Defined Benefit Plan Vs Defined Contribution Plan

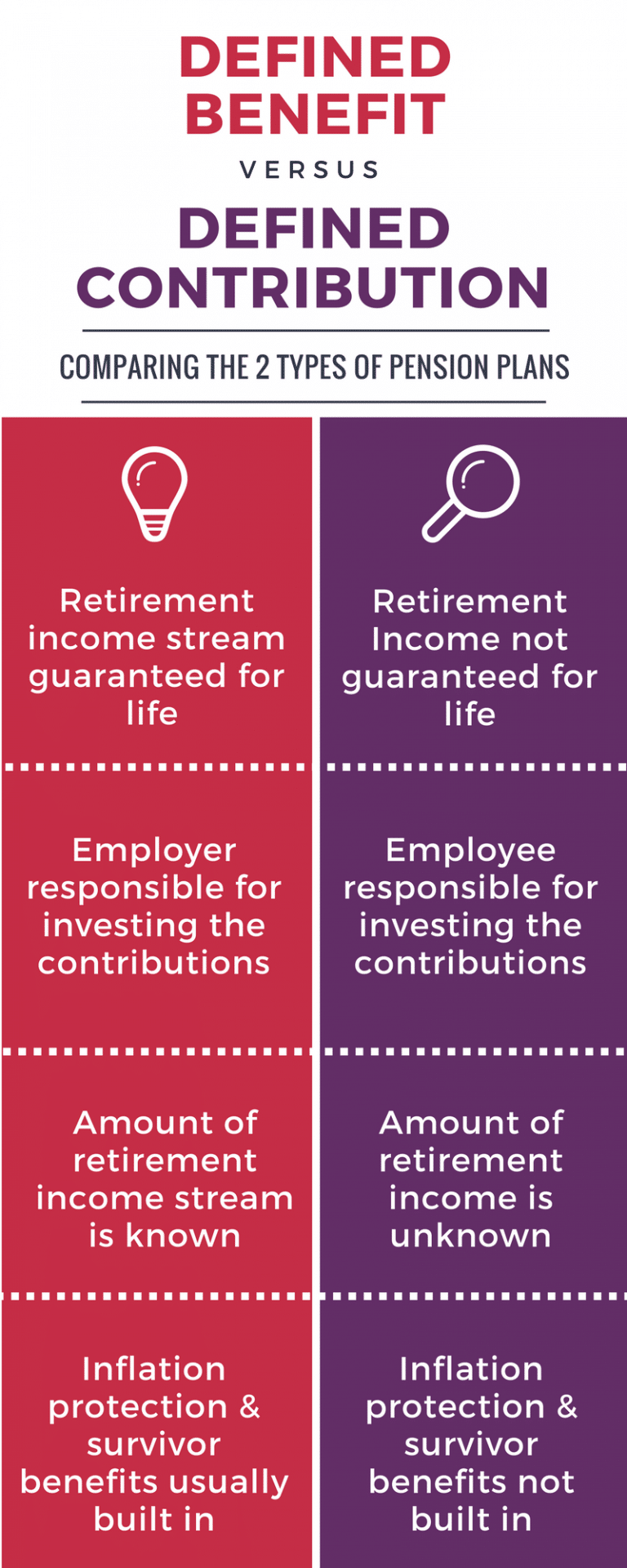

Infographic Defined Benefit Vs Defined Contribution Pension Plan Pharma Tax Defined benefit plans are funded by employers, while employees make contributions to defined contribution plans to save for retirement. Defined benefit plans and defined contribution plans are two primary categories of employer sponsored retirement plans, and they both can help you save along your journey toward retirement. the main differentiators fall around who primarily funds the plan, control over contributions and portability.

Defined Benefit Plan Vs Defined Contribution Plan How They Stack Up Learn the differences between defined benefit plans and defined contribution plans, and the advantages and disadvantages of each. find out how to choose a retirement plan that suits your needs and goals. Defined benefit plans and defined contribution plans are two employer sponsored ways of helping to provide employees with a comfortable retirement. the difference between them lies primarily in who takes responsibility for funding the plans, managing the assets, and, ultimately, ensuring that retirees actually enjoy financial security. While planning for your retirement, you may need to choose between a defined benefit plan versus a defined contribution plan. this choice necessitates careful consideration of numerous factors, such as employment types, tax liabilities, financial goals, and personal preferences. Contrary to a defined benefit plan, in a defined contribution plan, the pension amount is not known beforehand. here, the pension amount depends on your contribution along with the returns generated by your investment.

Defined Benefit Plan Vs Defined Contribution Plan Zalamea Actuarial Blog While planning for your retirement, you may need to choose between a defined benefit plan versus a defined contribution plan. this choice necessitates careful consideration of numerous factors, such as employment types, tax liabilities, financial goals, and personal preferences. Contrary to a defined benefit plan, in a defined contribution plan, the pension amount is not known beforehand. here, the pension amount depends on your contribution along with the returns generated by your investment. Retirement plans are classified into two types: defined benefit (db) and defined contribution (dc). for db plans, benefits to be provided for the members are defined by benefit formulas stated in the retirement plan rules. Two of the most common — and confusing — options are defined contribution plans and defined benefit plans. you may have heard about pensions, 401(k)s, or iras, but what do they really mean? how do they impact your retirement income, taxes, and future security?. Compare defined benefit and defined contribution plans. learn key differences, advantages, and choose the right retirement option for your future financial security. Defined benefit plans offer more predictable income in retirement, whereas defined contribution plans provide flexibility and potential for higher returns but with greater risk. understanding these differences is crucial for effective retirement planning and risk management.

Defined Benefit Plan Vs Defined Contribution Plan Retirement plans are classified into two types: defined benefit (db) and defined contribution (dc). for db plans, benefits to be provided for the members are defined by benefit formulas stated in the retirement plan rules. Two of the most common — and confusing — options are defined contribution plans and defined benefit plans. you may have heard about pensions, 401(k)s, or iras, but what do they really mean? how do they impact your retirement income, taxes, and future security?. Compare defined benefit and defined contribution plans. learn key differences, advantages, and choose the right retirement option for your future financial security. Defined benefit plans offer more predictable income in retirement, whereas defined contribution plans provide flexibility and potential for higher returns but with greater risk. understanding these differences is crucial for effective retirement planning and risk management.

Defined Benefit Plan Vs Defined Contribution Plan Compare defined benefit and defined contribution plans. learn key differences, advantages, and choose the right retirement option for your future financial security. Defined benefit plans offer more predictable income in retirement, whereas defined contribution plans provide flexibility and potential for higher returns but with greater risk. understanding these differences is crucial for effective retirement planning and risk management.

Comments are closed.