Bitcoin 4 Year Cycle Broken How Will The Bitcoin Halving Impact Price

Bitcoin 4 Year Cycle Broken How Will The Bitcoin Halving Impact Price Bitcoin’s price movements have historically been tied to its halving cycle, which occurs every four years. the halving event cuts bitcoin’s mining rewards in half, reducing the new supply of btc entering the market. Analysts question whether the halving driven price cycles are still reliable. “the traditional 4 year bitcoin cycle appears dead or at least significantly broken down, evolving into a less predictable, more sustained growth pattern rather than rigid boom bust phases tied strictly to halvings.” but the supply impact is a mere.

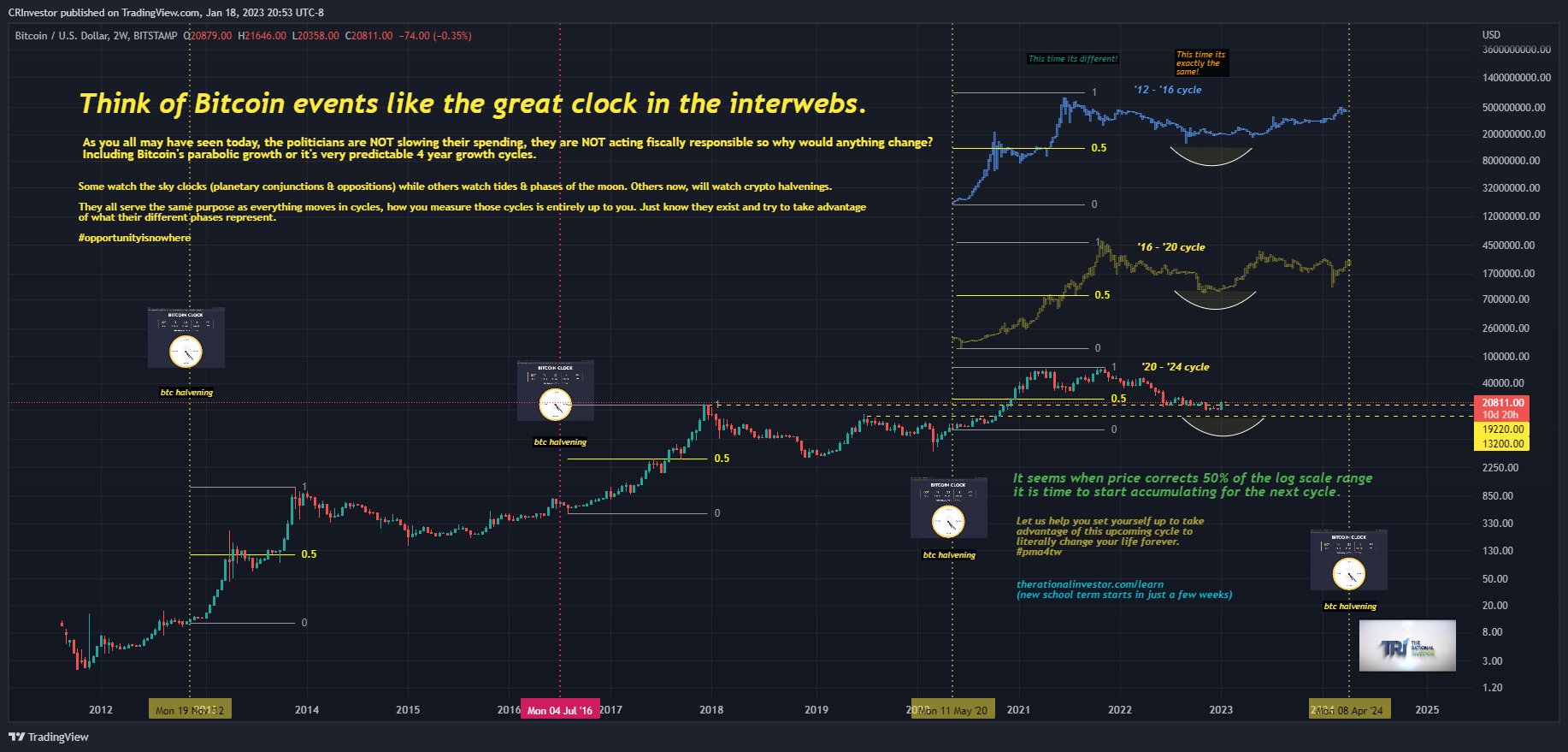

Next Bitcoin Halving Date Countdown Bitcoin 4 Year Cycle Bitcoin’s four year cycle is tied to an event called the halving, which cuts the reward for mining bitcoin in half roughly every four years. this slows the issuance of new coins, drastically reducing the supply flow entering the market. What happened: in a post on x on monday, deutscher stated that the traditional 4 year crypto cycle is no longer relevant due to two major shifts. first, the bitcoin halving has less. Bitcoin halving is a pre programmed event that occurs approximately every four years, cutting the reward miners receive for validating transactions in half. this reduces the rate at which. Industry experts are challenging the long held belief that bitcoin's price performance is intrinsically linked to the cryptocurrency's quadrennial halving event.

Next Bitcoin Halving Date Countdown Bitcoin 4 Year Cycle Bitcoin halving is a pre programmed event that occurs approximately every four years, cutting the reward miners receive for validating transactions in half. this reduces the rate at which. Industry experts are challenging the long held belief that bitcoin's price performance is intrinsically linked to the cryptocurrency's quadrennial halving event. Bitcoin’s market cycles have traditionally followed a halving driven four year cycle, but one industry heavyweight feels the crypto market is going beyond this narrative. bitwise cio matt hougan recently made headlines by forecasting a significant bitcoin rally in 2026, defying the generally held idea that bitcoin’s fortunes rise and fall. Bitcoin’s traditional four year price cycle, once a defining feature of its market behavior, is increasingly seen as obsolete, with 2026 positioned as a potential breakout year, according to matt hougan, chief investment officer of crypto asset manager bitwise. he attributed this shift to the halving’s diminishing impact, which becomes. Experts warn four year bitcoin cycle is dead. now what? like a lot of assets, bitcoin has traditionally moved according to a standard set cycle, more or less. but what is the impact on price? not so much. 2012 halving: price rose 8,800% within a year. 2016 halving: 294% gain post halving in the next 12 months. 2020 halving: roughly 540%. The four year bitcoin cycle, once a cornerstone of crypto market analysis, is losing its grip. the diminishing impact of halvings, a supportive macro environment, reduced systemic risks, and the rise of corporate bitcoin adoption signal the end of an era.

Comments are closed.