Difference Between Tds Vs Tcs Article Vibrantfinserv

Difference Between Tds And Tcs Easily Explained People searching for “tds vs tcs” want to understand the fundamental differences between tax deducted at source (tds) and tax collected at source (tcs). they may be business owners, accountants, finance students, or individuals looking to comply with tax laws. Tds represents the tax deducted by the payer from payments made when the amount exceeds a set limit. conversely, tcs refers to the tax collected by the sellers during transactions with buyers. however, taxpayers often mix up these terms and use them interchangeably.

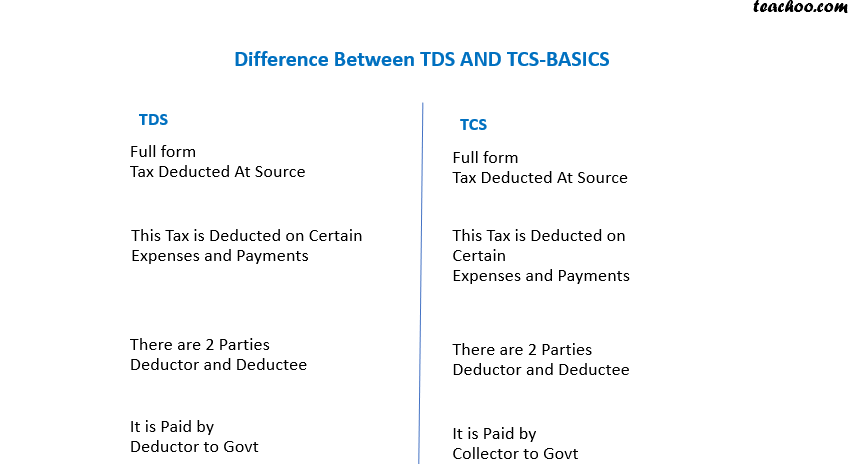

Understanding The Difference Between Tds And Tcs Tax deducted at source (tds) and tax collected at source (tcs) are two major concepts that has been dealt under the income tax act of india. both are tools used by the government to collect taxes in advance and reduce the chances of tax evasion. Tds is short form of tax deducted at source. it is the amount that companies and individuals deduct on payments made by them when the payments exceed a certain limit. these payments can be in the form of interest, rent, salaries, commission, professional fees etc. tds rates are determined by factors such as income, age, and so on. Tds (tax deducted at source) and tcs (tax collected at source) are two important taxes in india. tds is the tax deducted when income is earned, while tcs is the tax collected when a sale is made. these taxes are governed by different sections of the income tax act. for example, employers deduct tds from salaries before paying employees. While tds is an expense, tcs is an income. tds stands for tax deduction at source, tcs expands to tax collection at source. these are not taxes but are an obligation, which is deducted at the time of payment or received more and deposited to the income tax department.

Difference Between Tds And Tcs Tds (tax deducted at source) and tcs (tax collected at source) are two important taxes in india. tds is the tax deducted when income is earned, while tcs is the tax collected when a sale is made. these taxes are governed by different sections of the income tax act. for example, employers deduct tds from salaries before paying employees. While tds is an expense, tcs is an income. tds stands for tax deduction at source, tcs expands to tax collection at source. these are not taxes but are an obligation, which is deducted at the time of payment or received more and deposited to the income tax department. Confused between tds and tcs? learn their differences, how they work, penalties for non compliance, and their significance in tax planning. simplify taxes with expert insights. Tcs is applicable on specific goods and is collected by the seller, while tds is applicable on various payments and is deducted by the payer. understanding the differences between tcs and tds is essential for individuals and businesses to ensure compliance with tax laws. User intent people searching for “tds vs tcs” want to understand the fundamental differences between tax deducted at source (tds) and tax collected at source (tcs). Know the difference between tds and tcs, their full forms, and how they impact transactions. compare tds vs tcs in taxation and trading apps with real world examples.

Important Differences Between Tds And Tcs Chapter 11 Tcs Confused between tds and tcs? learn their differences, how they work, penalties for non compliance, and their significance in tax planning. simplify taxes with expert insights. Tcs is applicable on specific goods and is collected by the seller, while tds is applicable on various payments and is deducted by the payer. understanding the differences between tcs and tds is essential for individuals and businesses to ensure compliance with tax laws. User intent people searching for “tds vs tcs” want to understand the fundamental differences between tax deducted at source (tds) and tax collected at source (tcs). Know the difference between tds and tcs, their full forms, and how they impact transactions. compare tds vs tcs in taxation and trading apps with real world examples.

Comments are closed.