How Peer To Peer Lending Is Changing The Future Of Finance Make Money Without Banks Youtube

Is Peer To Peer Lending A Good Way To Make Money Women Who Money "are you tired of high bank fees and low interest rates on your savings? peer to peer (p2p) lending offers a revolutionary alternative that allows you to byp. I will explore how digital technology plays a key role in improving p2p lending platforms and the lessons we can learn from them for other areas of fintech.

Peer To Peer Lending Is Giving Banks A Run For Their Money As technology continues to advance, we can expect further innovations in the peer to peer lending space, making it an exciting area to watch in the future of finance. This blog explores how peer to peer lending platforms are shaping the future of finance and what this means for borrowers, investors, and the financial ecosystem. As we delve into 2025, the p2p lending market is not only thriving but also undergoing significant transformations driven by technological advancements, regulatory changes, and shifting consumer preferences. Looking ahead, peer to peer lending is poised to evolve in profound ways. the adoption of machine learning and ai will continue to refine credit models, enabling platforms to better predict borrower behavior and improve approval accuracy.

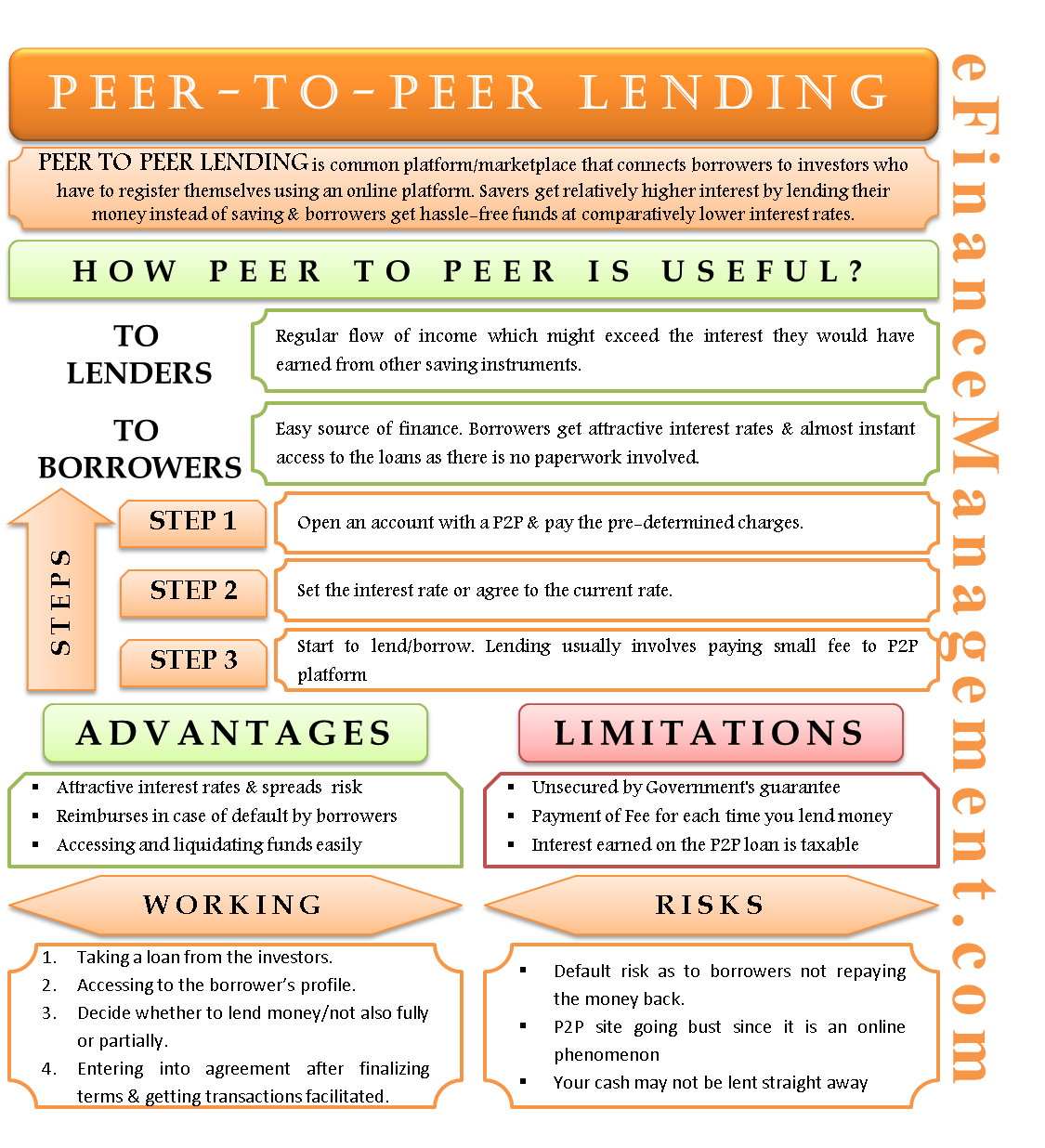

Advantages And Disadvantages Of Peer To Peer Lending Efm As we delve into 2025, the p2p lending market is not only thriving but also undergoing significant transformations driven by technological advancements, regulatory changes, and shifting consumer preferences. Looking ahead, peer to peer lending is poised to evolve in profound ways. the adoption of machine learning and ai will continue to refine credit models, enabling platforms to better predict borrower behavior and improve approval accuracy. Peer to peer (p2p) lending has emerged as a revolutionary model in the financial sector, challenging traditional banking by enabling direct transactions between individuals without the need for an intermediary. Peer to peer (p2p) lending has revolutionised the way individuals can borrow and lend money, bypassing traditional banks and financial institutions. by using online platforms, borrowers can connect directly with lenders, making the process more accessible and often more affordable. What is peer to peer lending? peer to peer (p2p) lending is an innovative financial model that connects borrowers directly with individual lenders through online platforms, bypassing traditional banks and financial institutions. Discover how peer to peer lending and financial technology innovations are transforming modern finance, enhancing credit access, and shaping future financial ecosystems.

Comments are closed.