Difference Between Tds And Tcs Tds Vs Tcs

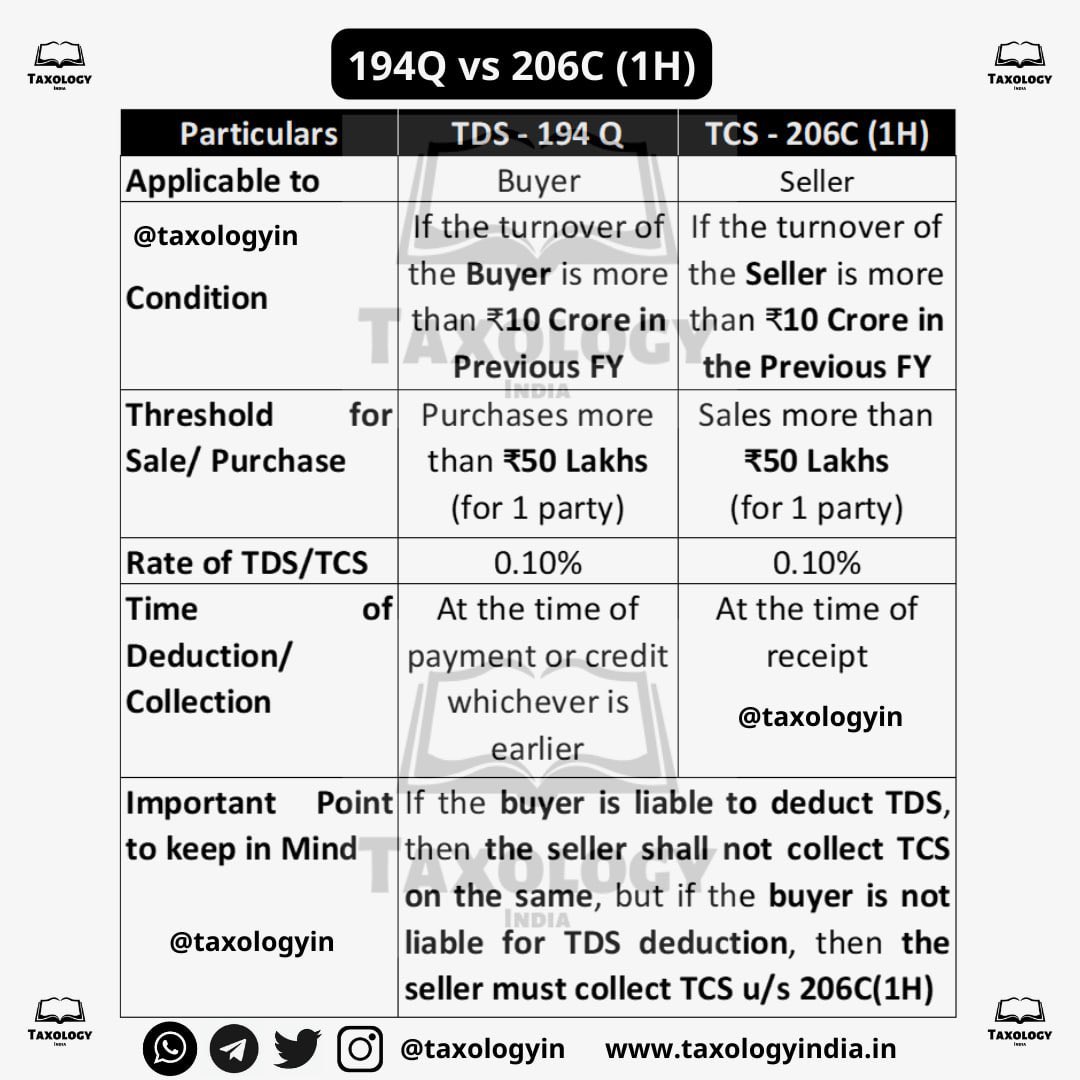

Pin On Mdp Referance Tds represents the tax deducted by the payer from payments made when the amount exceeds a set limit. conversely, tcs refers to the tax collected by the sellers during transactions with buyers. however, taxpayers often mix up these terms and use them interchangeably. While tds is an expense, tcs is an income. tds stands for tax deduction at source, tcs expands to tax collection at source. these are not taxes but are an obligation, which is deducted at the time of payment or received more and deposited to the income tax department.

