Chapter 2 How To Calculate Present Values Pdf Net Present Value Present Value

Chapter 2 How To Calculate Present Values Pdf Net Present Value Present Value Chapter 2 how to calculate present values free download as pdf file (.pdf), text file (.txt) or view presentation slides online. After five years, the factory’s value will be the present value of the five remaining year’s of cash flows. pv = $170,000 × ((1 .14) – {1 [.14(1.14) (10 – 5) ]}).

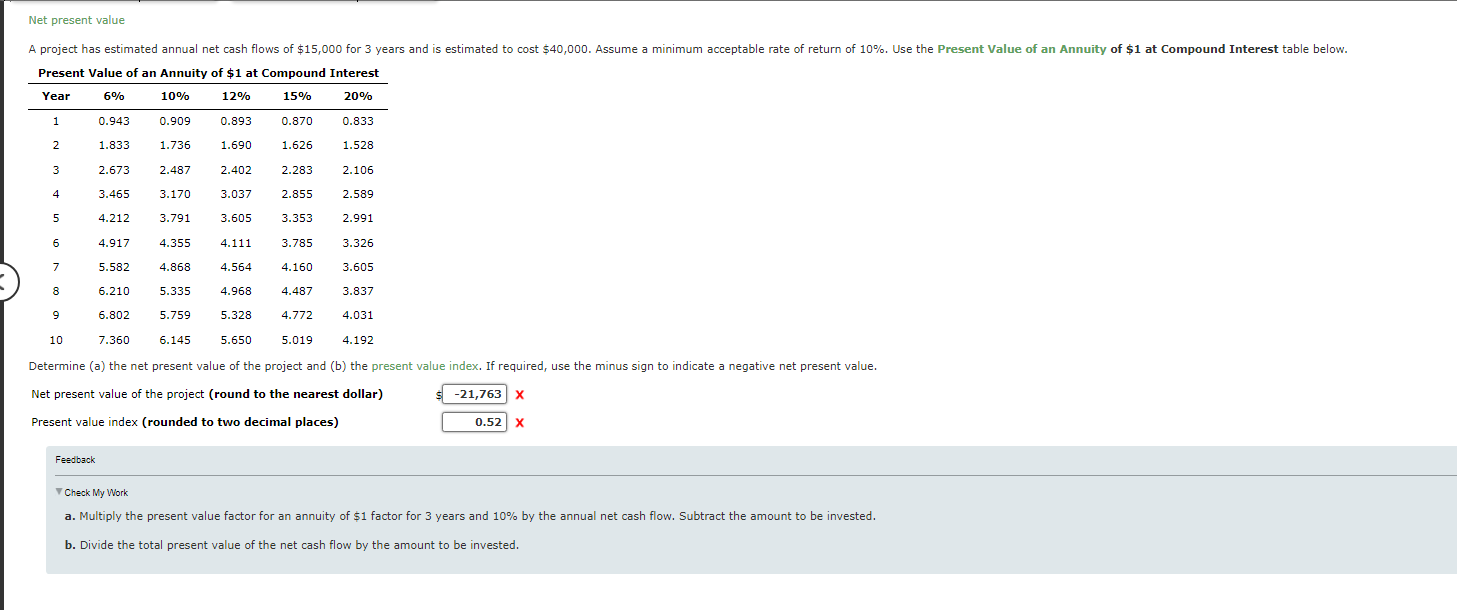

Solved Answernet Present Valuedetermine A ï The Net Present Chegg 2 how to calculate present values c ompanies invest in lots of things. some are tangible assets—that is, assets you can kick, like factories, machinery, and offices. others are intangible assets, such as patents or trademarks. in each case the company lays out some money now in the hope of receiving even more money later. If the three year present value annuity factor is 2.673 and two year present value annuity factor is 1.833, what is the present value of $1 received at the end of the 3 years? a. $1.1905. Current interest rate isr,say,4%. •$1 investable at a rate of returnr=4%. •fv in 1 year is. fv=1 r=$1.04. •fv intyears is. fv=$1×(1 r)×···×(1 r) =(1 r)t. example. bank pays an annual interest of 4% on 2 year cds and you deposit $10,000. what is your balance two years later?. The project costs $700,000, so the net present value (npv) is $47,664. net present value equals present value minus the required investment: npv = pv − investment = 747,664 − 700,000 = $47,664 in other words, the office development is worth more than it costs.

Chapter 2 How To Calculate Present Values Pdf Net Present Value Present Value Current interest rate isr,say,4%. •$1 investable at a rate of returnr=4%. •fv in 1 year is. fv=1 r=$1.04. •fv intyears is. fv=$1×(1 r)×···×(1 r) =(1 r)t. example. bank pays an annual interest of 4% on 2 year cds and you deposit $10,000. what is your balance two years later?. The project costs $700,000, so the net present value (npv) is $47,664. net present value equals present value minus the required investment: npv = pv − investment = 747,664 − 700,000 = $47,664 in other words, the office development is worth more than it costs. Sometimes there are shortcuts that make it very easy to calculate the present value of an asset that pays off in different periods. these tools allow us to cut through the calculations quickly. short cuts perpetuity financial concept in which a cash flow is theoretically received forever. This chapter discusses how to calculate present values. it provides examples of present value calculations for various cash flows, including: annuities, perpetuities, growing perpetuities, and uneven cash flows. it also covers future value calculations, compound interest, and sinking funds. True false chapter 02 how to calculate present values 88. in the amortization of a mortgage loan with equal payments, the fraction of each payment devoted to interest steadily increases over time and the fraction devoted to reducing the loan decreases steadily. The $400,000 present value is the only feasible price that satisfies both buyer and seller. therefore, the present value of the property is also its market price.

Solved Net Present Value Method Present Value Index And Chegg Sometimes there are shortcuts that make it very easy to calculate the present value of an asset that pays off in different periods. these tools allow us to cut through the calculations quickly. short cuts perpetuity financial concept in which a cash flow is theoretically received forever. This chapter discusses how to calculate present values. it provides examples of present value calculations for various cash flows, including: annuities, perpetuities, growing perpetuities, and uneven cash flows. it also covers future value calculations, compound interest, and sinking funds. True false chapter 02 how to calculate present values 88. in the amortization of a mortgage loan with equal payments, the fraction of each payment devoted to interest steadily increases over time and the fraction devoted to reducing the loan decreases steadily. The $400,000 present value is the only feasible price that satisfies both buyer and seller. therefore, the present value of the property is also its market price.

Net Present Value Pdf Net Present Value Present Value True false chapter 02 how to calculate present values 88. in the amortization of a mortgage loan with equal payments, the fraction of each payment devoted to interest steadily increases over time and the fraction devoted to reducing the loan decreases steadily. The $400,000 present value is the only feasible price that satisfies both buyer and seller. therefore, the present value of the property is also its market price.

Comments are closed.