Exponential Models Writing A Model Given Initial Value And Growth Decay Rate

Linear And Exponential Growth And Decay Models Download Free Pdf Applied Mathematics Just wondering how staking works and if there are any risks involved. also what are the benefits. i currently have about 15k sync and was wondering how much money i’d make per day if i was to stake all of it. i’ve just turned 18 and literally just want to make my bag and buy a house lolz. This is a scam. never sync and share: qr codes, secret recovery phrases, private keys, etc. uniswap labs has no plans for an airdrop, regardless of any information you may have seen elsewhere. i am a bot, and this action was performed automatically. please contact the moderators of this subreddit if you have any questions or concerns.

Solved Determine The Initial Value The Growth Rate And The Chegg If you're staking in uniswap then you're receiving a small fee from the trades but you'll be affected by price swings. you should read up on everything before staking much. i linked a image of liquidity vision. generally what the degen among us do is take the lp tokens and stake those on a site that offers a token that counteracts the il. Do i need metamask as well? hi, i’m new to using a dex. i wanted to buy $0x0 ai token and i have a uniswap wallet. can i just buy the token by sending eth from kraken to uniswap or do i also need a metamask wallet too? also, because gas fees are so expensive, is it only worth buying a lot of 0x0 rather than a small bag?. What is your opinion on the function of dfbtc dapp node staking lending uniswap lp uniswap liquidity mining revenue comparison. 74k subscribers in the uniswap community. uniswap is a decentralized trading protocol on ethereum.

Solved Initial Value Growth Or Decay Rate As A Exponential Function Course Hero What is your opinion on the function of dfbtc dapp node staking lending uniswap lp uniswap liquidity mining revenue comparison. 74k subscribers in the uniswap community. uniswap is a decentralized trading protocol on ethereum. From a slightly different angle, i would argue that staking eth for reth is a service provided to the network, which means that rewards are taxable as income. buying reth on uniswap and selling it later results in capital gains which are subject to different taxes. Yes, you will receive those fees. the lp tokens you receive when providing liquidity to a pool represent your share of the pool, which includes the amount of tokens you provided, plus your share of swap fees. when you stake your lp tokens and then redeem the same amount of lp tokens later, you will have the exactly as much as if you wouldn't stake (plus whatever you received for staking). On a long term perspective, eth staking seems a good bet (around 7% apy) but i would like to dig some alternatives in order to diversify my portfolio (with some matic) are there folks here that have experience with uniswap pooling : i have done some research and understood the risks related to impermanent loss (il) but i have difficulties on estimating real apy for a pool pair. first : why is. I'm currently staking at lido, but thinking i can earn more to staking in lp. i'm looking at the wbtc eth pool, looks like it's average 8% yield according to yieldsamurai pool ethereum 0x4585fe77225b41b697c938b018e2ac67ac5a20c0?.

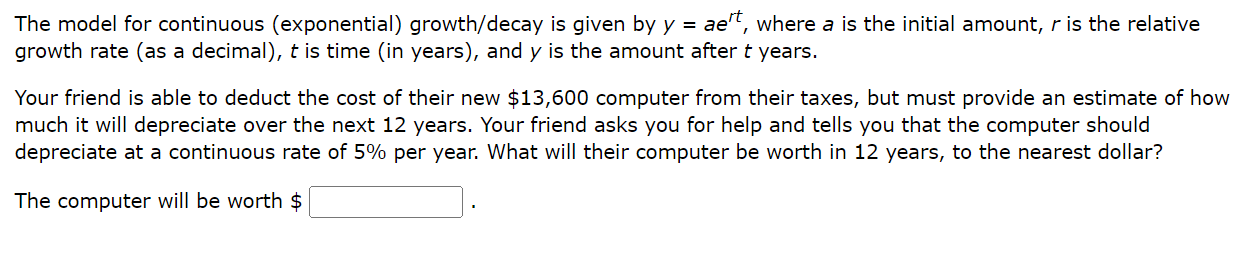

Solved The Model For Continuous Exponential Growth Decay Chegg From a slightly different angle, i would argue that staking eth for reth is a service provided to the network, which means that rewards are taxable as income. buying reth on uniswap and selling it later results in capital gains which are subject to different taxes. Yes, you will receive those fees. the lp tokens you receive when providing liquidity to a pool represent your share of the pool, which includes the amount of tokens you provided, plus your share of swap fees. when you stake your lp tokens and then redeem the same amount of lp tokens later, you will have the exactly as much as if you wouldn't stake (plus whatever you received for staking). On a long term perspective, eth staking seems a good bet (around 7% apy) but i would like to dig some alternatives in order to diversify my portfolio (with some matic) are there folks here that have experience with uniswap pooling : i have done some research and understood the risks related to impermanent loss (il) but i have difficulties on estimating real apy for a pool pair. first : why is. I'm currently staking at lido, but thinking i can earn more to staking in lp. i'm looking at the wbtc eth pool, looks like it's average 8% yield according to yieldsamurai pool ethereum 0x4585fe77225b41b697c938b018e2ac67ac5a20c0?.

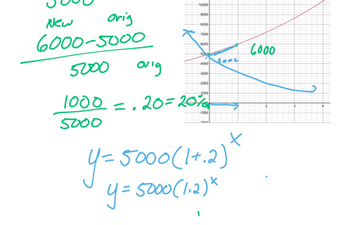

Determine Rate Of Growth Or Decay In Exponential Models Educreations On a long term perspective, eth staking seems a good bet (around 7% apy) but i would like to dig some alternatives in order to diversify my portfolio (with some matic) are there folks here that have experience with uniswap pooling : i have done some research and understood the risks related to impermanent loss (il) but i have difficulties on estimating real apy for a pool pair. first : why is. I'm currently staking at lido, but thinking i can earn more to staking in lp. i'm looking at the wbtc eth pool, looks like it's average 8% yield according to yieldsamurai pool ethereum 0x4585fe77225b41b697c938b018e2ac67ac5a20c0?.

Writing An Equation That Models Exponential Growth Or Decay Algebra Study

Comments are closed.