Accounting Chapter 3 Notes Chapter 3 Class Notes Each Transaction Must Be Analyzed Based On

Chapter 3 Notes Part 3 Pdf Chapter 3 class notes: each transaction must be analyzed based on assets liabilities stockholders’ equity transaction example: assets = liabilities stockholders’ equity if both options are on assets or the other side then you add or subtract both if on different sides you add or subtract one and add or subtract (opposite) the. Study with quizlet and memorize flashcards containing terms like transaction analysis, accounting transactions, transactions include two types of events and more.

Accounting Ch 3 Part1 Pdf O each transaction analyzed for effects on assets, liabilities, and shareholders’ equity. o equations must balance after each transaction. affect the accounting equation. o retained earnings calculated from net income and dividends. o dividends declared reduce retained earnings, not an expense. View notes class notes chapter 3 from acct 229 at texas a&m university. chapter 3 acct 229, knoop chapter 3: processing accounting information i. transaction analysis keeping the balance sheet. A business transaction that involves a purchase on account is considered to be a (a) cash transaction (b) credit transaction (c) investment by the owner (d) expense transaction. Information for each transaction recorded in a journal is called an entry. recording both debit and credit parts of a transaction is called double entry accounting. a business paper from which information is obtained for a journal entry is called a source document.

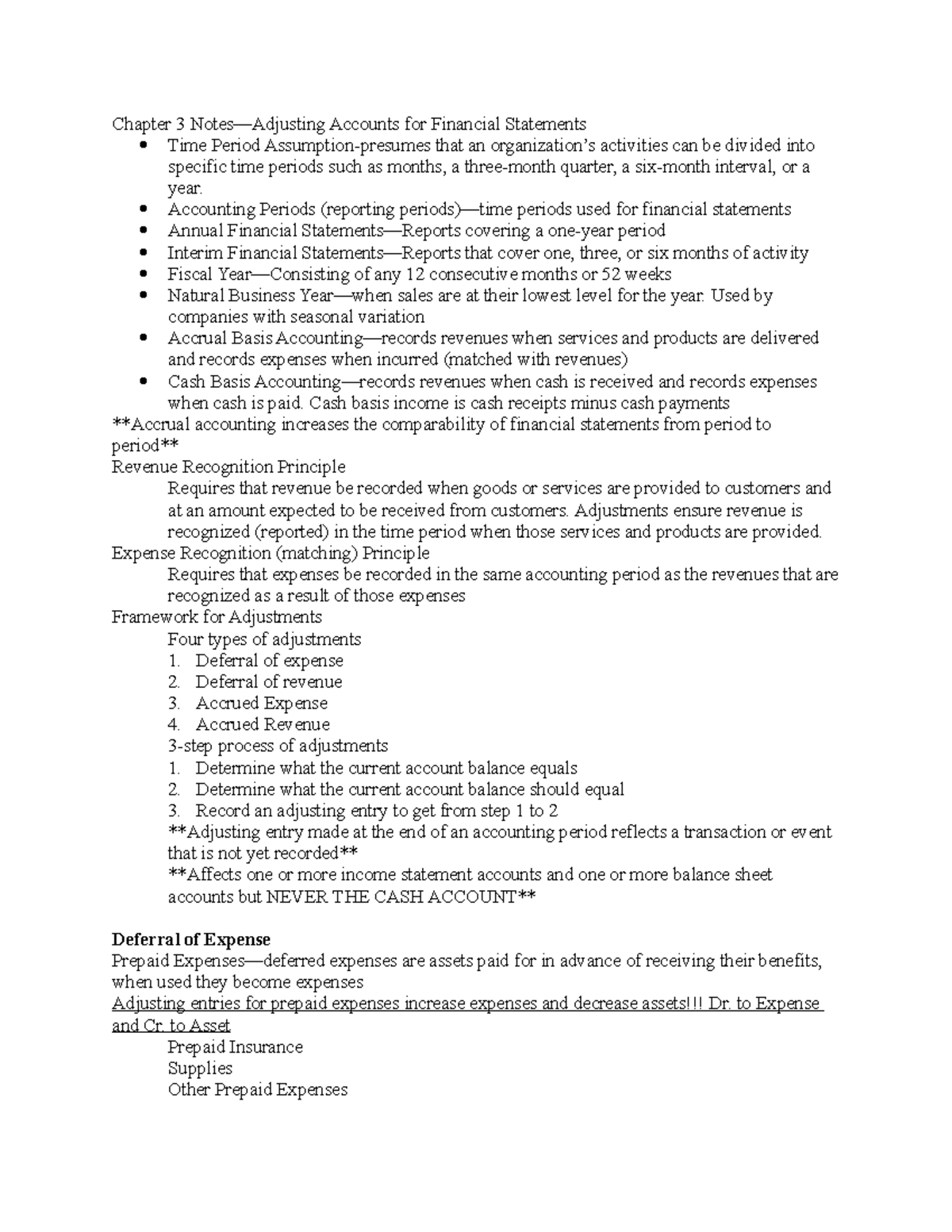

Chapter 3 Notes Chapter 3 Notes Adjusting Accounts For Financial Statements Time Period Studocu A business transaction that involves a purchase on account is considered to be a (a) cash transaction (b) credit transaction (c) investment by the owner (d) expense transaction. Information for each transaction recorded in a journal is called an entry. recording both debit and credit parts of a transaction is called double entry accounting. a business paper from which information is obtained for a journal entry is called a source document. Both cash and stockholders’ equity (salaries expense) decrease. summary of transactions each transaction is analyzed in terms of its effect on assets, liabilities, and stockholders’ equity. Lo 3.4 analyze business transactions using the accounting equation and show the impact of business transactions on financial statements. Pioneer’s accounting period is a month a basic analysis and a debit credit analysis precede the journalizing and posting of each transaction we use the t account form in the illustrations instead of the standard account form. Study with quizlet and memorize flashcards containing terms like accounting information system, accounting cycle, accounting transactions and more.

Chapter 3 Chapter 3 Lecture Notes Part 1 Che318 Studocu Both cash and stockholders’ equity (salaries expense) decrease. summary of transactions each transaction is analyzed in terms of its effect on assets, liabilities, and stockholders’ equity. Lo 3.4 analyze business transactions using the accounting equation and show the impact of business transactions on financial statements. Pioneer’s accounting period is a month a basic analysis and a debit credit analysis precede the journalizing and posting of each transaction we use the t account form in the illustrations instead of the standard account form. Study with quizlet and memorize flashcards containing terms like accounting information system, accounting cycle, accounting transactions and more.

Chapter 3 Notes Pdf Pioneer’s accounting period is a month a basic analysis and a debit credit analysis precede the journalizing and posting of each transaction we use the t account form in the illustrations instead of the standard account form. Study with quizlet and memorize flashcards containing terms like accounting information system, accounting cycle, accounting transactions and more.

Comments are closed.