Bitcoin Dominance Soars To Bear Market High Of 51

Bitcoin Dominance Soars To Bear Market High Of 51 Bitcoin’s dominance, a measure of its market share, reached a 31 month high, indicating strength. this surge is attributed to renewed interest in bitcoin’s fundamentals, institutional support, and reduced selling pressure, solidifying its position in the cryptocurrency market. When btc dominance is high, it generally implies that investors are more confident in bitcoin relative to other cryptocurrencies. this can be during times of market uncertainty or volatility, when investors may see bitcoin as a 'safer' bet because of its larger size and more established reputation.

Bitcoin Dominance Back Above 50 As Altcoins Struggle Bitcoin’s dominance in the crypto market has surged to 58.8%, up from 51% in december, reaching its highest level since early 2021. this means bitcoin is tightening its grip. Today’s bitcoin (btc) market dominance is 61.08%, and ethereum (eth) dominance is 11.52%. see bitcoin (btc) market cap dominance chart in real time. compare btc, eth, usdt, xrp, sol, usdc and more to understand the share of each coin in the global crypto market. Bitcoin’s price has shown extreme weakness despite reaching a new all time high in january. the entire bullish cycle may have ended unless bitcoin breaks out from its corrective channel and reclaims $100,000 soon. Bitcoin (btc) tightened its grip on the crypto market on tuesday, with dominance surging to fresh four year high as crypto traders rotated into the market’s anchor asset ahead of tomorrow's.

Bitcoin Dominance Crosses 50 For First Time In 2018 As Bear Market Continues To Deepen Btc Geek Bitcoin’s price has shown extreme weakness despite reaching a new all time high in january. the entire bullish cycle may have ended unless bitcoin breaks out from its corrective channel and reclaims $100,000 soon. Bitcoin (btc) tightened its grip on the crypto market on tuesday, with dominance surging to fresh four year high as crypto traders rotated into the market’s anchor asset ahead of tomorrow's. Bitcoin is in bear market territory after falling by as much as 23% from its january peak. bitcoin etf investors pulled more than $1 billion on tuesday as confidence in crypto dropped . “galaxy completed the sale of more than 80,000 bitcoin—valued at over $9 billion based on current market prices—for a satoshi era investor, representing one of the earliest and most. Track bitcoin price today, explore live btc price chart, bitcoin market cap, and learn more about bitcoin cryptocurrency. 2013 to 2016: bitcoin monopoly of crypto bitcoin dominated the crypto market from 2013 to 2016, with daily bitcoin dominance averaging between 82.6% and 93.3% per year. during this nascent period, bitcoin’s majority dominance of crypto reached a high of 99.1% on may 29, 2013, despite a recent bitcoin price correction and one of the first major us regulatory actions against then leading.

Bitcoin S Dominance Ratio Reached Nearly 60 In August Bitcoin is in bear market territory after falling by as much as 23% from its january peak. bitcoin etf investors pulled more than $1 billion on tuesday as confidence in crypto dropped . “galaxy completed the sale of more than 80,000 bitcoin—valued at over $9 billion based on current market prices—for a satoshi era investor, representing one of the earliest and most. Track bitcoin price today, explore live btc price chart, bitcoin market cap, and learn more about bitcoin cryptocurrency. 2013 to 2016: bitcoin monopoly of crypto bitcoin dominated the crypto market from 2013 to 2016, with daily bitcoin dominance averaging between 82.6% and 93.3% per year. during this nascent period, bitcoin’s majority dominance of crypto reached a high of 99.1% on may 29, 2013, despite a recent bitcoin price correction and one of the first major us regulatory actions against then leading.

