Difference Between Tds And Tcs Explained

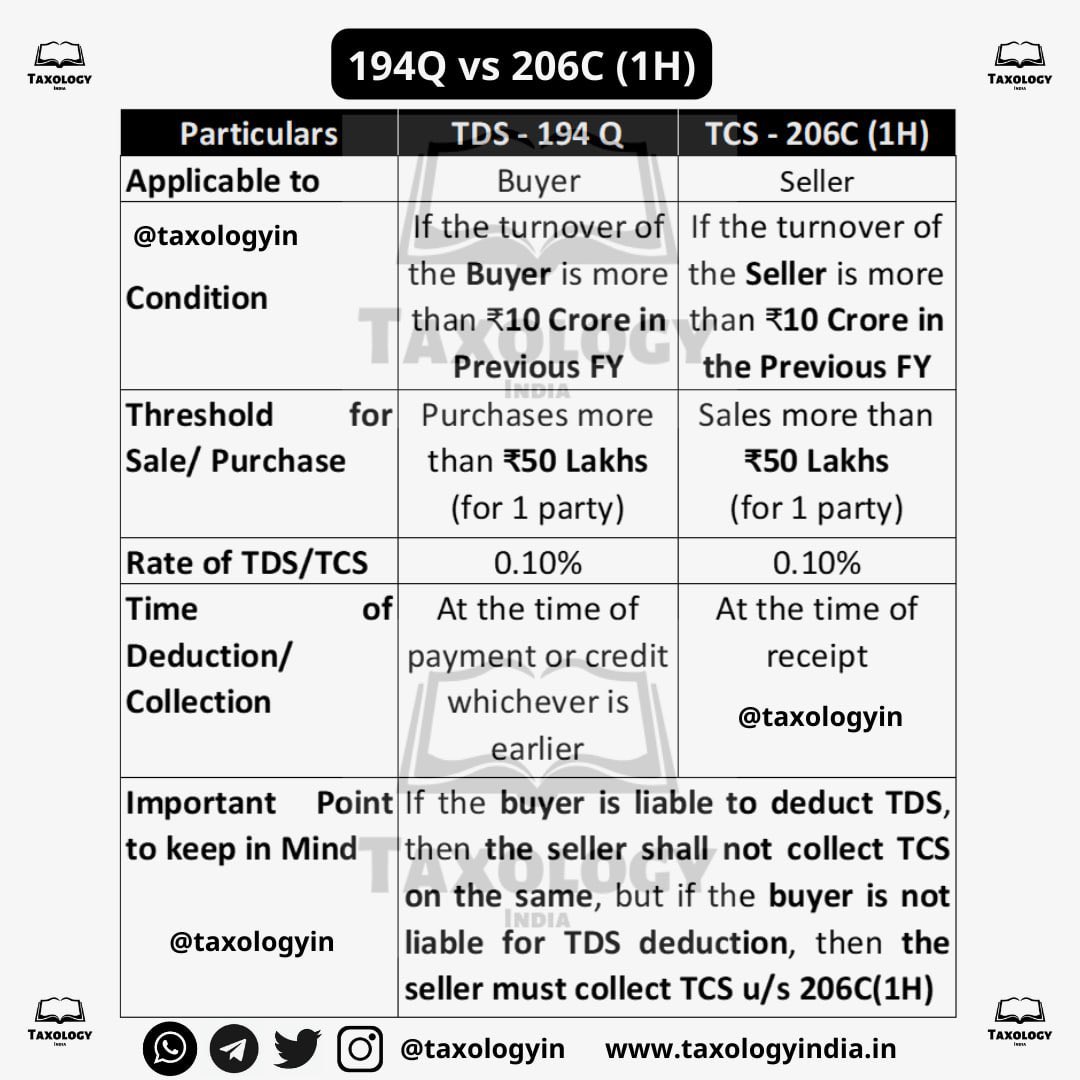

Pin On Mdp Referance Tds represents the tax deducted by the payer from payments made when the amount exceeds a set limit. conversely, tcs refers to the tax collected by the sellers during transactions with buyers. however, taxpayers often mix up these terms and use them interchangeably. Direct taxes are contributed to the government by the person receiving the income. on the other hand, indirect taxes must be deposited with the government by the seller. tds (tax deducted at source) and tcs (tax collected at source) are two instances of indirect taxes imposed by the government.

Tds Vs Tcs Difference Between Tds And Tcs What Is Tds And Tcs Tds And Hot Sex Picture Understand the key difference between tds and tcs in simple terms. learn how they work and why small businesses in india need to manage them correctly. Our article on the difference between tds & tcs explains everything you need to know, from basic definitions to practical examples, ensuring you stay compliant. Although both taxes are levied at the point of origin of income payment, there are quite a few significant differences between tds and tcs. read on to get a clear understanding of the difference between tds and tcs. Tds and tcs – firstly, the tds stands for tax deducted at source and on the other hand, tcs stands for tax collected at source. – secondly, tds is deducted on a payment made by a company to an individual whereas, tcs is collected by sellers while selling something to buyers.

Difference Between Tds And Tcs Easily Explained Although both taxes are levied at the point of origin of income payment, there are quite a few significant differences between tds and tcs. read on to get a clear understanding of the difference between tds and tcs. Tds and tcs – firstly, the tds stands for tax deducted at source and on the other hand, tcs stands for tax collected at source. – secondly, tds is deducted on a payment made by a company to an individual whereas, tcs is collected by sellers while selling something to buyers. Understand tds vs tcs in income tax and their key differences. learn how tds and tcs apply to your business, their compliance rules, and their impact on operations. What is the difference between tds and tcs in gst? tds (tax deducted at source) and tcs (tax collected at source) are often confused due to their similar names, which leads to taxpayers using the two terms interchangeably. While tds applies when income is paid, tcs is collected at the time of sale of certain goods and services. getting a clear grasp on these terms can help avoid confusion during tax filing and ensure compliance with regulations. In the complex world of taxation, two terms that often perplex individuals and businesses alike are tds (tax deducted at source) and tcs (tax collected at source). these mechanisms play a crucial role in the indian tax landscape, ensuring smooth revenue collection and compliance.

Comments are closed.