Chapter 15 Accounts Receivable And Uncollectible Accounts Two Methods On Accounting For

Solved 15 Two Methods Of Accounting For Uncollectible Chegg Companies with large amounts of uncollectible accounts normally use the direct write off method to account for uncollectible accounts expense. the direct write off method is used to ensure the matching of expenses with revenue. Under their approach, it is necessary to first determine the amount in the accounts estimated to be uncollectible and to adjust the allowance for doubtful accounts to that amount. the offsetting debit to expense is the result of focusing on the balance sheet accounts.

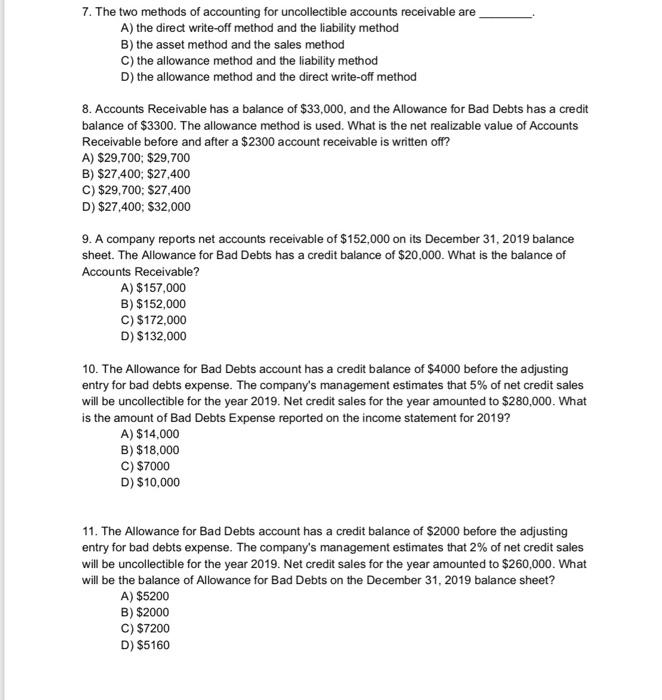

Solved 7 The Two Methods Of Accounting For Uncollectible Chegg Uncollectible accounts are frequently called “bad debts.” a simple method to account for uncollectible accounts is the direct write off approach. under this technique, a specific account receivable is removed from the accounting records at the time it is finally determined to be uncollectible. Companies use two methods for handling uncollectible accounts. the direct write off method recognizes bad accounts as an expense at the point when judged to be uncollectible and is the required method for federal income tax purposes. Determine uncollectible accounts receivable. use the direct write off method for uncollectible accounts. calculate bad debts expense. make an adjusting entry for uncollectible accounts. use the allowance method to record uncollectible accounts. record the collection of an account previously written off. describe two methods to estimate. Explore two key methods for estimating uncollectible receivables and their impact on financial statements.

Solved 15 Two Methods Of Accounting For Uncollectible Chegg Determine uncollectible accounts receivable. use the direct write off method for uncollectible accounts. calculate bad debts expense. make an adjusting entry for uncollectible accounts. use the allowance method to record uncollectible accounts. record the collection of an account previously written off. describe two methods to estimate. Explore two key methods for estimating uncollectible receivables and their impact on financial statements. Some accountants think that it is more important to focus on the balance in the allowance account than on the amount charged to expense. under their approach, it is necessary to first determine the amount in the accounts estimated to be uncollectible and to adjust the allowance for doubtful accounts to that amount. Under the allowance method for recording uncollectible accounts, the methods of estimating the allowances are percent of sales and analysis of receivables. see an expert written answer!. When the expense is recognised depends on the method of accounting for uncollectible accounts. there are two methods a business may use to recognise bad debt: (1) the direct write off method and (2) the allowance method. let’s look at these methods closely. There are two ways to do this method: a simple way that, of course, is not the best practice and a more complicated but more reliable way that uses an aging analysis that we’ll cover in the next section.

