Fortune Company Has The Following Equity Investments Chegg

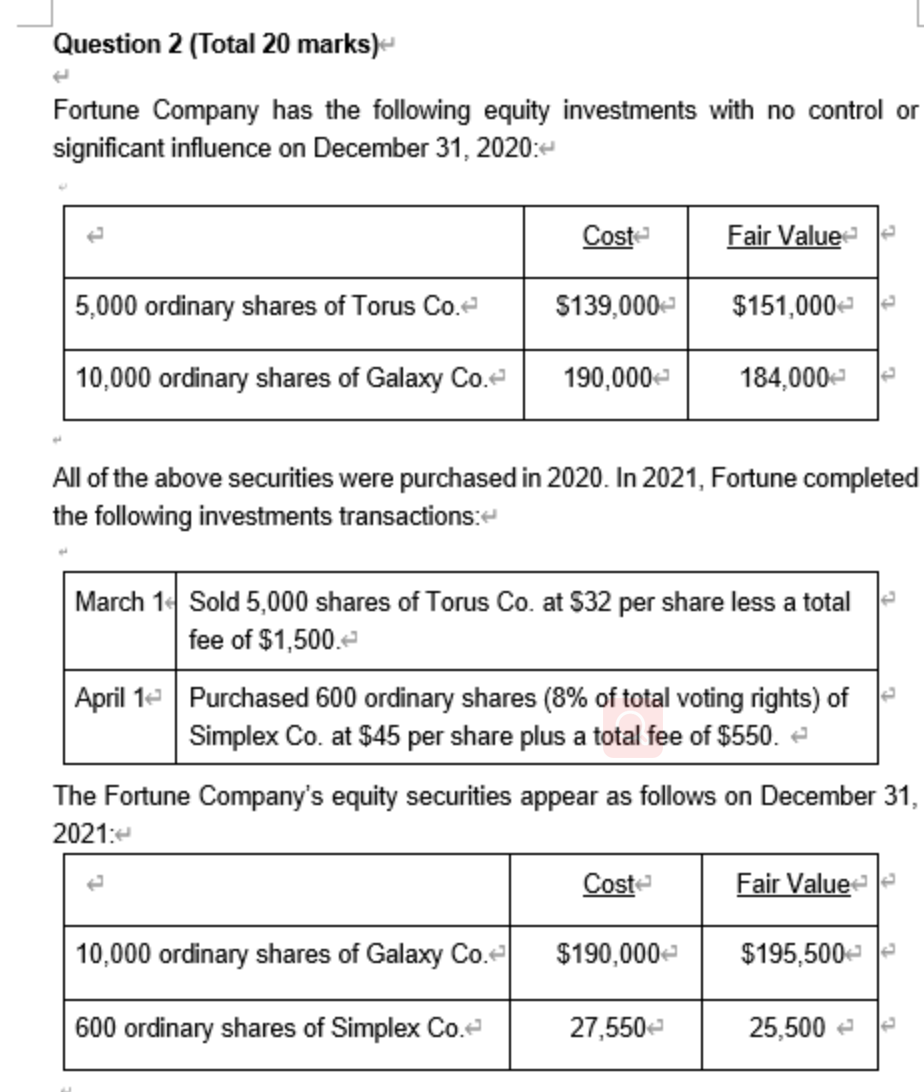

Fortune Company Has The Following Equity Investments Chegg Fortune company has the following equity investments with no control or significant influence on december 31, 2020: all of the above securities were purchased in 2020. Preferred stock was purchased for its constant dividend. the company is planning to hold the preferred stock for a long time. a bond that matures in 10 years was purchased. the company has committed the money for an expansion project planned 10 years from now.

Fortune Company Has The Following Equity Investments Chegg Following the financing pattern, acufed wacc, lewis runs an outdoor adventure company and wants to know what effect a tax change will have on his company's wacc. To start, identify the year end fair value and the cost of each equity investment in 2020, then calculate the difference between these two values for each security, which will represent the unrealized gain or loss. On january 3, 2022, moss company acquires $500,000 of adam company's 10 year, 10% bonds at a price of $532,090 to yield 9%. interest is payable each december 31. the bonds are classified as held to maturity. Answer: unrealized gain for the year 2018 is $4,200. cash debited by $1,800 and dividend revenue credited by $1,800. cash debited by $3,300, gain on sale of investment credited by $600 and equity investment credited by $2,700.

