Chart Patterns In Technical Analysis Various Types

Technical Analysis Chart Patterns Technical Analysis Charts Stock Chart Patterns Chart Chart patterns are unique formations within a price chart used by technical analysts in stock trading (as well as stock indices, commodities, and cryptocurrency trading). the patterns are identified using a series of trendlines or curves. Identify the various types of technical indicators, including trend, momentum, volume, volatility, and support and resistance. use charts and learn chart patterns through specific examples of important patterns in bar and candlestick charts. manage your trading risk with a range of confirmation methods.

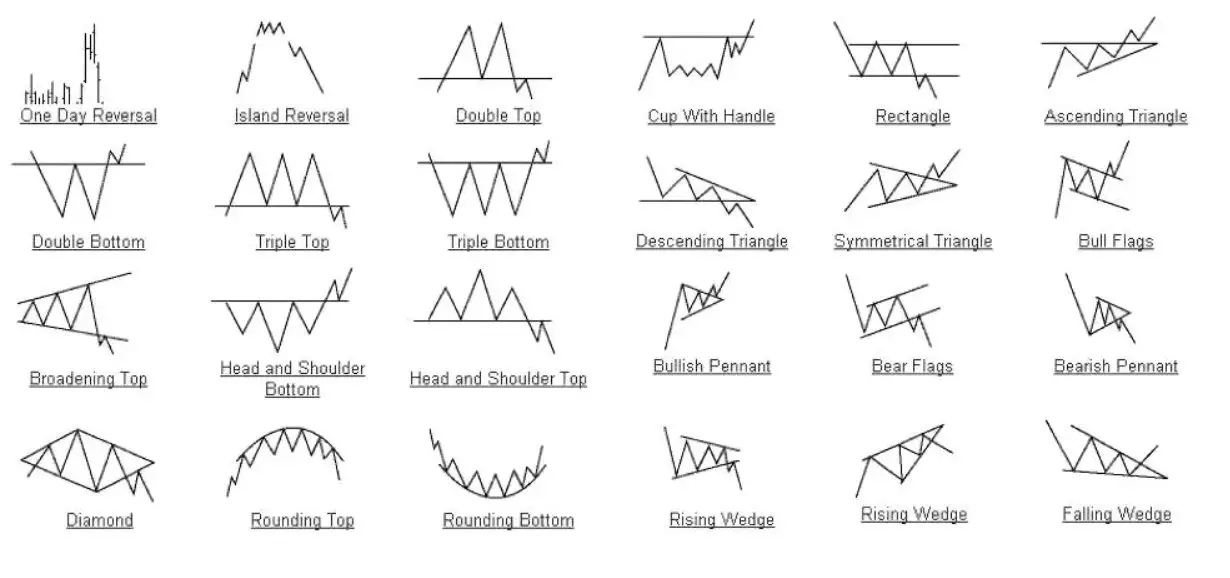

Chart Patterns In Technical Analysis Various Types How many types of chart patterns are there? there are three main types of chart patterns in technical analysis of the stock market – continuation patterns, reversal patterns, and bilateral patterns. Here’s our free chart patterns cheat sheet pdf containing the most popular and widely used trading patterns among traders. you can download and print it and stick it on your desktop or save it in a folder and use it whenever needed. Technical analysts and chartists seek to identify patterns to anticipate the future direction of a security’s price. these patterns can be as simple as trendlines and as complex as double. Adherents of different techniques (for example: candlestick analysis, the oldest form of technical analysis developed by a japanese grain trader; harmonics; dow theory; and elliott wave theory) may ignore the other approaches, yet many traders combine elements from more than one technique.

Understanding Chart Patterns In Technical Analysis Technical analysts and chartists seek to identify patterns to anticipate the future direction of a security’s price. these patterns can be as simple as trendlines and as complex as double. Adherents of different techniques (for example: candlestick analysis, the oldest form of technical analysis developed by a japanese grain trader; harmonics; dow theory; and elliott wave theory) may ignore the other approaches, yet many traders combine elements from more than one technique. Learn about 5 types of chart patterns used in technical analysis like line chart, bar charts, candlestick chart, renko chart, and point & figure charts. Identifying chart patterns is a skill that improves over time, as traders gain experience in how to trade around these patterns. chart pattern analysis can be applied to any chart type, including but not limited to candlestick, point and figure, bar charts, or even charts built on fundamental data. There are tons of chart patterns. most can be divided into two broad categories—reversal and continuation patterns. reversal patterns indicate a trend change, whereas continuation patterns indicate the price trend will continue after a brief consolidation. Types of charts in technical analysis. there are 3 mainly used charts and 5 other charts that traders use when trading. main types of charts: 1. candlestick charts: candlestick charts are the most important charts when discussing prices of financial securities and were developed in ancient japan. the chart depicts small ‘candles’ which.

Episode 2 Types Of Chart Patterns In Technical Analysis Riset Learn about 5 types of chart patterns used in technical analysis like line chart, bar charts, candlestick chart, renko chart, and point & figure charts. Identifying chart patterns is a skill that improves over time, as traders gain experience in how to trade around these patterns. chart pattern analysis can be applied to any chart type, including but not limited to candlestick, point and figure, bar charts, or even charts built on fundamental data. There are tons of chart patterns. most can be divided into two broad categories—reversal and continuation patterns. reversal patterns indicate a trend change, whereas continuation patterns indicate the price trend will continue after a brief consolidation. Types of charts in technical analysis. there are 3 mainly used charts and 5 other charts that traders use when trading. main types of charts: 1. candlestick charts: candlestick charts are the most important charts when discussing prices of financial securities and were developed in ancient japan. the chart depicts small ‘candles’ which.

Technical Analysis Chart Types Vrogue Co There are tons of chart patterns. most can be divided into two broad categories—reversal and continuation patterns. reversal patterns indicate a trend change, whereas continuation patterns indicate the price trend will continue after a brief consolidation. Types of charts in technical analysis. there are 3 mainly used charts and 5 other charts that traders use when trading. main types of charts: 1. candlestick charts: candlestick charts are the most important charts when discussing prices of financial securities and were developed in ancient japan. the chart depicts small ‘candles’ which.

Technical Analysis Types Of Technical Chart Patterns

Comments are closed.