A Study In Sector Allocation Seeking Alpha

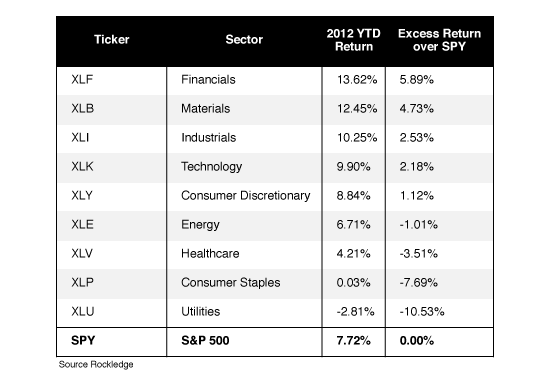

A Study In Sector Allocation Seeking Alpha Sectorsam is a robust quantitative sector selection and rotation analysis. rockledge manages funds for the us and european private and institutional investors. Applying a sector based framework to equity portfolio construction can help investors achieve a variety of alpha seeking investment objectives and greater control in managing portfolio risk.

About Seeking Alpha Sector strategies may enhance the core of a portfolio by seeking alpha opportunities or diversifying portfolio risks. they can also be used to adjust a portfolio based on changing business cycles or cyclical trends. While many investors have adopted a growth value style based framework for allocating among u.s. equities, we find a sector based approach more useful for making active allocation decisions. Discover how to use seeking alpha to optimize your portfolio through sector rotation strategies. learn the key tools and tips to shift between sectors effectively. if you’re an investor looking to stay ahead of market trends, you’ve probably heard the term “sector rotation” thrown around. Seeking alpha provides data on a sector's performance based on various etfs that imitate a particular sector. read more about tracking performance here.

About Seeking Alpha Discover how to use seeking alpha to optimize your portfolio through sector rotation strategies. learn the key tools and tips to shift between sectors effectively. if you’re an investor looking to stay ahead of market trends, you’ve probably heard the term “sector rotation” thrown around. Seeking alpha provides data on a sector's performance based on various etfs that imitate a particular sector. read more about tracking performance here. For each sector, i list the sector's percentage weighting of the economy, the sector's weighting of the portfolio, and the percentage of the portfolio's income that is contributed by the sector. Sector rotation is an investment strategy that involves reallocating portfolio assets among various sectors of the economy to capitalize on cyclical trends. this approach aims to outperform the market by investing in sectors that are expected to thrive during different phases of the economic cycle. In this post, we’re diving deep into leveraging alpha picks by seeking alpha to make sector specific investments that align with the cutting edge technologies and global economic trends shaping our future. Sector allocation is a crucial element of a dedicated portfolio, but it requires careful consideration and planning.

Comments are closed.