Fortune Company Has The Following Equity Investments Chegg On january 3, 2022, moss company acquires $500,000 of adam company's 10 year, 10% bonds at a price of $532,090 to yield 9%. interest is payable each december 31. the bonds are classified as held to maturity. Answer: unrealized gain for the year 2018 is $4,200. cash debited by $1,800 and dividend revenue credited by $1,800. cash debited by $3,300, gain on sale of investment credited by $600 and equity investment credited by $2,700. According to the current economic environment, fortune co. can issue new bonds or new stocks to fulfill the initial investment. fortune co. can issue two different types of bonds (i) bond a: par value is $1,000, maturity is 4 years, coupon rate is 8% (ii) bond b: par value is $1,000, maturity is 6 years, coupon rate is 4% both bonds paid the. Study with quizlet and memorize flashcards containing terms like comprehensive income, other comprehensive income, accumulated other comprehensive income and more. Get a grip on college. learn with confidence. instant step by step breakdowns. real expert support. stay on top of your classes and feel prepared with chegg. This investment has been accounted for using the equity method. what transactions or events create changes in the investment in watts corporation account as recorded by smith?.

Question 2 Total 20 Marks Fortune Company Has The Chegg According to the current economic environment, fortune co. can issue new bonds or new stocks to fulfill the initial investment. fortune co. can issue two different types of bonds (i) bond a: par value is $1,000, maturity is 4 years, coupon rate is 8% (ii) bond b: par value is $1,000, maturity is 6 years, coupon rate is 4% both bonds paid the. Study with quizlet and memorize flashcards containing terms like comprehensive income, other comprehensive income, accumulated other comprehensive income and more. Get a grip on college. learn with confidence. instant step by step breakdowns. real expert support. stay on top of your classes and feel prepared with chegg. This investment has been accounted for using the equity method. what transactions or events create changes in the investment in watts corporation account as recorded by smith?.

