Difference Between Tds And Tcs A Complete Guide Razorpayx

Pin On Mdp Referance Although both taxes are levied at the point of origin of income payment, there are quite a few significant differences between tds and tcs. read on to get a clear understanding of the difference between tds and tcs. Tax collected at source (tcs) is collected by the seller on certain goods and services such as scrap, forest produce, or sale of cars above rs 10 lakh. it’s added to the bill and deposited with the government. tds is deducted by the person making the payment, while tcs is collected by the seller.

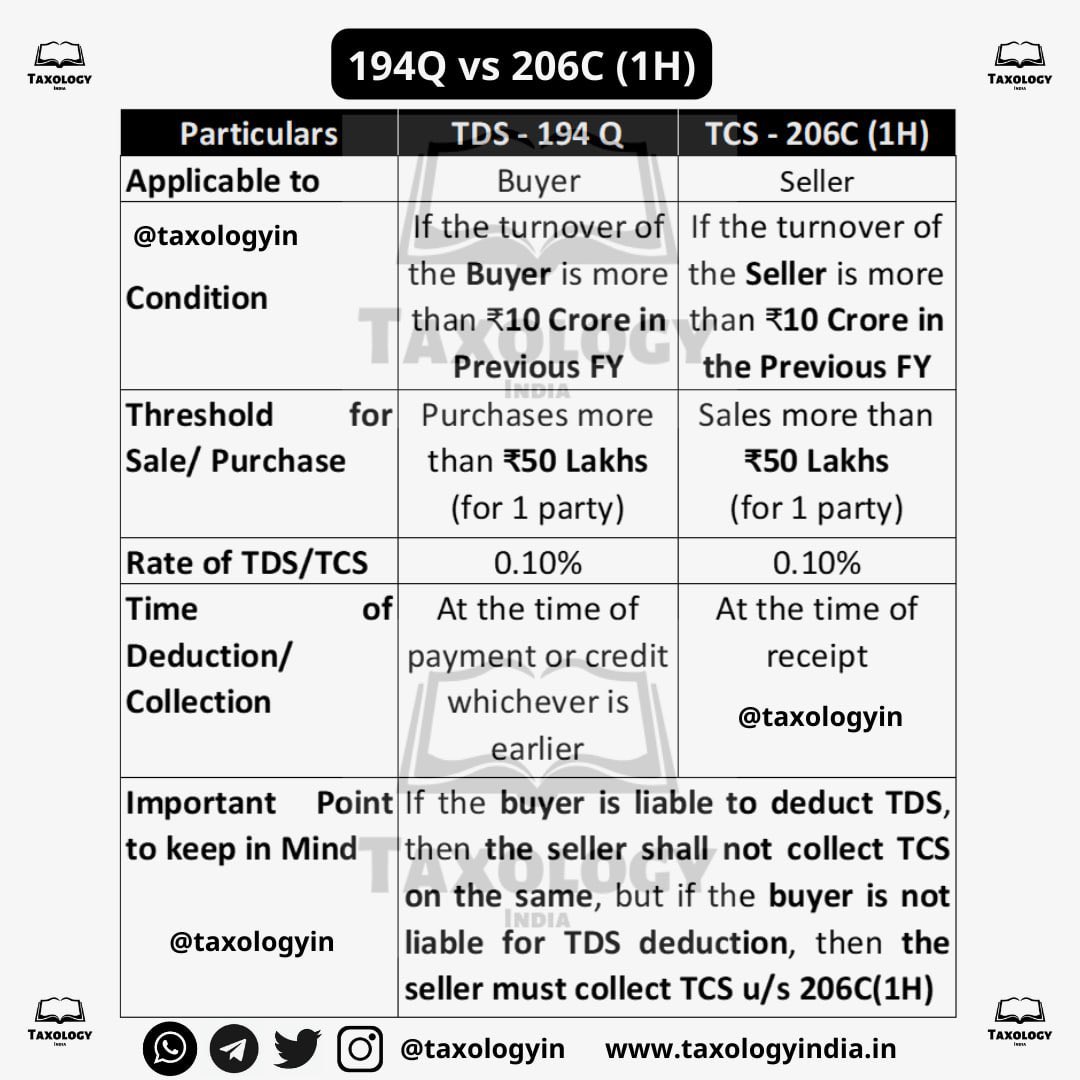

Tds Vs Tcs Difference Between Tds And Tcs What Is Tds And Tcs Tds And Hot Sex Picture Tds represents the tax deducted by the payer from payments made when the amount exceeds a set limit. conversely, tcs refers to the tax collected by the sellers during transactions with buyers. however, taxpayers often mix up these terms and use them interchangeably. Both tds and tcs are imposed at the source of income in india. tds refers to the tax deducted by a company on payments to an individual that exceed a specified limit. on the other hand, tcs represents the tax collected by sellers during transactions with buyers. In this blog, we’ll explain what tds and tcs mean, how they work, where they apply, the key differences between them, and the latest applicable rates for 2025. Know the difference between tds and tcs, their full forms, and how they impact transactions. compare tds vs tcs in taxation and trading apps with real world examples.

Difference Between Tds And Tcs A Complete Guide In this blog, we’ll explain what tds and tcs mean, how they work, where they apply, the key differences between them, and the latest applicable rates for 2025. Know the difference between tds and tcs, their full forms, and how they impact transactions. compare tds vs tcs in taxation and trading apps with real world examples. Learn what tds and tcs mean, where they apply, and how they differ. this guide covers their purpose, collection process, and impact on taxpayers. When navigating indian tax regulations, understanding the fundamental differences between tax deducted at source (tds) and tax collected at source (tcs) can save you time and confusion. While tds is an expense, tcs is an income. tds stands for tax deduction at source, tcs expands to tax collection at source. these are not taxes but are an obligation, which is deducted at the time of payment or received more and deposited to the income tax department. Understand the key differences between tds and tcs in india's tax system, including when each applies, who is responsible for collection, and practical examples.

Comments are closed.