. many employers offer this type of plan, helping their workers save for the future in a tax advantaged way. In general, a 401 (k) is a retirement account that your employer sets up for you. when you enroll, you decide to put a percentage of each paycheck into the account. these contributions are placed into investments that you’ve selected based on your retirement goals and risk tolerance. If your employer offers benefits through fidelity, log in to fidelity netbenefits to see your 401(k), 403(b), health benefits, stock plans, and more. For u.s. employees, your username (up to 15 characters) can be any customer identifier you've chosen or your social security number (ssn). if you use your ssn to log in, please create a personalized username for added security.

Comments are closed.