Tds Vs Tcs Difference Between Tds And Tcs What Is Tds And Tcs Tds And Hot Sex Picture Tax deducted at source (tds) and tax collected at source (tcs) are two major concepts that has been dealt under the income tax act of india. both are tools used by the government to collect taxes in advance and reduce the chances of tax evasion. Although both taxes are levied at the point of origin of income payment, there are quite a few significant differences between tds and tcs. read on to get a clear understanding of the difference between tds and tcs. Both tds and tcs aim to ensure timely tax collection and improve compliance, but they function differently. in tds, the deductor (payer) is responsible for deducting and depositing the tax. in tcs, the collector (seller) is responsible for collecting and depositing the tax. However, there is a clear difference between tds and tcs, which this blog will explain in simple terms. what is tds, and when is it applicable? tds is a system where a certain percentage of tax is deducted when making payments, such as salaries, professional fees, rent, or income through interest.

Difference Between Tds And Tcs Tds Vs Tcs 5 Best Points Tax Deducted At Source Share Both tds and tcs aim to ensure timely tax collection and improve compliance, but they function differently. in tds, the deductor (payer) is responsible for deducting and depositing the tax. in tcs, the collector (seller) is responsible for collecting and depositing the tax. However, there is a clear difference between tds and tcs, which this blog will explain in simple terms. what is tds, and when is it applicable? tds is a system where a certain percentage of tax is deducted when making payments, such as salaries, professional fees, rent, or income through interest. Both tds & tcs are imposed at the source of the revenue or payment, but there are several noteworthy distinctions between tds and tcs. both tax obligations—tax collected at source and tax deducted at source—are made at the place of income generation. if tds tcs is not timely paid deducted, it will attract fines or penalties. There is a significant difference between tds and tcs. the distinction between tds vs tcs deviates at the tax deduction and collection level, as well as who is responsible and who is applicable. in this blog, we will evaluate tds and tcs and discover the key differences between them. Two essential tax systems, tds (tax deducted at source) and tcs (tax collected at source), play critical roles in tax collection. they may seem similar at first glance, yet there are substantial differences between the two. they serve distinctive purposes and are subject to various regulations. Understand the key difference between tds and tcs in simple terms. learn how they work and why small businesses in india need to manage them correctly.

What Is The Difference Between Tds Vs Tcs Turbocomplyturbocomply Both tds & tcs are imposed at the source of the revenue or payment, but there are several noteworthy distinctions between tds and tcs. both tax obligations—tax collected at source and tax deducted at source—are made at the place of income generation. if tds tcs is not timely paid deducted, it will attract fines or penalties. There is a significant difference between tds and tcs. the distinction between tds vs tcs deviates at the tax deduction and collection level, as well as who is responsible and who is applicable. in this blog, we will evaluate tds and tcs and discover the key differences between them. Two essential tax systems, tds (tax deducted at source) and tcs (tax collected at source), play critical roles in tax collection. they may seem similar at first glance, yet there are substantial differences between the two. they serve distinctive purposes and are subject to various regulations. Understand the key difference between tds and tcs in simple terms. learn how they work and why small businesses in india need to manage them correctly.

Difference Between Tds Vs Tcs Article Vibrantfinserv Two essential tax systems, tds (tax deducted at source) and tcs (tax collected at source), play critical roles in tax collection. they may seem similar at first glance, yet there are substantial differences between the two. they serve distinctive purposes and are subject to various regulations. Understand the key difference between tds and tcs in simple terms. learn how they work and why small businesses in india need to manage them correctly.

Difference Between Tds Vs Tcs Article Vibrantfinserv

Comments are closed.