How To Avoid Paying Tax Like The Rich

10 Ways The Rich Avoid Taxes Visual Capitalist Last june, drawing on the largest trove of confidential american tax data that’s ever been obtained, propublica launched a series of stories documenting the key ways the ultrawealthy avoid. You only have to know how to take advantage of some popular tax loopholes the wealthy use to reduce their yearly tax bill. here are 12 ways to save more on your taxes.

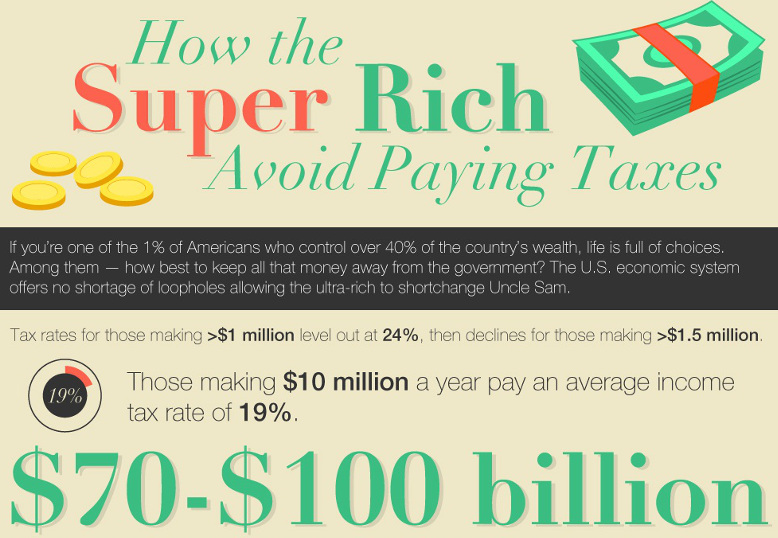

How To Avoid Taxes Officially Strategies Rich People Use To Decrease Or Avoid Their Taxes By Super rich people may avoid paying more than $160 billion in taxes every year, the treasury says. here are some strategies they use to do that. In fact, the wealthy employ a variety of sophisticated strategies to minimize their tax burdens, often paying a significantly lower effective tax rate than middle and lower income individuals. Let's examine the five step "buy, borrow, die" strategy that makes this possible. billionaires structure their finances fundamentally differently from typical wage earners. From maximizing deductions to stashing money in offshore accounts, here are 12 strategies the rich use to lower their tax bills.

How To Avoid Taxes Legally Discover 7 Ways Rich People Use To Reduce Or Eliminate Their Taxes Let's examine the five step "buy, borrow, die" strategy that makes this possible. billionaires structure their finances fundamentally differently from typical wage earners. From maximizing deductions to stashing money in offshore accounts, here are 12 strategies the rich use to lower their tax bills. One of the best ways to cut your tax bill is to take lessons from millionaires, many of whom have spent a fortune working with tax professionals to identify every deduction and credit they can use to reduce what they owe the irs. Many wealthy individuals utilize legal tax avoidance strategies to reduce their liabilities. understanding asset ownership and investment income can optimize your tax situation. while the average property tax rate is 1%, the wealthy often have their financial structures designed to minimize taxes. By leveraging complex financial strategies, legal loopholes, and policy incentives, billionaires manage to significantly reduce their tax liabilities. here’s a closer look at how they do it. The run up in stock prices paired with relatively low interest rates has delivered an excellent way for rich americans to avoid paying taxes on their investment gains.

How The Rich Avoid Paying Taxes Understanding Tax Evasion And Tax Avoidance Galaxy Ai One of the best ways to cut your tax bill is to take lessons from millionaires, many of whom have spent a fortune working with tax professionals to identify every deduction and credit they can use to reduce what they owe the irs. Many wealthy individuals utilize legal tax avoidance strategies to reduce their liabilities. understanding asset ownership and investment income can optimize your tax situation. while the average property tax rate is 1%, the wealthy often have their financial structures designed to minimize taxes. By leveraging complex financial strategies, legal loopholes, and policy incentives, billionaires manage to significantly reduce their tax liabilities. here’s a closer look at how they do it. The run up in stock prices paired with relatively low interest rates has delivered an excellent way for rich americans to avoid paying taxes on their investment gains.

Comments are closed.