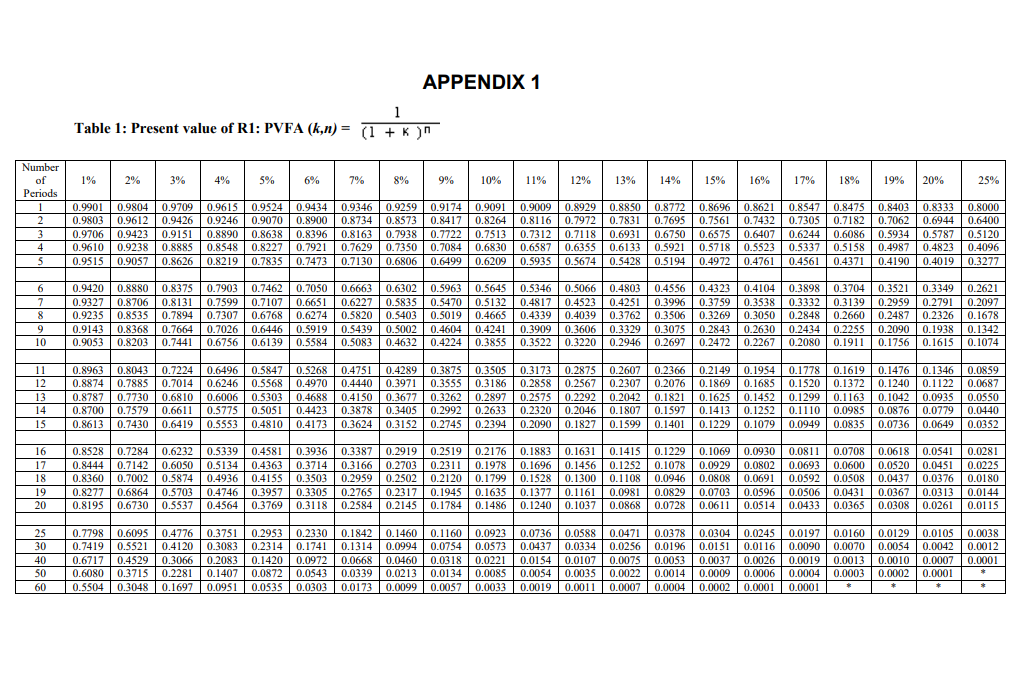

Appendix 1 Table 1 Present Value Of R1 Pvfa Chegg

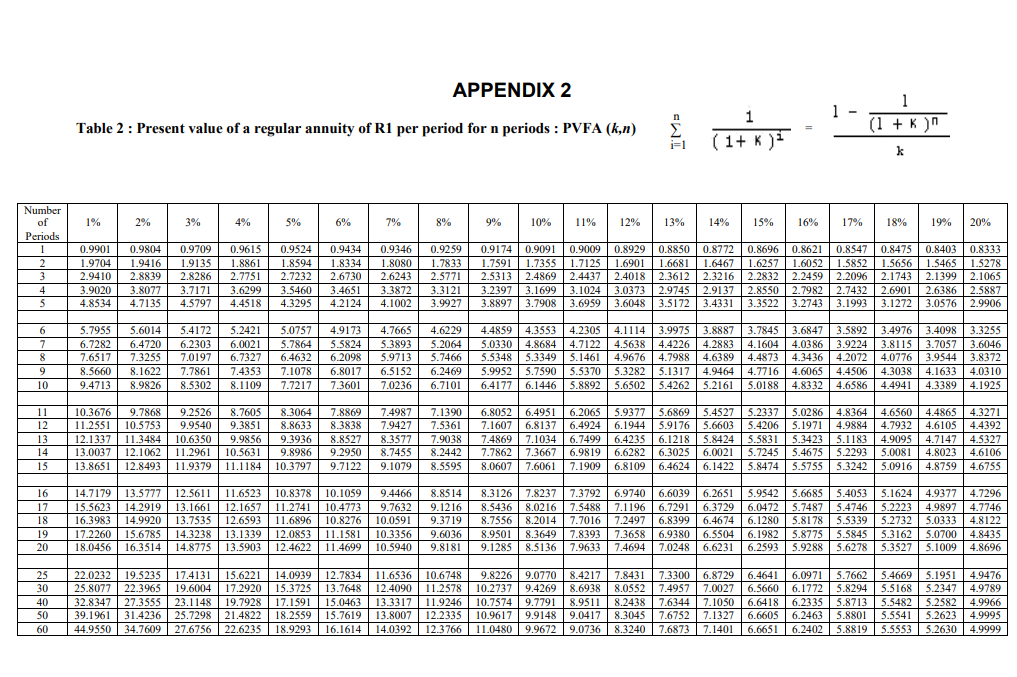

Appendix 1 Table 1 Present Value Of R1 Pvfa Chegg Appendix 1 table 1: present value of r1: pvfa (k, n) = (1 k) n 1 appendix 2 table 2 : present value of a regular annuity of r1 per period for n periods : pvfa (k, n) ∑ i = 1 n (1 k) i 1 = k 1 − (1 k) n 1. On studocu you find all the lecture notes, summaries and study guides you need to pass your exams with better grades.

