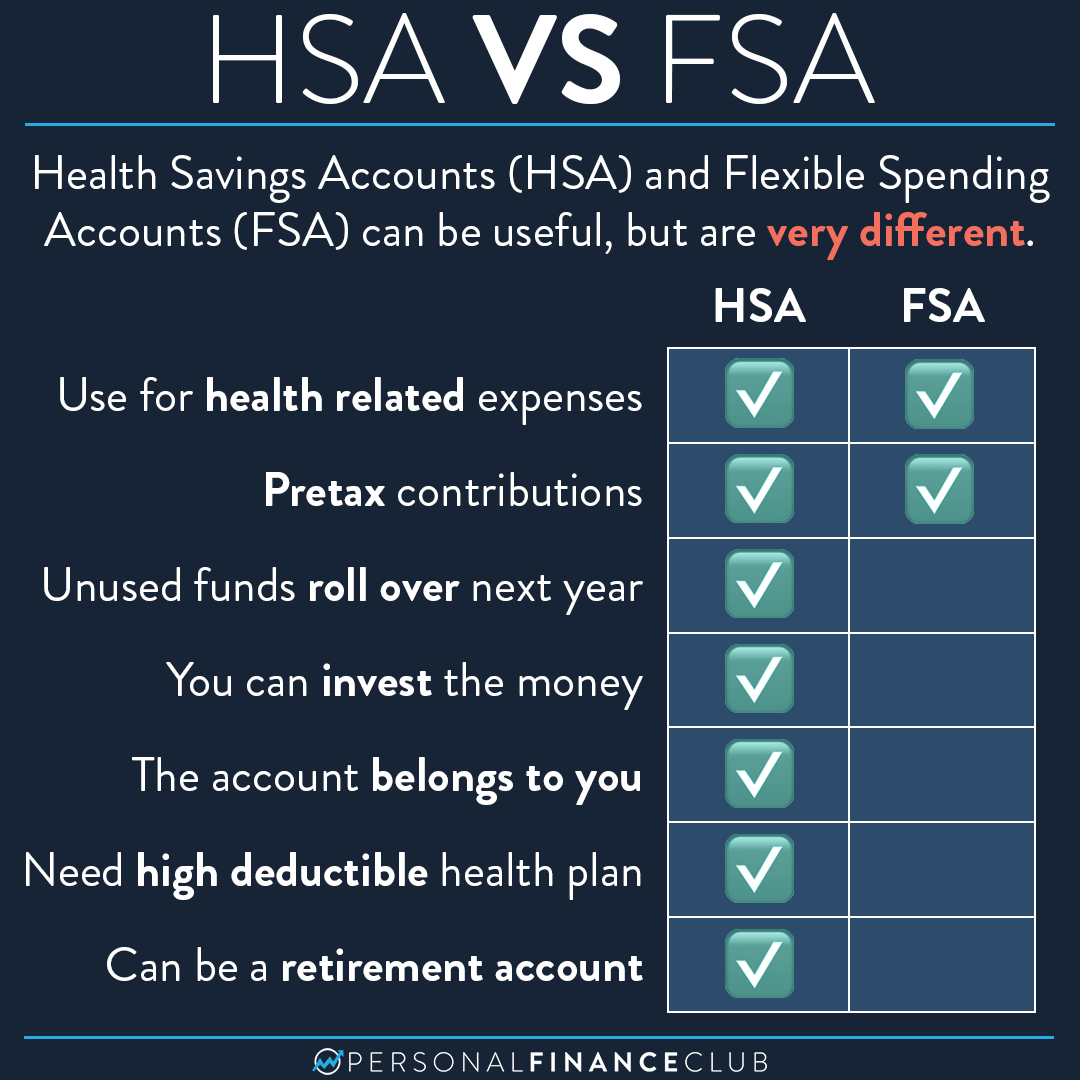

Fsa Vs Hsa What Is The Difference

How Is An Hsa Different From An Fsa Personal Finance Club A health care fsa (hcfsa) is a pre tax benefit account that's used to pay for eligible medical, dental, and vision care expenses that are not covered by your health care plan or elsewhere. with an hcfsa, you use pre tax dollars to pay for qualified out of pocket health care expenses. Loading.

Fsa Vs Hsa Difference And Comparison Diffen We can help you get started or grow your farming operation through a variety of programs and services: nominations are being accepted for farmers and ranchers to serve on local fsa county committees. these committees make important decisions about how federal farm programs are administered locally. A flexible spending account (fsa) is a tax advantaged account offered by your employer that allows you to pay for medical expenses or dependent care. Learn about the fsa flexible spending account to save on copays, deductibles, drugs, and other health care costs. visit healthcare.gov for payment options. It allows a person to use tax free money on health related expenses such as prescription medications and medical devices. an fsa allows a person to contribute a portion of their income to a.

Fsa Vs Hsa Difference And Comparison Diffen Learn about the fsa flexible spending account to save on copays, deductibles, drugs, and other health care costs. visit healthcare.gov for payment options. It allows a person to use tax free money on health related expenses such as prescription medications and medical devices. an fsa allows a person to contribute a portion of their income to a. More than 21 million students used the free application for federal student aid (fafsa) last year, and many of them apply online at fafsa on the web. visit studentaid.gov for complete information on receiving federal financial aid for college. A flexible spending account (fsa) is a tax advantaged account that can help you save on medical and dependent care expenses. learn how an fsa works. What is a flexible spending account (fsa)? if you have a health plan through an employer, a flexible spending account (fsa) is a tool offered by many employers as part of their overall benefits package. there are two different types of fsas: one for health and medical expenses and one for dependent care childcare expenses. Qualified transportation and health fsa limits 2026 projected 2025; tax free qualified transportation fringe benefits (irc § 132(f)) qualified parking, transit passes or commuter highway vehicle: $340: $325: health fsa limits (irc § 125(i)) salary reduction contribution: 3,400: 3,300: carryover to next plan year: 680: 660.

Hsa Vs Fsa What S The Difference Health Myths Health Care Health Savings Account Savings More than 21 million students used the free application for federal student aid (fafsa) last year, and many of them apply online at fafsa on the web. visit studentaid.gov for complete information on receiving federal financial aid for college. A flexible spending account (fsa) is a tax advantaged account that can help you save on medical and dependent care expenses. learn how an fsa works. What is a flexible spending account (fsa)? if you have a health plan through an employer, a flexible spending account (fsa) is a tool offered by many employers as part of their overall benefits package. there are two different types of fsas: one for health and medical expenses and one for dependent care childcare expenses. Qualified transportation and health fsa limits 2026 projected 2025; tax free qualified transportation fringe benefits (irc § 132(f)) qualified parking, transit passes or commuter highway vehicle: $340: $325: health fsa limits (irc § 125(i)) salary reduction contribution: 3,400: 3,300: carryover to next plan year: 680: 660.

Fsa Vs Hsa What S The Difference Taskforce Hr What is a flexible spending account (fsa)? if you have a health plan through an employer, a flexible spending account (fsa) is a tool offered by many employers as part of their overall benefits package. there are two different types of fsas: one for health and medical expenses and one for dependent care childcare expenses. Qualified transportation and health fsa limits 2026 projected 2025; tax free qualified transportation fringe benefits (irc § 132(f)) qualified parking, transit passes or commuter highway vehicle: $340: $325: health fsa limits (irc § 125(i)) salary reduction contribution: 3,400: 3,300: carryover to next plan year: 680: 660.

Comments are closed.