Best Mutual Funds For 2025 India Fai Thalsop

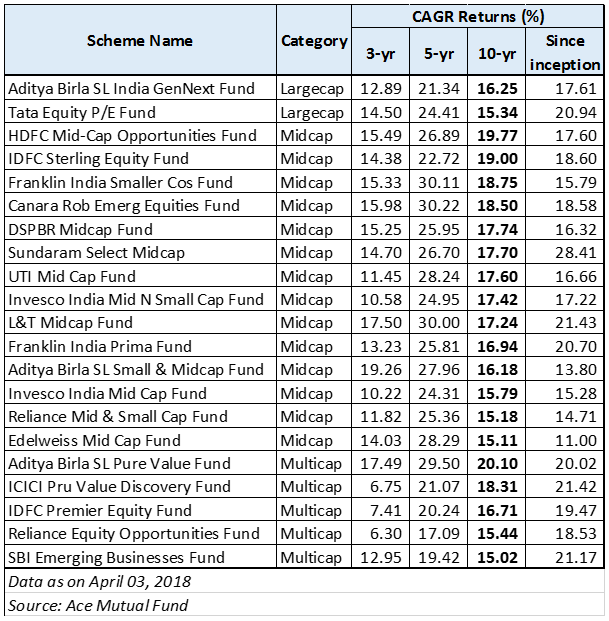

Best Performing Mutual Funds 2025 India James Hughes Looking for stable, tax efficient investments? discover the 10 best fixed income mutual funds in india for 2025 with high safety and consistent returns. For long term investors with moderate to high risk tolerance and a 10 year time horizon, investing via equity mutual funds is a better strategy. in this editorial, we describe why a 10 year.

Best Mutual Funds For 2025 India Fai Thalsop With over 1,000 schemes available across various categories, identifying the top 10 mutual funds in india 2025 requires careful analysis of performance metrics, fund management quality, and alignment with your financial goals. Looking for mutual funds for investment in 2025. explore the best performing mutual funds in india. compare returns, risks, and benefits. As 2025 unfolds, we bring you the top 10 best mutual funds in india, providing detailed insights into their performance, features, and benefits. 1. sbi bluechip fund. the sbi bluechip fund remains a favorite for investors seeking long term wealth creation through equity investments in large cap companies. key highlights:. Etmutualfunds has shortlisted 10 funds across five equity mutual fund categories. investors should choose mutual funds based on their financial goals, investment horizon, and risk appetite.

Best Performing Mutual Funds 2025 India Images References Aase V Thomsen As 2025 unfolds, we bring you the top 10 best mutual funds in india, providing detailed insights into their performance, features, and benefits. 1. sbi bluechip fund. the sbi bluechip fund remains a favorite for investors seeking long term wealth creation through equity investments in large cap companies. key highlights:. Etmutualfunds has shortlisted 10 funds across five equity mutual fund categories. investors should choose mutual funds based on their financial goals, investment horizon, and risk appetite. Here’s a comprehensive, easy to understand guide to the top 10 mutual funds in india for 2025 – perfect for sips, long term growth, or building a secure future. why mutual funds? why now? sips are booming: over 10 crore sip accounts in india as of 2025. Top pick: nippon india large cap fund. 2. mid cap funds. top pick: axis midcap fund. 3. small cap funds. top pick: quant small cap fund. 4. elss (tax saving funds) top pick: mirae asset tax saver fund. We have compiled a list of the top mutual funds in india for 2025, suitable for both lump sum and systematic investment plans, to help you make informed choices. this guide makes it easier to find the best mutual funds to invest in india this year. Large cap or flexi cap funds like axis bluechip or parag parikh flexi cap are suitable for beginners due to lower volatility and strong management.

Best Mutual Funds For 2025 Usa In India Megan Knox Here’s a comprehensive, easy to understand guide to the top 10 mutual funds in india for 2025 – perfect for sips, long term growth, or building a secure future. why mutual funds? why now? sips are booming: over 10 crore sip accounts in india as of 2025. Top pick: nippon india large cap fund. 2. mid cap funds. top pick: axis midcap fund. 3. small cap funds. top pick: quant small cap fund. 4. elss (tax saving funds) top pick: mirae asset tax saver fund. We have compiled a list of the top mutual funds in india for 2025, suitable for both lump sum and systematic investment plans, to help you make informed choices. this guide makes it easier to find the best mutual funds to invest in india this year. Large cap or flexi cap funds like axis bluechip or parag parikh flexi cap are suitable for beginners due to lower volatility and strong management.

Best Mutual Funds For 2025 India Stock Market Raza Zara We have compiled a list of the top mutual funds in india for 2025, suitable for both lump sum and systematic investment plans, to help you make informed choices. this guide makes it easier to find the best mutual funds to invest in india this year. Large cap or flexi cap funds like axis bluechip or parag parikh flexi cap are suitable for beginners due to lower volatility and strong management.

Comments are closed.