Difference Between Financial Accounting And Management Accounting

Difference Between Financial Accounting And Management Accounting Pdf In this post, we have explained the difference between financial accounting and management accounting. plus, you will get to know the meaning, functions, and similarities between the two. Financial accounting is wholly historical. managerial accounting, on the other hand, looks at past performance but also creates business forecasts.

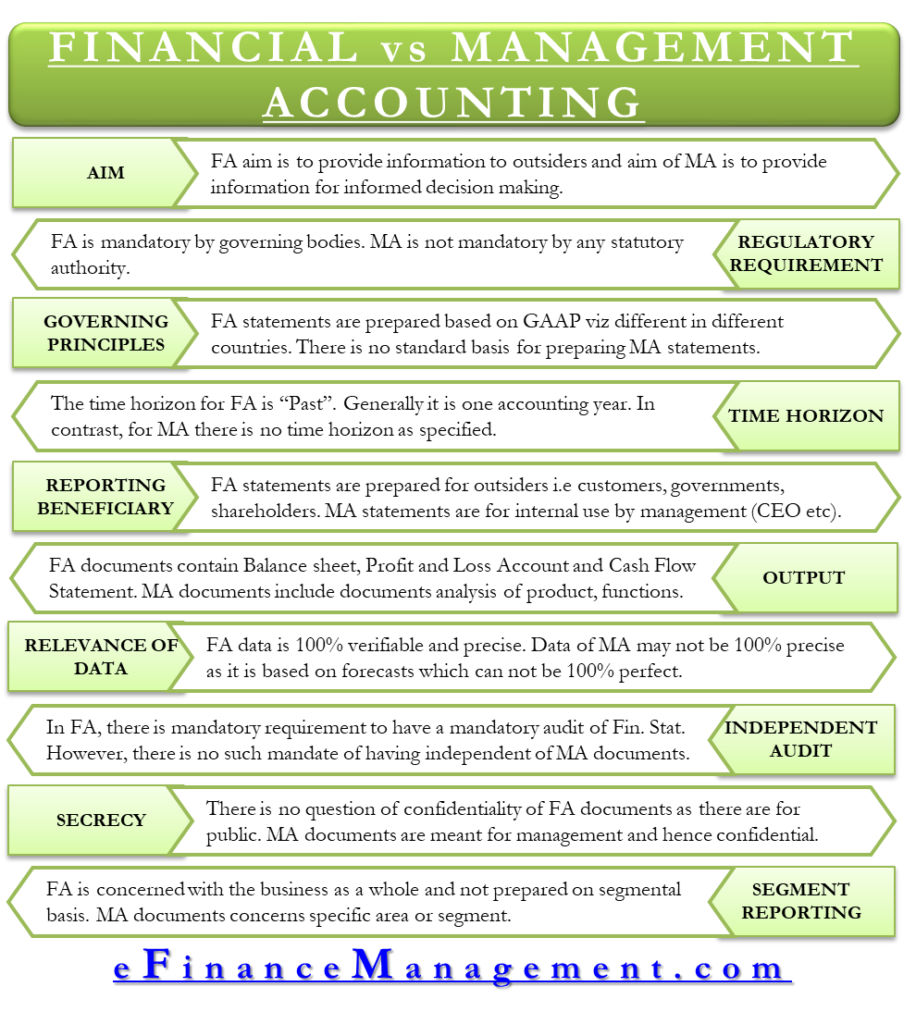

Top 10 Differences Between Financial Accounting And Management Accounting With Pdf Accounting is often divided into two categories: financial accounting and management accounting. financial accounting information is designed primarily for use by persons outside the firm, including creditors, stockholders, owners, governmental agencies, and the general public. Guide to financial accounting vs management accounting. here we discuss the top differences between them with infographics and comparative table. Managerial accounting is concerned with providing information to managers i.e. people inside an organization who direct and control its operations. in contrast, financial accounting is concerned with providing information to stockholders, creditors, and others who are outside an organization. It is a branch of accounting, which deals with classifying, measuring and recording a business transaction. financial accounting is concerned with the preparation of financial statements for the purpose of demonstrating the performance and position of a business.

