Apple Vs Google Determining The Most Attractive Stock Seeking Alpha

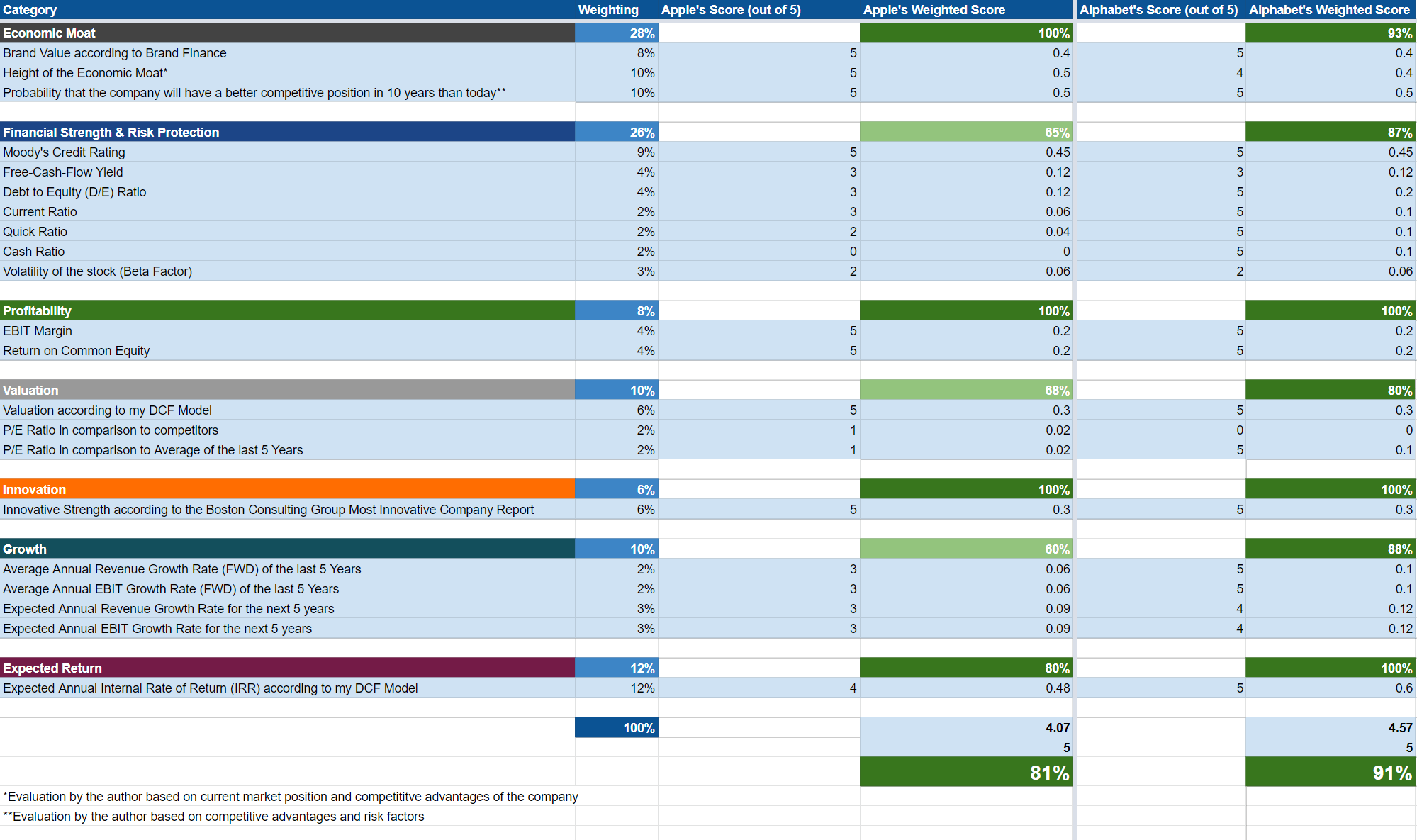

Apple Vs Google Determining The Most Attractive Stock Seeking Alpha In this analysis, i will show you which of the two companies is currently more attractive in terms of risk and reward. i rate both alphabet (nasdaq: goog) (nasdaq: googl) and apple (nasdaq:. As a reminder, the two main factors that determine how richly a stock deserves to trade are (1) growth prospects and (2) investment risk. according to ycharts, apple is expected to grow eps by.

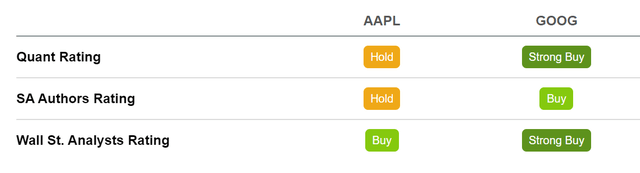

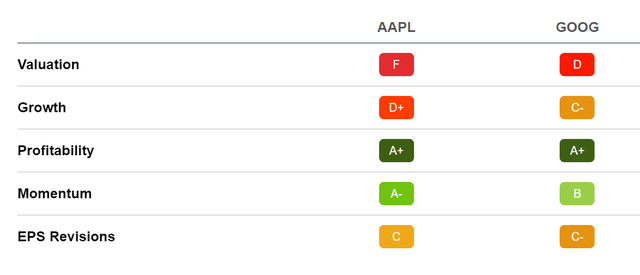

Apple Vs Google Determining The Most Attractive Stock Seeking Alpha Compare aapl and googl stocks to check their ai scores, past performance, fundamental, technical and sentiment indicators, alpha signals, key stock metrics, price, and more. this comparison, powered by ai, can help you understand which stock is a better buy right now. Apple inc (aapl) and alphabet (nasdaq: goog) (nasdaq: googl) shares have both performed very well compared to the s&p 500 index over the last 10 years. With this in mind, i intend to analyze and compare two mega cap stocks: apple inc. (aapl) and alphabet inc. (googl), to determine which is a better buy at current levels. But if you're thinking about buying apple stock, there's another earnings call to which you might want to pay attention. google parent alphabet ( goog 2.31% ) ( googl 2.32% ) provided its second.

Apple Vs Google Determining The Most Attractive Stock Seeking Alpha With this in mind, i intend to analyze and compare two mega cap stocks: apple inc. (aapl) and alphabet inc. (googl), to determine which is a better buy at current levels. But if you're thinking about buying apple stock, there's another earnings call to which you might want to pay attention. google parent alphabet ( goog 2.31% ) ( googl 2.32% ) provided its second. In my opinion, google is the most attractive large cap technology firm in the big tech group due to its 1) dominant position in the search business, 2) strong cloud growth, and 3) enormous. Apple inc. (nasdaq:aapl) is one of the ai stocks in the spotlight today. on july 28, jpmorgan analyst samik chatterjee reiterated an “overweight” rating on the stock as apple faces potential. As for the risk that apple will shift away from the google search engine, while it is a potential challenge, the required investment for a new search provider to build comparable data. Google has the siege power to take apple's moat. google stands to profit from the three biggest changes coming in the near future.

Comments are closed.