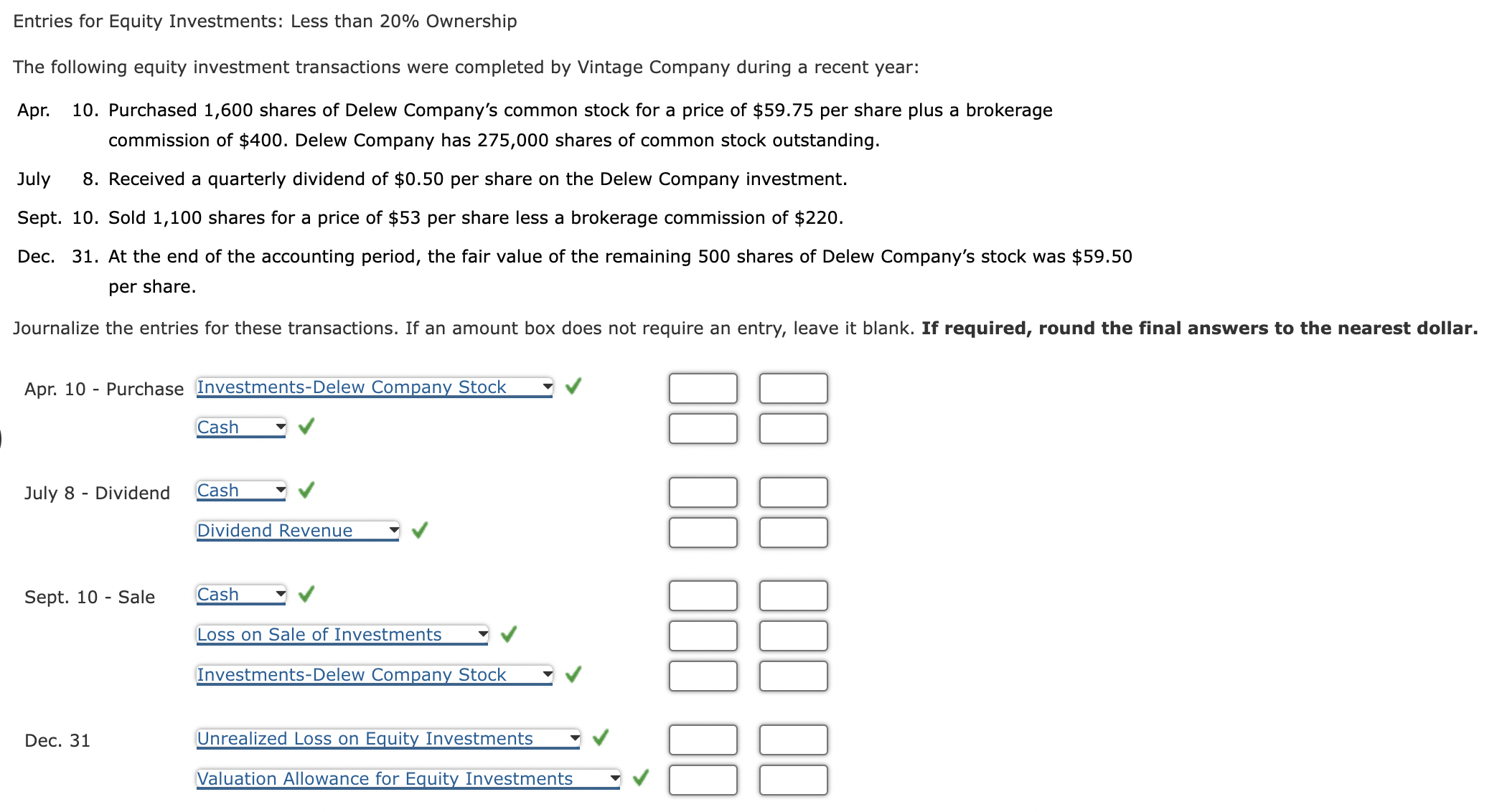

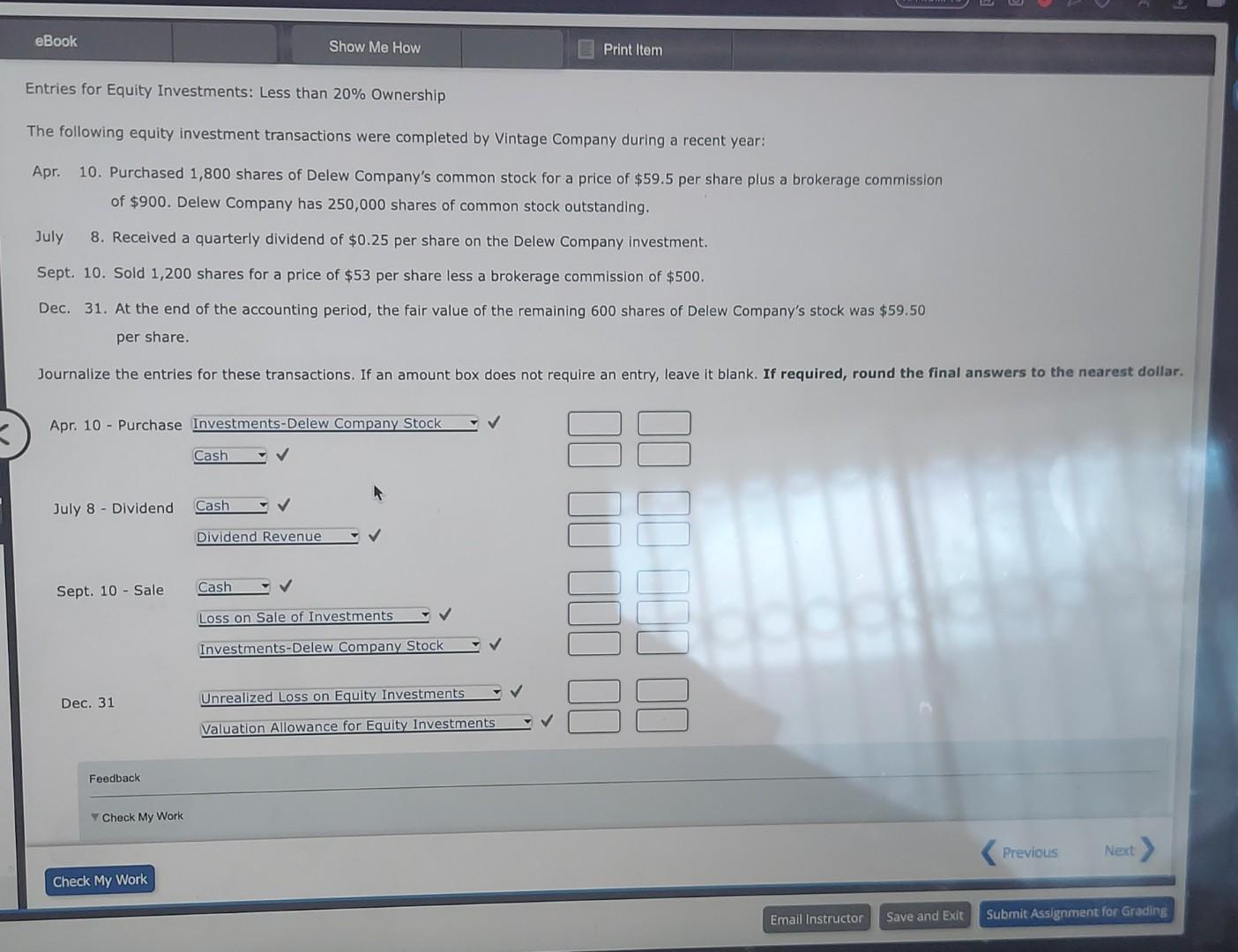

Solved Entries For Equity Investments Less Than 20 Chegg Get a grip on college. learn with confidence. instant step by step breakdowns. real expert support. stay on top of your classes and feel prepared with chegg. This investment has been accounted for using the equity method. what transactions or events create changes in the investment in watts corporation account as recorded by smith?.

Solved Entries For Equity Investments Less Than 20 Chegg

Comments are closed.