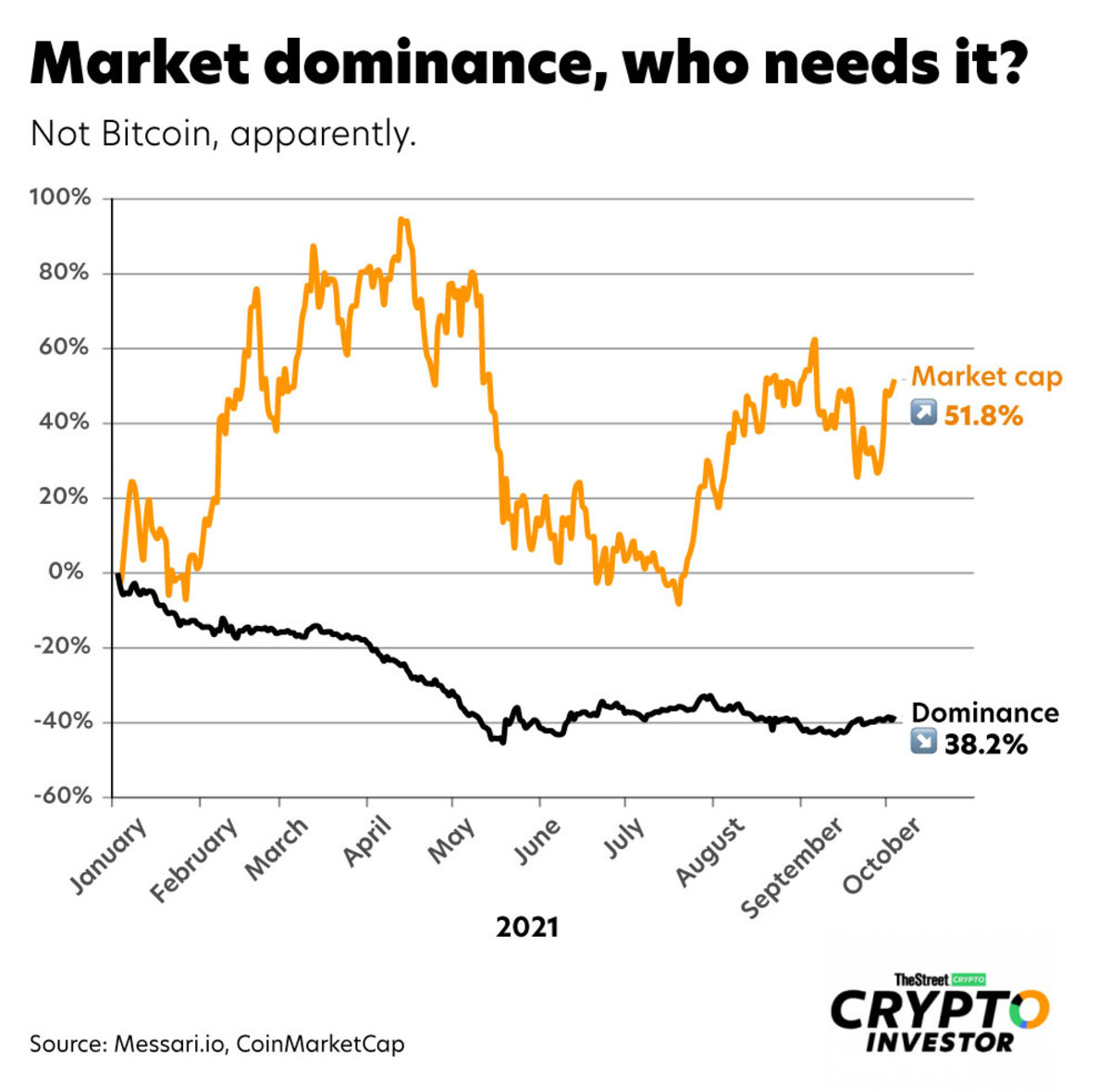

Bitcoin Dominance Fades As Relevant Market Indicator In 2021 The Street Crypto Bitcoin And Track bitcoin price today, explore live btc price chart, bitcoin market cap, and learn more about bitcoin cryptocurrency. 2013 to 2016: bitcoin monopoly of crypto bitcoin dominated the crypto market from 2013 to 2016, with daily bitcoin dominance averaging between 82.6% and 93.3% per year. during this nascent period, bitcoin’s majority dominance of crypto reached a high of 99.1% on may 29, 2013, despite a recent bitcoin price correction and one of the first major us regulatory actions against then leading.

Comments are closed.