Accounting Expenses Explained With Examples

Expenses Definition And Examples An expense is a type of expenditure that flows through the income statement and is deducted from revenue to arrive at net income. due to the accrual principle in accounting, expenses are recognized when they are incurred, not necessarily when they are paid for. List of expense accounts. each account title is described for you to know and understand what items are reported under expenses in the income statement.

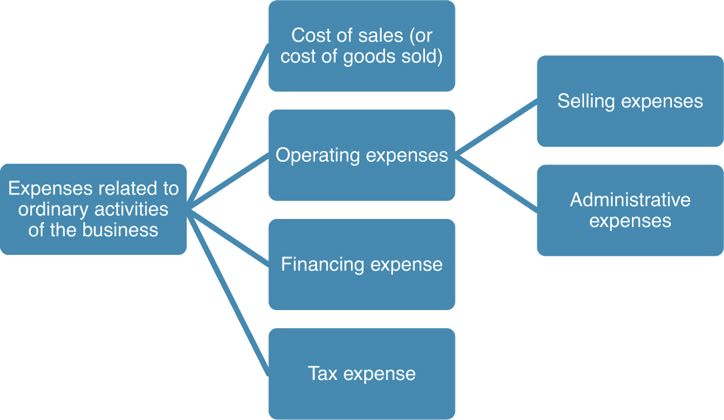

Different Types Of Accounting Expenses And Rules Of Work With Them тлж Accounting Services Expenses for a company are generally categorized as operating or nonoperating expenses. they’re every cost that a business runs into to produce income. common expenses include payments to. Organizational expenses may range from operating and non operating expenses to expenses to acquire or maintain capital assets, known as capital expenditures. below we discuss these three types of organizational expenses. An expense is a cost incurred by a business in its operations to produce revenues. expenses in accounting can be either variable or fixed. Types and examples of expenses in accounting. expenses in accounting can be classified into three main categories on the income statement: operating expenses (opex) these are the day to day costs of running the business. they show up on the income statement and are deducted from revenue to calculate operating income.

What Are Expenses In Accounting Definition Example Accounting Proficient An expense is a cost incurred by a business in its operations to produce revenues. expenses in accounting can be either variable or fixed. Types and examples of expenses in accounting. expenses in accounting can be classified into three main categories on the income statement: operating expenses (opex) these are the day to day costs of running the business. they show up on the income statement and are deducted from revenue to calculate operating income. What are expenses in accounting? expenses in accounting are the money spent or costs incurred by a business in an effort to generate revenue. hence, expenses in accounting are the cost of doing business, including a sum of all the activities that will hopefully generate profit for you. Some of the basic accounting terms that you will learn include revenues, expenses, assets, liabilities, income statement, balance sheet, and statement of cash flows. you will become familiar with accounting debits and credits as we show you how to record transactions. Expense is a decrease in the net assets over an accounting period except for such decreases caused by the distributions to owners. common types of expenses include employee benefits, depreciation, finance cost, administrative expenses, and operating expenses. In this lesson we're going to define expenses, go through some common examples, and look at how a cash expense affects the basic accounting equation.

Comments are closed.