Ach Payment Processing How To Start Accepting Ach Transfers

Ach Payment Processing How To Start Accepting Ach Transfers To receive an ach payment, you need to provide your bank’s routing number and the account number for the checking or savings account you want the money deposited into. with some companies,. To start accepting these types of payments, you need to set up a business bank account and sign up for a merchant account that offers ach payment services. this quick guide will show you how to accept ach payments in five steps.

Ach Payment Processing How To Start Accepting Ach Transfers Learn to accept ach payments: quick setup for secure, direct bank transfers to streamline your business transactions and lower processing fees. Ach payments can cost significantly less than credit card processing, with transactions clearing in 3 5 business days instead of potentially weeks for paper checks. many common ach payment challenges like manual processing and reconciliation can be eliminated by choosing the right payment platform. Ach payment processing involve your customer authorizing you, the merchant, to pull funds directly from their bank account as payment for a good or service. this authorization is usually in the form of a web form or document that the customer fills out with their bank details and authorization. Setting up ach payments is easy. if you have a business checking account, you can already accept ach payments through your bank. alternatively, you can register with a third party.

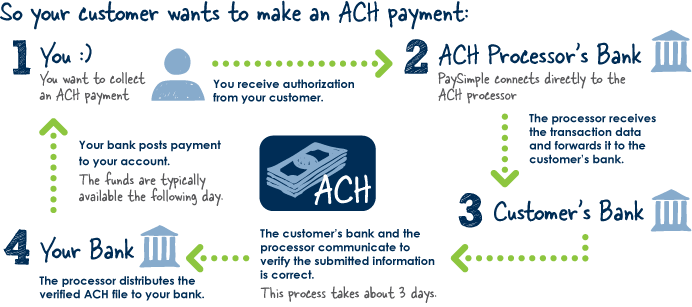

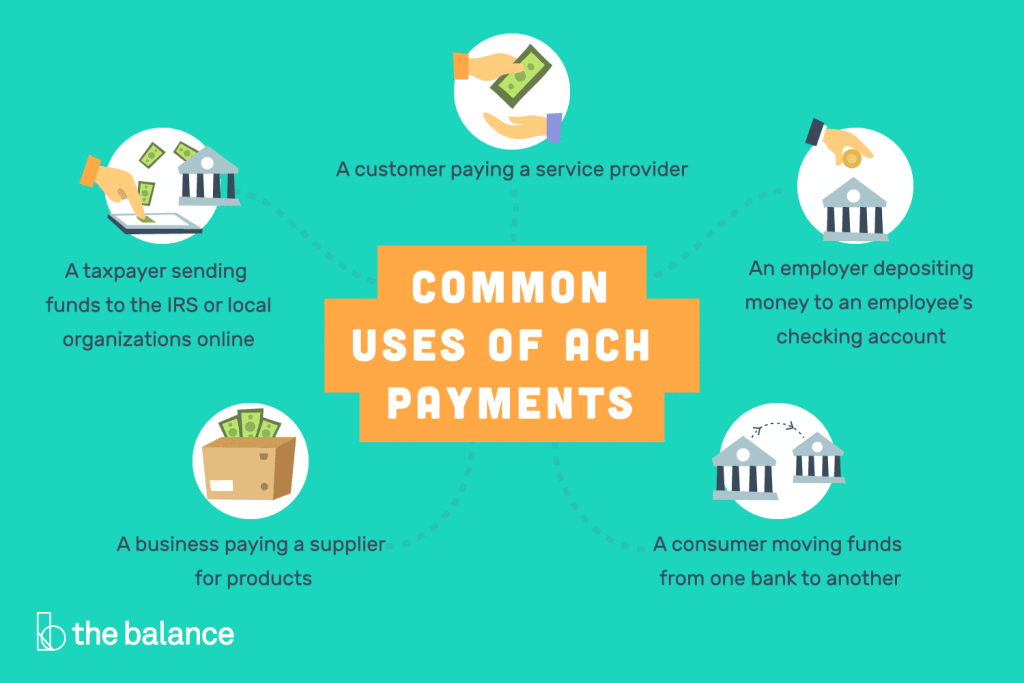

Ach Payment Processing How To Start Accepting Ach Transfers Ach payment processing involve your customer authorizing you, the merchant, to pull funds directly from their bank account as payment for a good or service. this authorization is usually in the form of a web form or document that the customer fills out with their bank details and authorization. Setting up ach payments is easy. if you have a business checking account, you can already accept ach payments through your bank. alternatively, you can register with a third party. There are a few steps you’ll need to take to enable your business to accept ach payments. start by thinking about your business needs. ach can be a great fit if you regularly collect recurring payments like subscriptions, memberships or invoices. Ach is a payment rail for processing bank to bank payments. it’s commonly used for recurring bill payments, peer to peer money transfers through apps like paypal and venmo, and direct deposit payroll. ach processing refers to the steps required to move money from one bank account to another. Ach stands for automated clearing house, which is an electronic payment system that facilitates the transfer of funds between banks and financial institutions. Learn how to accept ach payments for your business. discover instant acceptance options and effective strategies for requesting ach payments from your customers.

Ach Payment Processing How To Start Accepting Ach Transfers There are a few steps you’ll need to take to enable your business to accept ach payments. start by thinking about your business needs. ach can be a great fit if you regularly collect recurring payments like subscriptions, memberships or invoices. Ach is a payment rail for processing bank to bank payments. it’s commonly used for recurring bill payments, peer to peer money transfers through apps like paypal and venmo, and direct deposit payroll. ach processing refers to the steps required to move money from one bank account to another. Ach stands for automated clearing house, which is an electronic payment system that facilitates the transfer of funds between banks and financial institutions. Learn how to accept ach payments for your business. discover instant acceptance options and effective strategies for requesting ach payments from your customers.

Comments are closed.