Cracking The Code Of Peer To Peer Lending

Demystifying Peer To Peer Lending A Comprehensive Guide Dollarsharp Explore the dynamics of peer to peer lending, understanding its benefits and risks, and how it fits into your financial strategy.#peertopeerlending #p2plendi. This chapter focuses on demystifying the regulations governing peer to peer (p2p) lending. it guides readers through the legal framework, compliance requirements, and consumer protections that shape the p2p lending landscape, highlighting its importance for both lenders and borrowers.

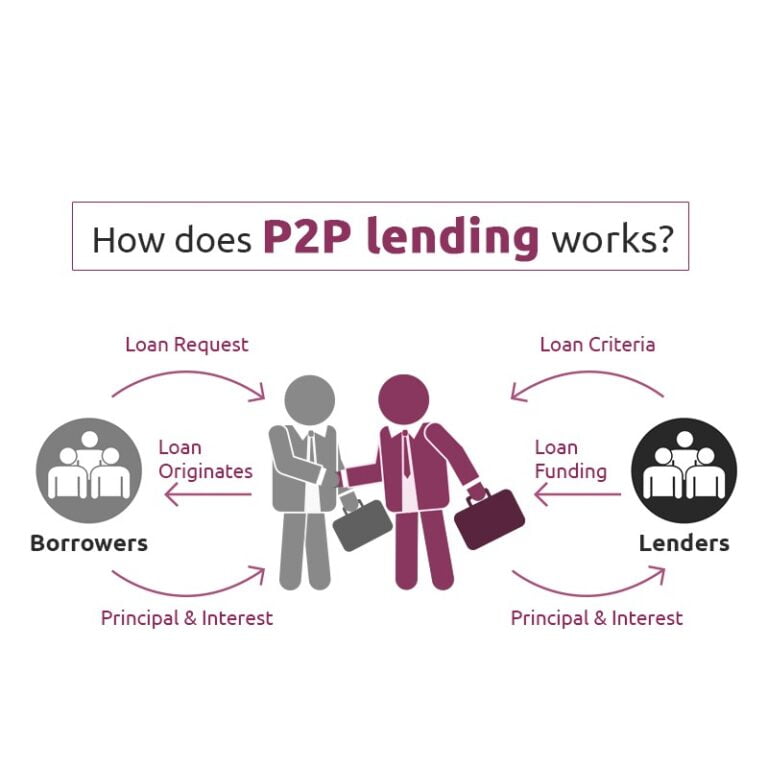

Your Guide On Peer To Peer Lending Malaysia Nexea Digital technologies have disrupted the established order created by traditional financial services. among these disruptions is the rise of peer to peer (p2p) lending platforms, an offshoot. Peer to peer (p2p) lending is an innovative financial model that connects borrowers directly with individual lenders through online platforms, bypassing traditional banks and financial institutions. Fintech peer to peer lending is revolutionizing the way we borrow and lend money. it allows individuals to lend and borrow money directly, cutting out traditional financial institutions and reducing costs. this model has gained popularity in recent years, with platforms like lending club and prosper leading the way. This paper analyzes the performance of peer to peer investments, the potential benefits of their information processing and the investor returns, based on the entire portfolio of the estonian platform bondora.

Peer To Peer Lending Pdf Free Download Fintech peer to peer lending is revolutionizing the way we borrow and lend money. it allows individuals to lend and borrow money directly, cutting out traditional financial institutions and reducing costs. this model has gained popularity in recent years, with platforms like lending club and prosper leading the way. This paper analyzes the performance of peer to peer investments, the potential benefits of their information processing and the investor returns, based on the entire portfolio of the estonian platform bondora. Peer to peer (p2p) lending has emerged as a compelling alternative in the financial landscape, posing a disruptive challenge to traditional banking institutions. by directly connecting borrowers and lenders through online platforms, p2p lending bypasses the role of banks, offering potential benefits for both sides. Banks can reduce credit if borrowing from fintech lenders increases default risk. alternatively, banks can provide more credit if such bor rowing signals creditworthiness. i examine these possibilities using a unique set ting of a large peer to peer lender. Peer to peer lending is a more approachable source of revenue for some borrowers than traditional loans from banking institutions. it could be due to the borrower's poor credit score. The rbi is set to crack down on p2p lending. the central bank has serious concerns about how peer to peer lending companies are marketing themselves and partnering with fintechs—and regulatory action is imminent.

Comments are closed.