Calculating Expected Portfolio Returns And Portfolio Variances

Solution Calculating Expected Portfolio Returns Studypool To calculate the portfolio’s expected return, you take the expected returns of each security in the portfolio. then, you multiply each security’s expected return by its proportion in the portfolio and add them up. the formula below helps you find the portfolio’s expected return:. In today’s video, we learn how to calculate a portfolio’s return and variance. we go through four different examples and then i provide a homework example fo.

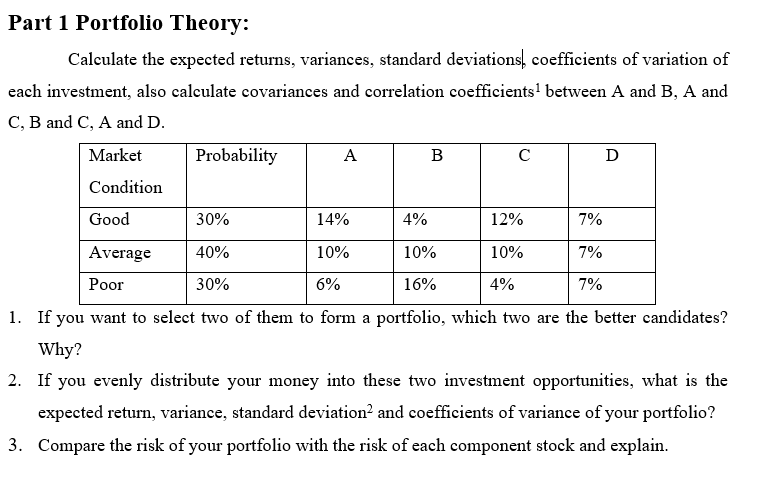

Part 1 Portfolio Theory Calculate The Expected Chegg A comprehensive exploration of how to calculate, interpret, and apply portfolio expected returns, variance, and standard deviation in investment management. "calculating expected returns and the standard deviation can be a useful exercise so that the investor knows whether their portfolio is on or near the efficient frontier," said david. Portfolio risk and return the expected return on a portfolio is a weighted average of the individual returns with the portfolio proportions used as weights. the portfolio proportion of stock i isproportion of stock i is i dollars spent on stock i w total dollars invested in the portfolio = stock expected return. Here we study the performance of a one period investment x0 > 0 (dollars) shared among several different assets. our criterion for measuring performance will be the mean and variance of its rate of return; the variance being viewed as measuring the risk involved.

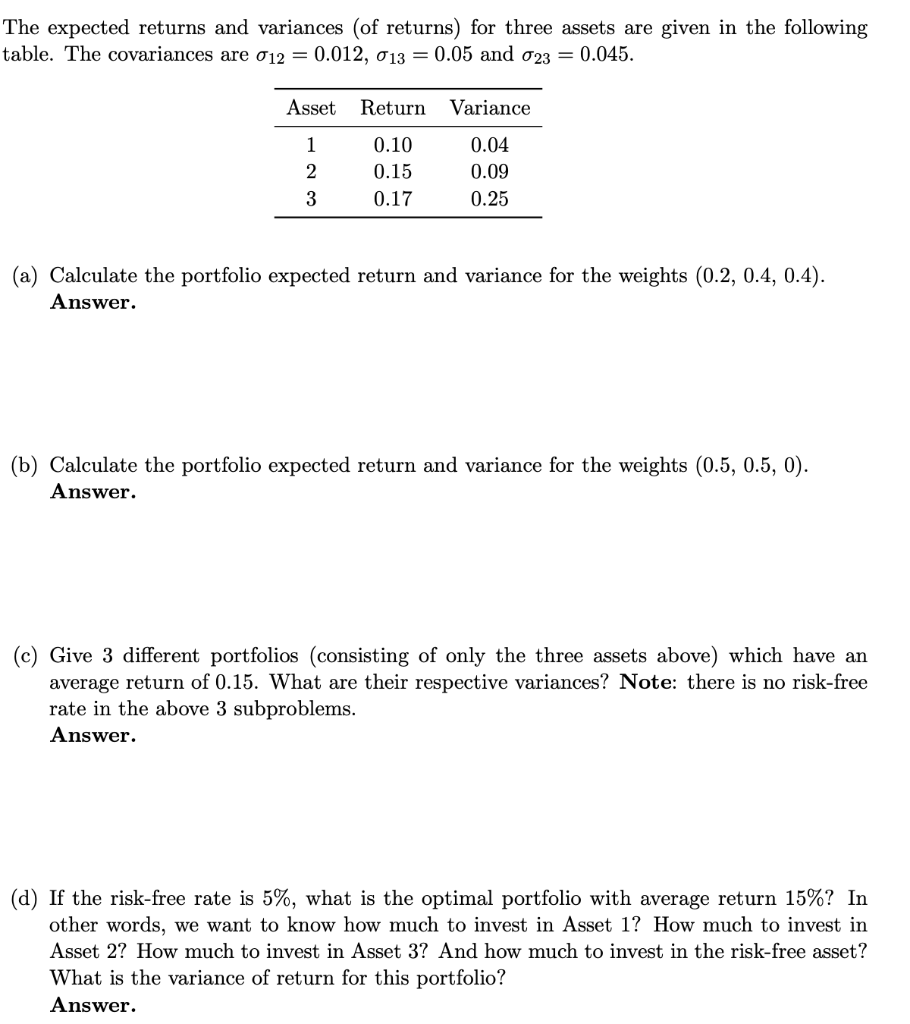

The Expected Returns And Variances Of Returns For Chegg Portfolio risk and return the expected return on a portfolio is a weighted average of the individual returns with the portfolio proportions used as weights. the portfolio proportion of stock i isproportion of stock i is i dollars spent on stock i w total dollars invested in the portfolio = stock expected return. Here we study the performance of a one period investment x0 > 0 (dollars) shared among several different assets. our criterion for measuring performance will be the mean and variance of its rate of return; the variance being viewed as measuring the risk involved. When working with large portfolios, the algebra of representing portfolio expected returns and variances becomes cumbersome. the use of matrix (lin ear) algebra can greatly simplify many of the computations. matrix algebra formulations are also very useful when it comes time to do actual computa tions on the computer. •negative > if return on one asset is above its expected value, return on the other tends to be below its expected value. •positive > if return on one asset is above its expected value, return on the other tends to be above its expected value as well. same for returns below expected value. Financial professionals usually manage a portfolio. portfolio expected return is the sum of each individual asset’s expected returns multiplied by its associated weight. therefore: e(rp) = ∑w iri where i = 1,2,3 … n e (r p) = ∑ w i r i where i = 1,2,3 … n. where: w i w i = weights (market value) attached to each asset i i. Expected portfolio return is simply the weighted average of the expected returns of all the individual investments in your portfolio. think of it like calculating your overall gpa —each course grade is weighted by the number of credit hours it’s worth.

Comments are closed.