Ach Transfer Vs Wire Transfer Explained Beginners Guide To Sending Money

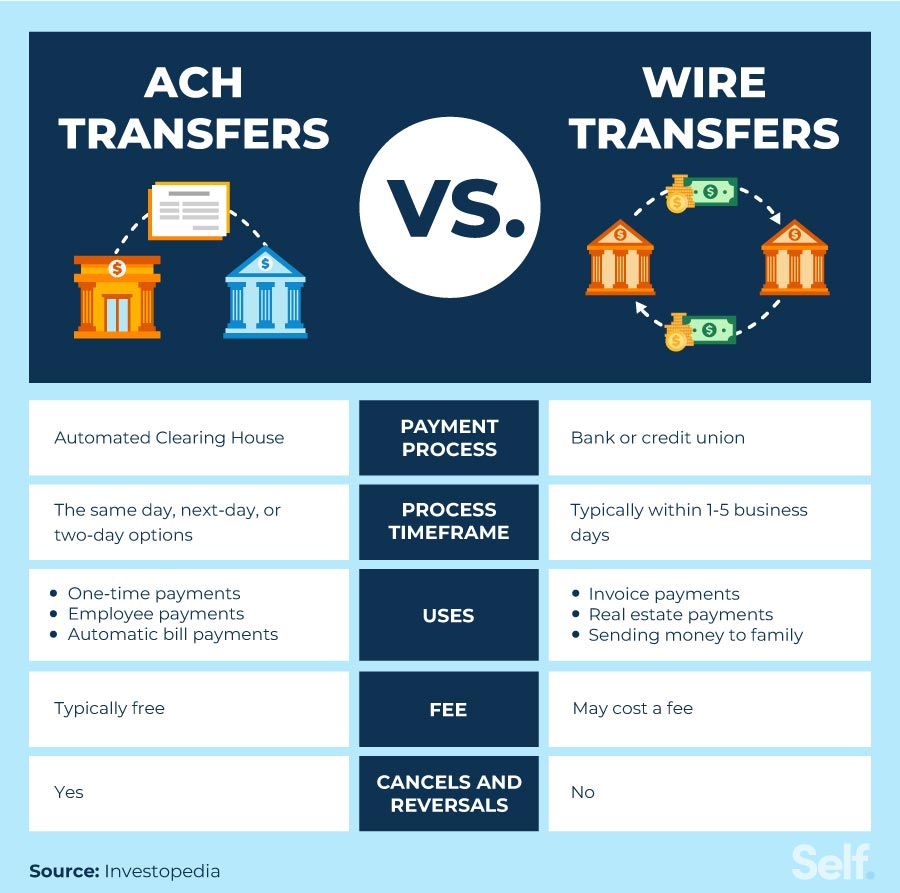

Ach Transfer Vs Wire Transfer Explained Beginners Guide To Sending Money Money Instructor Compare ach vs. wire transfer methods based on speed, cost, and security differences to learn how to decide which method is best for any situation. Both automated clearing house (ach) transfers and wire transfers are forms of electronic fund transfers (efts), but there are a few key differences between them.

64e8eb9d4ccfa3a8dd0fda70 Ach Vs Wire Transfer Pdf Learn how to choose between ach and wire transfers based on their cost, speed, and security features. find out which method is best for your financial needs and how to use each safely and. A simple, easy to understand guide to electronic transfers. in this discussion, you’ll learn about ach and wire transfers, two popular electronic payment methods for sending money. we cover when to use each, focusing on their differences in cost, speed, and security. Automated clearing house (ach) and wire transfer methods are electronic ways to move money. but how do they differ in terms of costs, transaction time, and security considerations?. Automated clearing house (ach) transactions and wire transfers can do the trick when you need to send money electronically. but one will likely be better than the other for your situation. while the two share similarities, they differ in cost, speed, funding options, international access, and more.

Ach Vs Wire Transfer Comparison Faqs Avidxchange 52 Off Automated clearing house (ach) and wire transfer methods are electronic ways to move money. but how do they differ in terms of costs, transaction time, and security considerations?. Automated clearing house (ach) transactions and wire transfers can do the trick when you need to send money electronically. but one will likely be better than the other for your situation. while the two share similarities, they differ in cost, speed, funding options, international access, and more. Ach transfers are cost effective for domestic, recurring payments but are slower, typically taking 1 3 business days. wire transfers are faster— with funds often arriving within hours—and are better for urgent, international transfers. looking for a quick answer? here’s a top down look at these two transfer types:. Two of the most common transfer methods are ach (automated clearing house) transfers and wire transfers. while both serve to move money electronically, their differences in cost, speed, and functionality make them suitable for different situations. At its core, an ach transfer is a way to move money between banks without using paper checks, wire transfers, credit card networks, or cash. the term ach stands for automated clearing house, which is a fancy way of saying it’s a digital network for financial transactions in the u.s. Wire transfers are one to one electronic payments sent in real time between financial institutions over networks like fedwire (domestic) or swift (international). when you send a wire, your bank immediately withdraws the funds and transmits payment instructions to the recipient's bank.

Comments are closed.