Appendix 1 Table 1 Present Value Of R1 Pvfa Chegg Table 1: present value of an annuity of $1 per period for t periods = [1 1 (1 r)t ]. Explore pvf, pvaf, cvf, and cvaf tables essential for financial management and decision making in this comprehensive guide. The required rate of return is. Present value and future value tables visit knowledgequity .au for practice questions, videos, case studies and support for your cpa studies © knowledgequity® 2016.

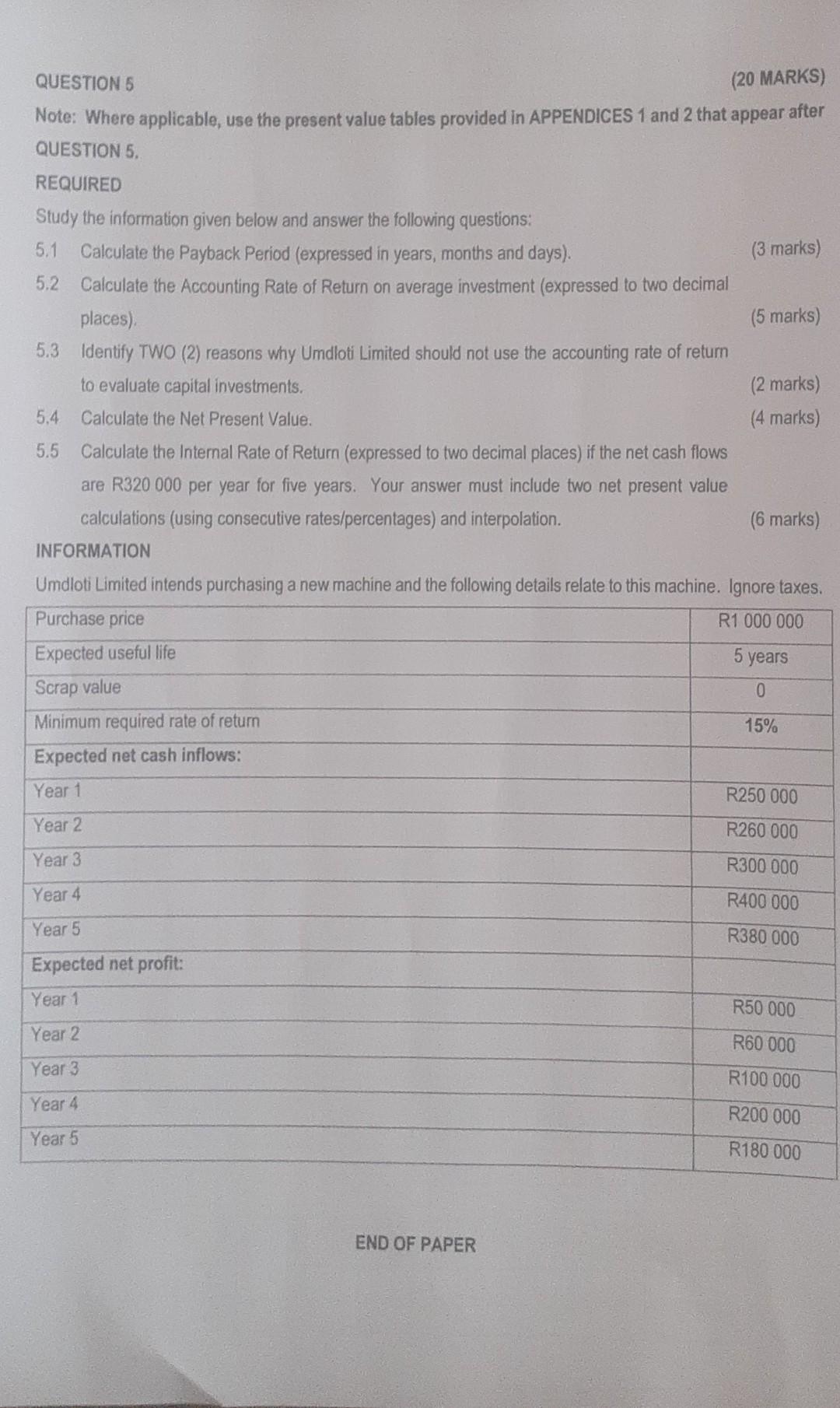

Solved End Of Paper R Nappendix 1 Table 1 Present Value Of Chegg The required rate of return is. Present value and future value tables visit knowledgequity .au for practice questions, videos, case studies and support for your cpa studies © knowledgequity® 2016. Present value interest factor of r1 per period at i% for n periods, pvif(i,n). To download present value interest factor table (pvifa) pdf, you can go through the link provided below. the factor used to calculate present value of series of annuity payments known as present value interest factor of annuity (pvifa). Figure 18.2 present value of annuity due (annuity in advance—beginning of period payments) chapter 18 appendix: present value tables 1100. The purpose of the present value annuity tables is to make it possible to carry out annuity calculations without the use of a financial calculator. they provide the value now of 1 received at the end of each period for n periods at a discount rate of i%.

Comments are closed.