Difference Between Tds And Tcs A Brief Analysis

Tds Vs Tcs Difference Between Tds And Tcs What Is Tds And Tcs Tds And Hot Sex Picture In this post, we will examine the key distinctions between tax deducted at source (tds) and tax collected at source (tcs). Tds represents the tax deducted by the payer from payments made when the amount exceeds a set limit. conversely, tcs refers to the tax collected by the sellers during transactions with buyers.

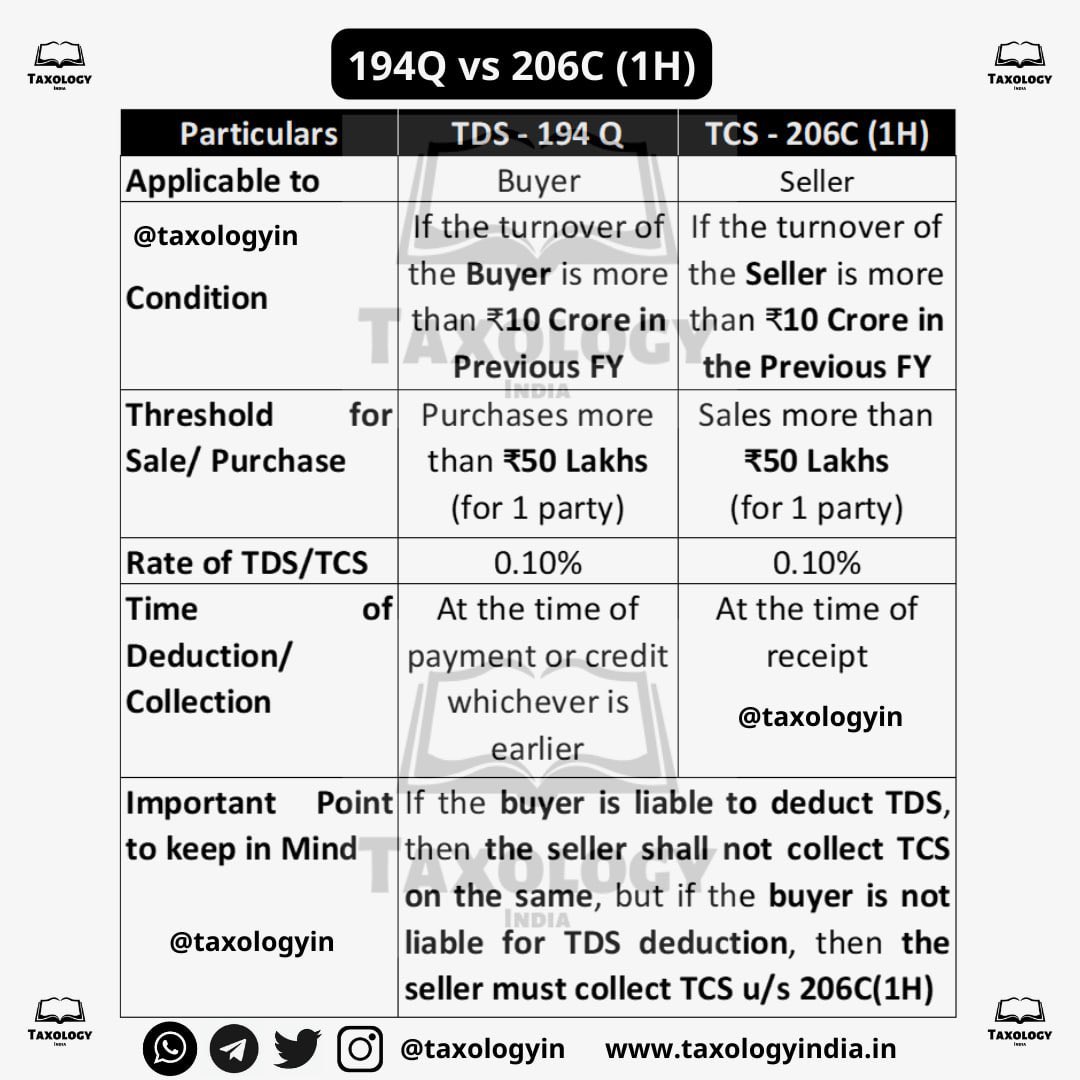

Difference Between Tcs And Tds A Critical Analysis While tds is an expense, tcs is an income. tds stands for tax deduction at source, tcs expands to tax collection at source. these are not taxes but are an obligation, which is deducted at the time of payment or received more and deposited to the income tax department. In this blog, we’ll explain what tds and tcs mean, how they work, where they apply, the key differences between them, and the latest applicable rates for 2025. Tax collected at source (tcs) is collected by the seller on certain goods and services such as scrap, forest produce, or sale of cars above rs 10 lakh. it’s added to the bill and deposited with the government. tds is deducted by the person making the payment, while tcs is collected by the seller. When dealing with taxes in india, you may have come across terms like tax deducted at source (tds) and tax collected at source (tcs). these are important components of the tax system and affect various transactions. both are methods used by the government to collect tax at the point of transaction, ensuring steady revenue collection.

Difference Between Tds And Tcs A Brief Analysis Tax collected at source (tcs) is collected by the seller on certain goods and services such as scrap, forest produce, or sale of cars above rs 10 lakh. it’s added to the bill and deposited with the government. tds is deducted by the person making the payment, while tcs is collected by the seller. When dealing with taxes in india, you may have come across terms like tax deducted at source (tds) and tax collected at source (tcs). these are important components of the tax system and affect various transactions. both are methods used by the government to collect tax at the point of transaction, ensuring steady revenue collection. Tds involves the payer (such as an employer or bank) deducting tax from income payments like salaries, interest or rent. in contrast, tcs requires the seller to collect tax from the buyer during specific transactions, such as the sale of luxury goods or vehicles. Although both taxes are levied at the point of origin of income payment, there are quite a few significant differences between tds and tcs. read on to get a clear understanding of the difference between tds and tcs. Understanding the difference between tds and tcs is crucial for ensuring compliance and avoiding penalties. while tds applies to payments like salaries and rent, tcs is limited to transactions involving specific goods and services. Tds amount is the tax deducted by an individual or company while making a payment. in comparison, tcs amount is the tax collected by the seller during the time of sale.

Difference Between Tds And Tcs A Brief Analysis Tds involves the payer (such as an employer or bank) deducting tax from income payments like salaries, interest or rent. in contrast, tcs requires the seller to collect tax from the buyer during specific transactions, such as the sale of luxury goods or vehicles. Although both taxes are levied at the point of origin of income payment, there are quite a few significant differences between tds and tcs. read on to get a clear understanding of the difference between tds and tcs. Understanding the difference between tds and tcs is crucial for ensuring compliance and avoiding penalties. while tds applies to payments like salaries and rent, tcs is limited to transactions involving specific goods and services. Tds amount is the tax deducted by an individual or company while making a payment. in comparison, tcs amount is the tax collected by the seller during the time of sale.

5 Difference Between Tds And Tcs Examples Legal Repercussions Understanding the difference between tds and tcs is crucial for ensuring compliance and avoiding penalties. while tds applies to payments like salaries and rent, tcs is limited to transactions involving specific goods and services. Tds amount is the tax deducted by an individual or company while making a payment. in comparison, tcs amount is the tax collected by the seller during the time of sale.

Comments are closed.