Financial Accounting Vs Management Accounting Managerial accounting is concerned with providing information to managers i.e. people inside an organization who direct and control its operations. in contrast, financial accounting is concerned with providing information to stockholders, creditors, and others who are outside an organization. It is a branch of accounting, which deals with classifying, measuring and recording a business transaction. financial accounting is concerned with the preparation of financial statements for the purpose of demonstrating the performance and position of a business. In this post, we’ll break down the key differences between management and financial accounting. management accounting focuses on internal processes, aiding managers in planning and control. it uses detailed financial and non financial data to support decision making within the organisation. Understanding the difference is key for anyone looking to enter the profession or decide which path to pursue. in this article, we’ll break down the key differences between financial and management accounting, explain why they matter, and help you see how each contributes to organisational success. Certainly, a significant difference exists between both; while financial accounting shows accountability and transparency to the stakeholders in terms of conformity and trust, management accounting measures and employs more internal efficiencies to reach strategic goals. When it comes to financial accounting vs managerial accounting, the main differences are the manners of collecting, processing, and reporting information. users of financial and managerial accounting information also have different goals in analyzing and interpreting this information.

Difference Between Financial And Management Accounting In this post, we’ll break down the key differences between management and financial accounting. management accounting focuses on internal processes, aiding managers in planning and control. it uses detailed financial and non financial data to support decision making within the organisation. Understanding the difference is key for anyone looking to enter the profession or decide which path to pursue. in this article, we’ll break down the key differences between financial and management accounting, explain why they matter, and help you see how each contributes to organisational success. Certainly, a significant difference exists between both; while financial accounting shows accountability and transparency to the stakeholders in terms of conformity and trust, management accounting measures and employs more internal efficiencies to reach strategic goals. When it comes to financial accounting vs managerial accounting, the main differences are the manners of collecting, processing, and reporting information. users of financial and managerial accounting information also have different goals in analyzing and interpreting this information. Financial management and accounting—two frameworks, one financial system—link your business decisions to every transaction. accounting records, organizes, and interprets numeric data; financial management translates these figures into strategic actions. Financial accounting and management accounting are two distinct fields of accounting, both of which serve different purposes in a business. while both types of accounting involve the use of financial data, their applications, and intended audiences are different. Typically, there are two major types of accounting, known as financial accounting and management accounting. in this article, you’ll learn the ways in which financial accounting and management accounting differ. we’ll explain what each one is, the distinct purposes they serve, and how they both may be able to help your business. Financial accounting: external stakeholders (creditors, investors) and historical data for transparency and compliance. management accounting: internal stakeholders (managers) and future oriented information for decision making.

Difference Between Financial Accounting And Management Accounting Certainly, a significant difference exists between both; while financial accounting shows accountability and transparency to the stakeholders in terms of conformity and trust, management accounting measures and employs more internal efficiencies to reach strategic goals. When it comes to financial accounting vs managerial accounting, the main differences are the manners of collecting, processing, and reporting information. users of financial and managerial accounting information also have different goals in analyzing and interpreting this information. Financial management and accounting—two frameworks, one financial system—link your business decisions to every transaction. accounting records, organizes, and interprets numeric data; financial management translates these figures into strategic actions. Financial accounting and management accounting are two distinct fields of accounting, both of which serve different purposes in a business. while both types of accounting involve the use of financial data, their applications, and intended audiences are different. Typically, there are two major types of accounting, known as financial accounting and management accounting. in this article, you’ll learn the ways in which financial accounting and management accounting differ. we’ll explain what each one is, the distinct purposes they serve, and how they both may be able to help your business. Financial accounting: external stakeholders (creditors, investors) and historical data for transparency and compliance. management accounting: internal stakeholders (managers) and future oriented information for decision making. Two fundamental branches of accounting, financial accounting and management accounting, serve distinct purposes and cater to different audiences. while they both aim to enhance the financial health of a business, their approaches, goals, and outputs vary significantly. Understanding the differences between financial accounting and management accounting is crucial for businesses and individuals alike. these two branches of accounting serve distinct purposes, audiences, and methodologies. let's dive into the key differences and understand how each plays a vital role in the financial health of a business. Some of the fundamental differences between financial accounting and managerial accounting are: financial accounting primarily focuses on the outcome of generating a profit, not the overall system. Managerial accounting empowers internal users, such as managers and executives, with vital financial insights to shape the future of their businesses. on the other hand, financial accounting shines a light on a company's financial performance for external stakeholders like investors and creditors.

Comments are closed.