5 Difference Between Tds And Tcs Examples Legal Repercussions

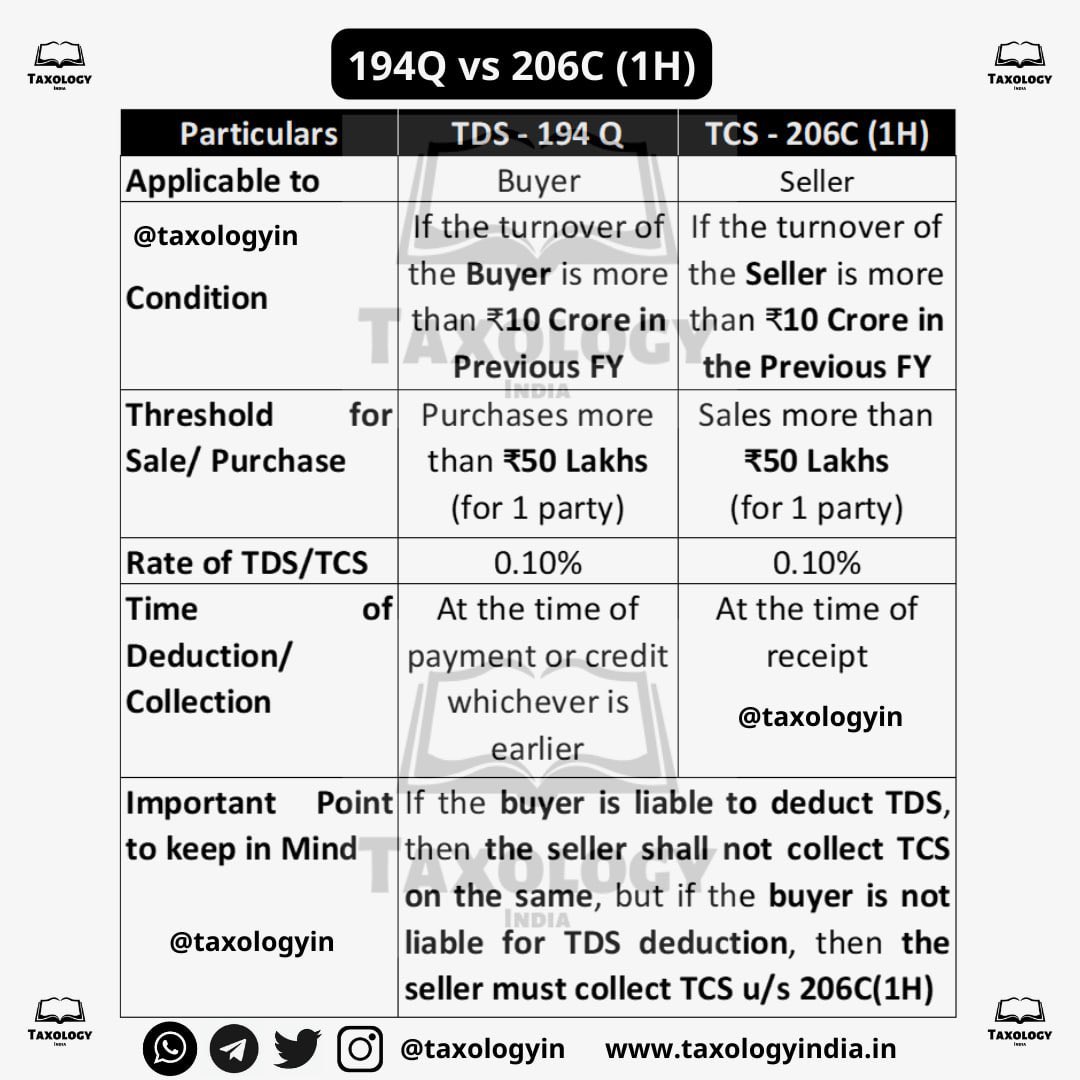

Pin On Mdp Referance Tcs stands for tax collection at source and tds stands for tax withheld at source. the obligations that are subtracted at the moment of payment or receipt and subsequently filed to the income tax department are referred to by these words. Tds represents the tax deducted by the payer from payments made when the amount exceeds a set limit. conversely, tcs refers to the tax collected by the sellers during transactions with buyers. however, taxpayers often mix up these terms and use them interchangeably.

Tds Vs Tcs Difference Between Tds And Tcs What Is Tds And Tcs Tds And Hot Sex Picture Understand tds vs tcs in income tax and their key differences. learn how tds and tcs apply to your business, their compliance rules, and their impact on operations. Both tds and tcs are imposed at the source of income in india. tds refers to the tax deducted by a company on payments to an individual that exceed a specified limit. on the other hand, tcs represents the tax collected by sellers during transactions with buyers. Discover the necessary differences between tds and tcs. understand the implications for taxpayers, avoid penalties, & optimize tax compliance effortlessly. Introduction: tax collection at source (tcs) and tax deducted at source (tds) are two essential concepts in the indian taxation system. while they share similarities, they serve distinct.

Difference Between Tds And Tcs A Brief Analysis Discover the necessary differences between tds and tcs. understand the implications for taxpayers, avoid penalties, & optimize tax compliance effortlessly. Introduction: tax collection at source (tcs) and tax deducted at source (tds) are two essential concepts in the indian taxation system. while they share similarities, they serve distinct. Confused between tds and tcs? learn their differences, how they work, penalties for non compliance, and their significance in tax planning. simplify taxes with expert insights. Understand the difference between tds and tcs, their meaning, applicability, tax implications, and how they affect transactions under indian tax laws. Understand the key differences between tds and tcs in india's tax system, including when each applies, who is responsible for collection, and practical examples. Direct tax is assessed directly on the individual and paid directly to the government, and nobody else can pay the tax or pass it to some other organisation. hence, we call it direct. the indirect tax applies to the purchase of services and goods in india but not to the earnings of any person.

Difference Between Tds And Tcs Tds Vs Tcs 5 Best Points Tax Deducted At Source Share Confused between tds and tcs? learn their differences, how they work, penalties for non compliance, and their significance in tax planning. simplify taxes with expert insights. Understand the difference between tds and tcs, their meaning, applicability, tax implications, and how they affect transactions under indian tax laws. Understand the key differences between tds and tcs in india's tax system, including when each applies, who is responsible for collection, and practical examples. Direct tax is assessed directly on the individual and paid directly to the government, and nobody else can pay the tax or pass it to some other organisation. hence, we call it direct. the indirect tax applies to the purchase of services and goods in india but not to the earnings of any person.

Comments are closed.