Candlestick Patterns Explained Plus Free Cheat Sheet Tradingsim

Candlestick Patterns Explained Plus Free Cheat Sheet Tradingsim Pdf Market Trend Stocks What is a candlestick chart? a candlestick chart is a type of financial diagram that technical analysts use to follow price trends. the candlestick shows key pieces of information: opening. Learn about all the trading candlestick patterns that exist: bullish, bearish, reversal, continuation and indecision with examples and explanation.

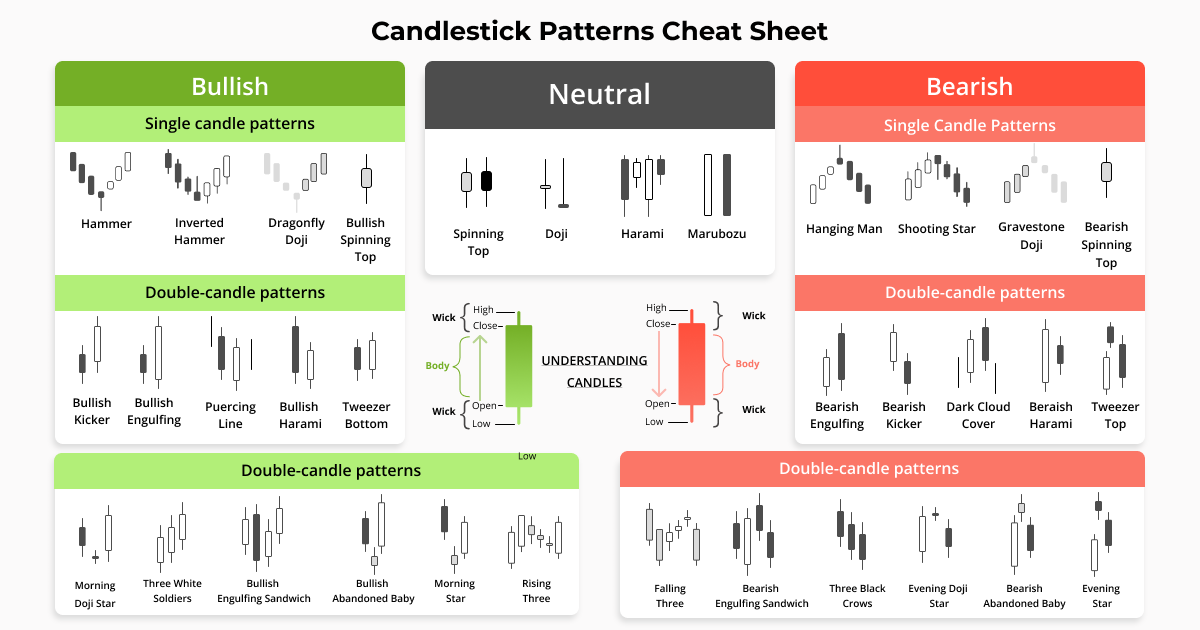

Candlestick Patterns Explained Plus Free Cheat Sheet 41 Off All candlestick patterns are read and analyzed on the basis of these 3 parts i.e, the upper shadow, the body and the lower shadow. the different combinations of the upper shadow, the lower shadow and the body results in different candlestick patterns. Candlestick is a visual tool that depicts fluctuations in an asset's past and current prices. the candle has three parts: the upper shadow, the real body, and the lower shadow. stock market analysts and traders use this tool to anticipate future movement in an asset's price. There are three main parts to a candlestick: upper shadow: the vertical line between the high of the day and the closing price (bullish candle) or open (bearish candle) real body: the difference between the opening price and closing prices. this is shown by the colored portion of the candlestick. A candlestick chart is a charting technique used in the stock market to visualize price movements and trends of a security, such as a stock, over a specific time period. candlestick charts convey information about the opening, closing, high, and low prices for each time interval.

