Ach Payment Processing What It Is How It Works And A Better Alternative

Ach Payment Processing Solutions Gotchapay Learn how ach payment processing works and find out which alternatives might be better for your business. a simple guide to help you choose wisely. skip to content. Ach payments work by moving money from one bank to another electronically, without a physical exchange of currency. two categories of transactions use ach payments: direct payment and.

Ach Payment Processing What It Is How It Works And A Better Alternative Learn what ach payment processing is, how it works, key benefits for businesses, and how to get started with secure, efficient payments. An automated clearing house (ach) transfer is used to pay bills or transfer money between accounts. learn how an ach transfer works and when you might need to make one. In this guide, ramp breaks down everything you need to know about ach payments—how they work, who uses them, and why they're an essential part of modern banking. How does ach payment processing work? an ach payment begins when you send a payment request to your bank or payment processor. several times a day your bank will send all of the requests it’s gathered to an ach operator.

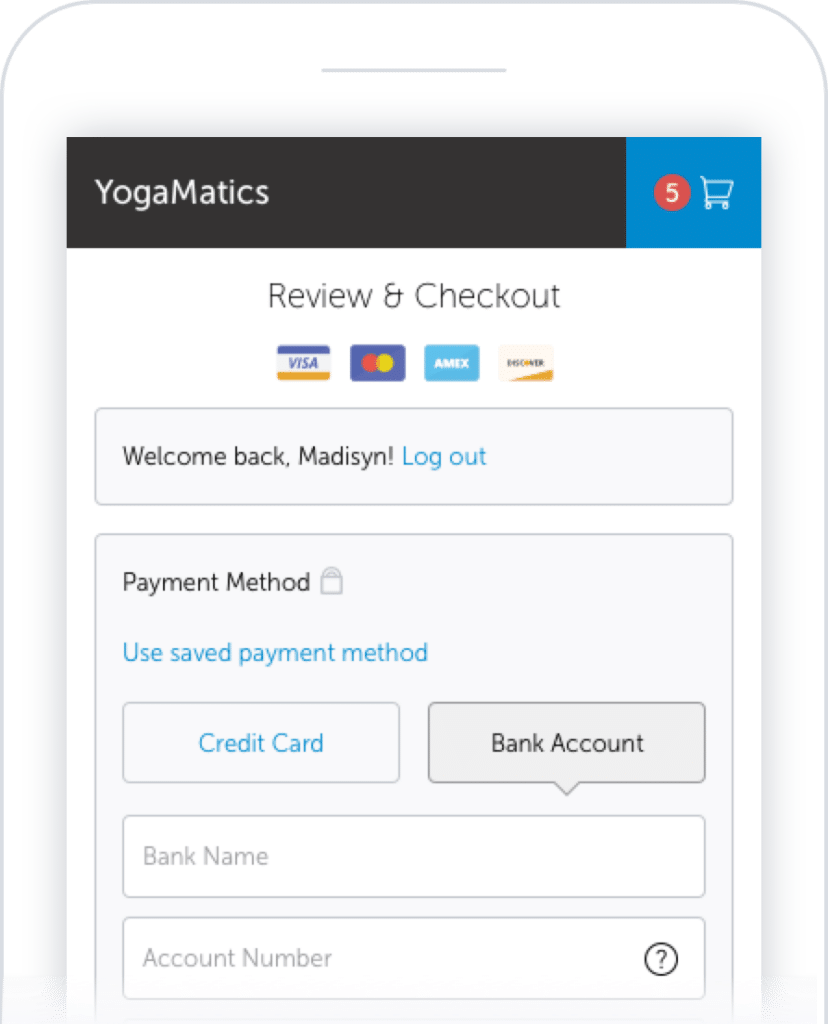

Ach Payment Processing Accept Ach Payments Online Save In this guide, ramp breaks down everything you need to know about ach payments—how they work, who uses them, and why they're an essential part of modern banking. How does ach payment processing work? an ach payment begins when you send a payment request to your bank or payment processor. several times a day your bank will send all of the requests it’s gathered to an ach operator. Ach is a payment rail for processing bank to bank payments. it’s commonly used for recurring bill payments, peer to peer money transfers through apps like paypal and venmo, and direct deposit payroll. ach processing refers to the steps required to move money from one bank account to another. Ach processing allows fast, low cost electronic payments between banks for things like paychecks, bills, and taxes. ach transfers can be either debits (pulling money) or credits (pushing money), with varying costs and speeds. benefits of ach include lower fees, faster processing, and no paper checks, making it ideal for recurring payments. Ach payments are a cost effective and efficient choice for small businesses, offering lower processing fees and improved stability for recurring transactions. modernized ach networks provide faster processing times, including same day transfers. That is why ach payments have become so popular. today, you can find ach payment features everywhere you shop online. in this guide, we will explain everything you need to know about ach payments, including the pros and cons, how to set up an ach payment system, and more!.

Ach Payment Processing High Risk Merchant Account Uk Ach is a payment rail for processing bank to bank payments. it’s commonly used for recurring bill payments, peer to peer money transfers through apps like paypal and venmo, and direct deposit payroll. ach processing refers to the steps required to move money from one bank account to another. Ach processing allows fast, low cost electronic payments between banks for things like paychecks, bills, and taxes. ach transfers can be either debits (pulling money) or credits (pushing money), with varying costs and speeds. benefits of ach include lower fees, faster processing, and no paper checks, making it ideal for recurring payments. Ach payments are a cost effective and efficient choice for small businesses, offering lower processing fees and improved stability for recurring transactions. modernized ach networks provide faster processing times, including same day transfers. That is why ach payments have become so popular. today, you can find ach payment features everywhere you shop online. in this guide, we will explain everything you need to know about ach payments, including the pros and cons, how to set up an ach payment system, and more!.

Ach Payment Processing Netpay Ach payments are a cost effective and efficient choice for small businesses, offering lower processing fees and improved stability for recurring transactions. modernized ach networks provide faster processing times, including same day transfers. That is why ach payments have become so popular. today, you can find ach payment features everywhere you shop online. in this guide, we will explain everything you need to know about ach payments, including the pros and cons, how to set up an ach payment system, and more!.

Comments are closed.