Calculating Wacc Formula Examples Calculator

Wacc Calculation Pdf Put simply, if the value of a company equals the present value of its future cash flows, wacc is the rate we use to discount those future cash flows to the present. This weighted average cost of capital calculator, or wacc calculator for short, lets you find out how profitable your company needs to be in order to generate value. with the use of the wacc formula, calculating the cost of capital will be nothing but a piece of cake.

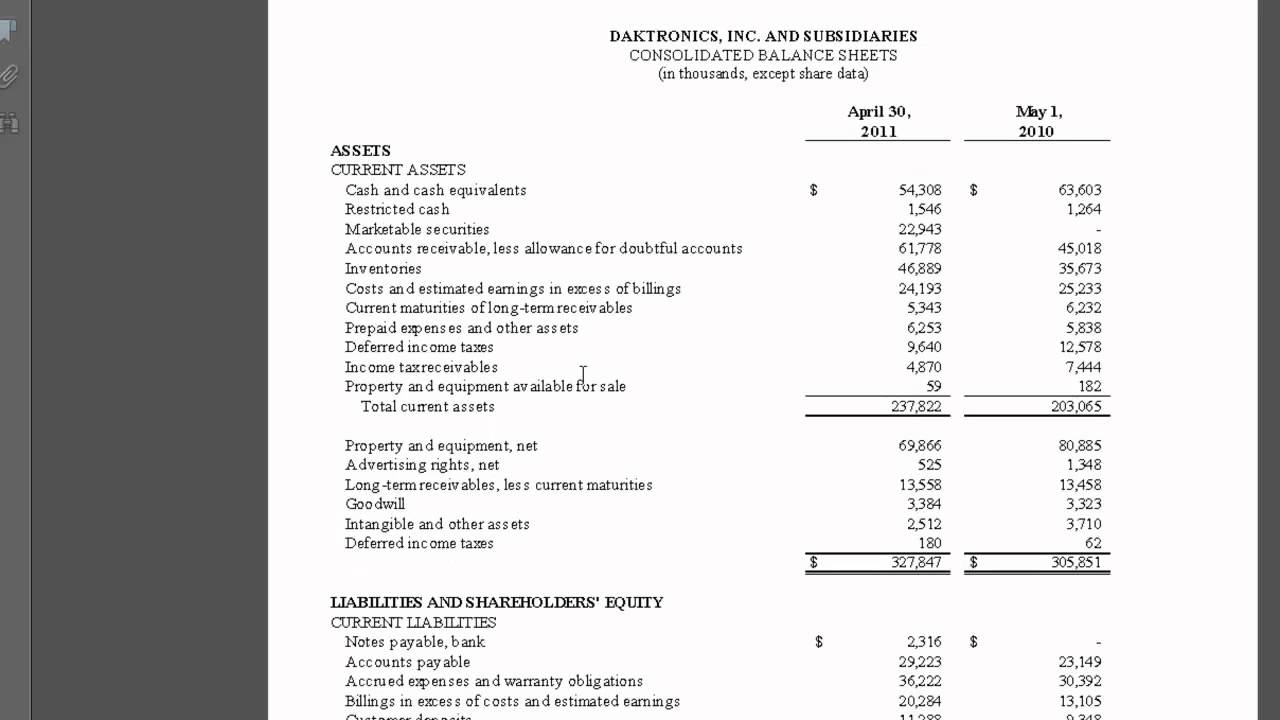

Wacc Formula Excel Overview Calculation And Example 42 Off The weighted average cost of capital (wacc) calculates a company's cost of capital, proportionately weighing its use of debt and equity financing. Wacc may be computed by taking the market value of each capital source and multiplying its cost by its weight. the total can then be obtained by summing the results. wacc is frequently used as a benchmark rate by which businesses and investors assess whether a certain project or purchase is desirable. what is wacc used for? how do i calculate wacc?. You can use this wacc calculator to calculate the weighted average cost of capital based on the cost of equity and the after tax cost of debt. enter the information in the form below and click the "calculate wacc" button to determine the weighted average cost of capital for a company. Simply put, the wacc formula helps companies determine how much they should pay to use someone else’s money to invest in their business. it is a complex formula that takes the percentage of a company’s capital that comes from debt and multiplies it by the cost of that debt.

Wacc Formula Excel Overview Calculation And Example 42 Off You can use this wacc calculator to calculate the weighted average cost of capital based on the cost of equity and the after tax cost of debt. enter the information in the form below and click the "calculate wacc" button to determine the weighted average cost of capital for a company. Simply put, the wacc formula helps companies determine how much they should pay to use someone else’s money to invest in their business. it is a complex formula that takes the percentage of a company’s capital that comes from debt and multiplies it by the cost of that debt. Wacc formula = (e v * ke) (d v) * kd * (1 – tax rate) the equation may look complex, but it will begin to make sense as we learn each term. let’s begin. let’s start with the e, the market value of equity. how should we calculate it? here’s how –. This wacc calculator helps you calculate wacc based on capital structure, cost of equity, cost of debt and tax rate. This makes the calculator highly valuable for business owners and those who plan to start their own businesses. it uses the wacc formula, so if you have to calculate wacc, the calculator does the work for you. Estimate your company's financing cost with our wacc calculator. analyze debt, equity, and tax inputs to support investment, valuation, and loan planning decisions. wacc calculator is part of the finance calculators collection.

+Excel+Formula.JPG)

Calculating Wacc Wacc formula = (e v * ke) (d v) * kd * (1 – tax rate) the equation may look complex, but it will begin to make sense as we learn each term. let’s begin. let’s start with the e, the market value of equity. how should we calculate it? here’s how –. This wacc calculator helps you calculate wacc based on capital structure, cost of equity, cost of debt and tax rate. This makes the calculator highly valuable for business owners and those who plan to start their own businesses. it uses the wacc formula, so if you have to calculate wacc, the calculator does the work for you. Estimate your company's financing cost with our wacc calculator. analyze debt, equity, and tax inputs to support investment, valuation, and loan planning decisions. wacc calculator is part of the finance calculators collection.

Comments are closed.