Cd Accounts Explained Use For Strong Fixed Returns Nerdwallet

Cd Accounts Explained At Sam Moonlight Blog Cds, or certificate of deposit, are a good option for earning interest, especially now that interest rates have bounced back. but be mindful of the drawbacks to cds that you should know, like. A certificate of deposit is a type of savings account with a fixed interest rate and term. cds, called share certificates at credit unions, tend to have the highest rates among federally.

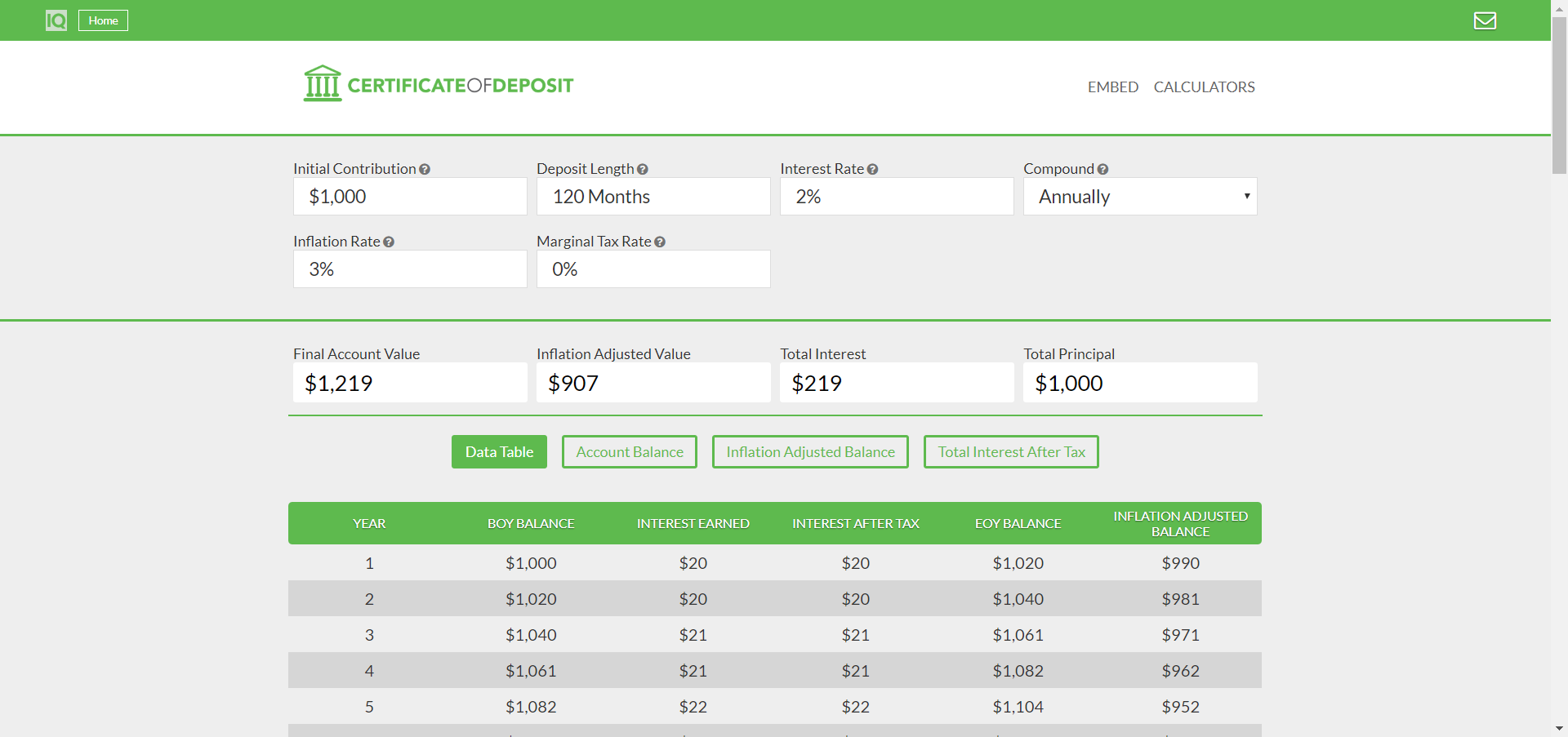

Cds Vs High Yield Savings Which Is Better While cds can provide some guaranteed returns over time and some level of security, they’re not likely to provide you with the returns needed to build wealth for retirement over time. Learn the key difference between certificate of deposit and savings account, and discover which one suits your financial needs better. Each type comes with its own set of features designed to meet various financial goals and needs: traditional cd: this is the most common type of cd. you deposit a fixed amount for a set term, and at the end of that term, you receive your principal plus interest. High yield certificates of deposit (cds) are low risk saving instruments that offer fixed returns for a specific period of time. they have higher rates than traditional cds and savings.

Comparing A Fixed Annuity To A Bank Cd Disadvantages And Advantages Of Both Each type comes with its own set of features designed to meet various financial goals and needs: traditional cd: this is the most common type of cd. you deposit a fixed amount for a set term, and at the end of that term, you receive your principal plus interest. High yield certificates of deposit (cds) are low risk saving instruments that offer fixed returns for a specific period of time. they have higher rates than traditional cds and savings. Explore the pros and cons of cds to determine if they're worth it for your savings. discover alternatives and tips for maximizing returns. Cds have historically offered some of the highest guaranteed returns among bank accounts, but that doesn’t automatically make them the best home for your savings or investments. With a cd, you can "avoid the volatility of the stock market and earn a return that's typically better than other savings accounts." even better, your funds are insured, which means up to a. Here's how much interest a $10,000 cd can earn now compared to last august cd interest rates are fixed, unlike high yield savings accounts, which have similarly high rates now but are subject to.

Comments are closed.