Candlestick Patterns Explained Plus Free Cheat Sheet 47 Off There are three main parts to a candlestick: upper shadow: the vertical line between the high of the day and the closing price (bullish candle) or open (bearish candle) real body: the difference between the opening price and closing prices. this is shown by the colored portion of the candlestick. A candlestick chart is a charting technique used in the stock market to visualize price movements and trends of a security, such as a stock, over a specific time period. candlestick charts convey information about the opening, closing, high, and low prices for each time interval. What is a candlestick? a candlestick is a single bar on a candlestick price chart, showing traders market movements at a glance. each candlestick shows the open price, low price, high price, and close price of a market for a particular period of time. An hourly candlestick shown with order book depth on a currency exchange. a candlestick chart (also called japanese candlestick chart or k line) is a style of financial chart used to describe price movements of a security, derivative, or currency. What is a candlestick? at its core, a candlestick is a type of price chart used in technical analysis that displays the high, low, open, and close prices of an asset for a specific period. let’s take a look at a candlestick and analyse it…. They help traders and investors quickly assess price movements and short term market sentiment. candlesticks originated in japan and are useful for recognizing market sentiment and the balance of.

Candlestick Patterns Explained Plus Free Cheat Sheet 47 Off What is a candlestick? a candlestick is a single bar on a candlestick price chart, showing traders market movements at a glance. each candlestick shows the open price, low price, high price, and close price of a market for a particular period of time. An hourly candlestick shown with order book depth on a currency exchange. a candlestick chart (also called japanese candlestick chart or k line) is a style of financial chart used to describe price movements of a security, derivative, or currency. What is a candlestick? at its core, a candlestick is a type of price chart used in technical analysis that displays the high, low, open, and close prices of an asset for a specific period. let’s take a look at a candlestick and analyse it…. They help traders and investors quickly assess price movements and short term market sentiment. candlesticks originated in japan and are useful for recognizing market sentiment and the balance of. What are candlesticks, and how can you read a candlestick as a beginner? read this detailed candlesticks article to get all you need. Candlestick charts are a powerful visual tool that provides traders an intuitive way to understand price movements and market trends. learning to read these charts will give you insights into market sentiment, help you identify trading opportunities, and refine your trading strategy. A candlestick pattern is a graphical representation used in technical analysis to indicate potential price movements in financial markets. a candlestick consists of a rectangular body, two wicks extending above and below the body, and the open and close prices. the ten best and most popular candlestick patterns are listed below. bullish engulfing. The candlestick shadow is the line at the top and bottom of the candlestick body, called the upper and lower shadow, and shows the maximum and minimum price during the trading session. the length of the shadow also carries some information when talking about the best candlestick signals for beginners.

Candlestick Patterns Explained Plus Free Cheat Sheet 45 Off What is a candlestick? at its core, a candlestick is a type of price chart used in technical analysis that displays the high, low, open, and close prices of an asset for a specific period. let’s take a look at a candlestick and analyse it…. They help traders and investors quickly assess price movements and short term market sentiment. candlesticks originated in japan and are useful for recognizing market sentiment and the balance of. What are candlesticks, and how can you read a candlestick as a beginner? read this detailed candlesticks article to get all you need. Candlestick charts are a powerful visual tool that provides traders an intuitive way to understand price movements and market trends. learning to read these charts will give you insights into market sentiment, help you identify trading opportunities, and refine your trading strategy. A candlestick pattern is a graphical representation used in technical analysis to indicate potential price movements in financial markets. a candlestick consists of a rectangular body, two wicks extending above and below the body, and the open and close prices. the ten best and most popular candlestick patterns are listed below. bullish engulfing. The candlestick shadow is the line at the top and bottom of the candlestick body, called the upper and lower shadow, and shows the maximum and minimum price during the trading session. the length of the shadow also carries some information when talking about the best candlestick signals for beginners. The new candlestick trading bible for beginners distinguishes itself by taking traders beyond theory, offering a complete, practical, bonus packed package for mastering candlestick trading from scratch. with its beginner friendly approach, it provides clear definitions, examples, and tips on how to use patterns for better trading decisions. In this video, i’ll show you how to read candlestick charts step by step, so you can start spotting bullish and bearish moves, trends, reversals, and powerfu. Master trading with 40 powerful candlestick patterns. learn key patterns, enhance market predictions, and improve your technical analysis today!. Candlestick charts are unique in their ability to convey multiple data points within a single graphical representation. unlike simple line charts, which display only closing prices over time, candlestick charts include the open, high, low, and close of a given trading period.

Comments are closed.