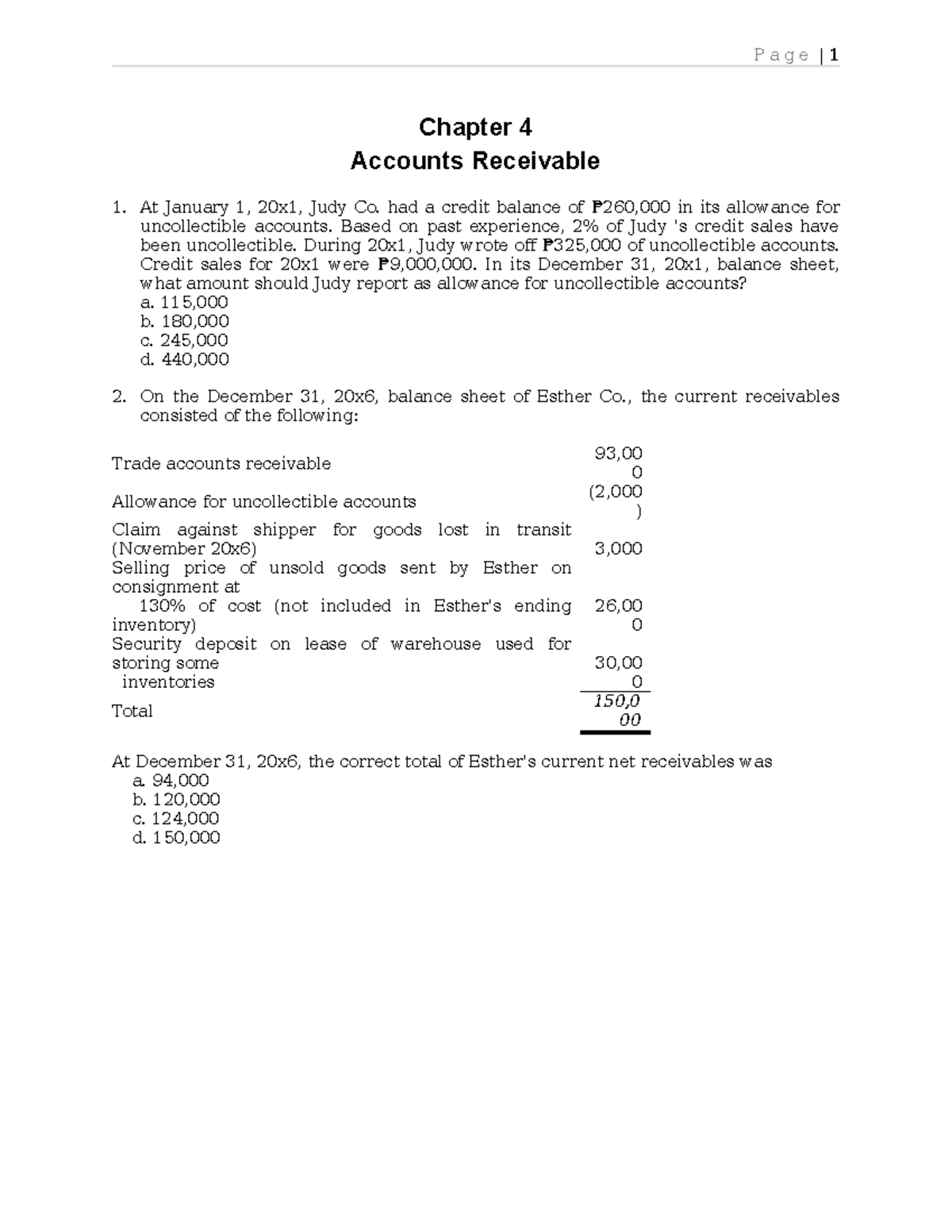

Chapter 4 Accounts Receivable Uncollectible Accounts Accounting Studocu Some accountants think that it is more important to focus on the balance in the allowance account than on the amount charged to expense. under their approach, it is necessary to first determine the amount in the accounts estimated to be uncollectible and to adjust the allowance for doubtful accounts to that amount. Under the allowance method for recording uncollectible accounts, the methods of estimating the allowances are percent of sales and analysis of receivables. see an expert written answer!. When the expense is recognised depends on the method of accounting for uncollectible accounts. there are two methods a business may use to recognise bad debt: (1) the direct write off method and (2) the allowance method. let’s look at these methods closely. There are two ways to do this method: a simple way that, of course, is not the best practice and a more complicated but more reliable way that uses an aging analysis that we’ll cover in the next section.

And Accounts Receivable Methods When the expense is recognised depends on the method of accounting for uncollectible accounts. there are two methods a business may use to recognise bad debt: (1) the direct write off method and (2) the allowance method. let’s look at these methods closely. There are two ways to do this method: a simple way that, of course, is not the best practice and a more complicated but more reliable way that uses an aging analysis that we’ll cover in the next section.

Solved Two Methods Of Accounting For Uncollectible Accounts Chegg

Comments are closed.