How To Calculate The Future Value Of An Ordinary Annuity

How To Calculate Future Value Of Ordinary Annuity Annuityf Calculate Annuity In Excel Use this calculator to find the future value of annuities due, ordinary regular annuities and growing annuities. the purpose of this calculator is to compute the future value of a series of deposits. Whether making a series of fixed payments over a period, such as rent or car loan, or receiving periodic income from a bond or certificate of deposit (cd), you can calculate the present value.

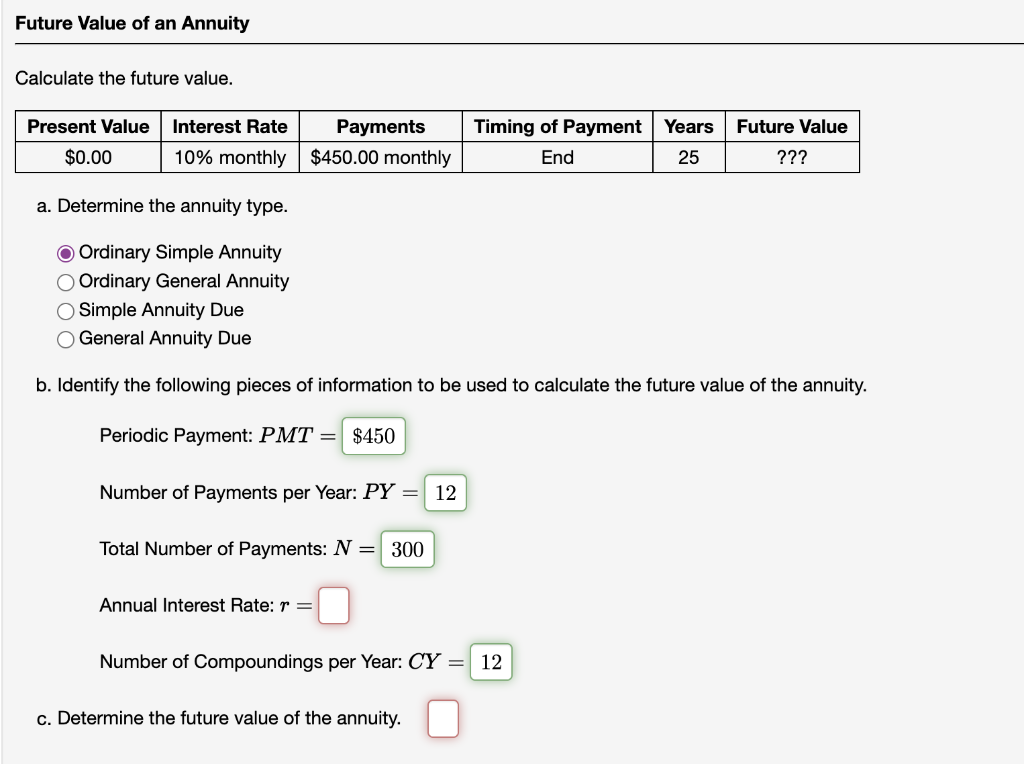

Solved Calculate The Future Value A Determine The Annuity Chegg In an ordinary annuity, payments are made at the end of each agreed upon period. in an annuity due, payments are made at the beginning of each period. to calculate the future value of an. The future value of annuity calculator is designed to help you to estimate the value of a series of payments at a future date. Calculating the present and future value of an annuity can help you decide whether to buy an annuity or what to do with the one you already have. the present value is handy to know if you want to compare the windfall from selling an annuity against its expected payments in the future. Now that we’ve discussed the basics of annuities, let’s look at how to calculate future value. to calculate an annuity’s future value, use the following formula: the formula above is for an “ordinary annuity,” which is an annuity that involves making payments at the end of each payment period.

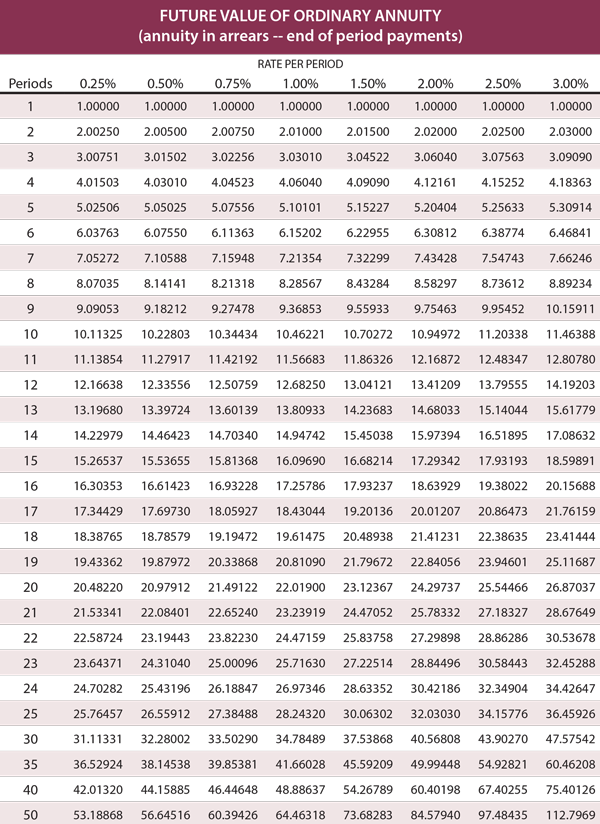

Future Value Of Ordinary Annuity Principlesofaccounting Calculating the present and future value of an annuity can help you decide whether to buy an annuity or what to do with the one you already have. the present value is handy to know if you want to compare the windfall from selling an annuity against its expected payments in the future. Now that we’ve discussed the basics of annuities, let’s look at how to calculate future value. to calculate an annuity’s future value, use the following formula: the formula above is for an “ordinary annuity,” which is an annuity that involves making payments at the end of each payment period. While future value tells you how much a series of investments will be worth in the future, present value takes the opposite approach. it calculates the current amount of money you’d need to. On this page, you can calculate future value of annuity (fva) of both simple as well as complex annuities. use this calculator for financial goal planning and to estimate the returns from regular savings or investments. Future value is the value of a sum of cash to be paid on a specific date in the future. therefore, the formula for the future value of an ordinary annuity refers to the value on a specific future date of a series of periodic payments, where each payment is made at the end of a period. You can use the following formula to calculate the future value of an annuity: p=pmt× ( ( (1 r)n−1) r) . when you sit down to plan for retirement, more likely than not, you will calculate the future value of an annuity.

Future Value Of Ordinary Annuity Table Accountingexplanation While future value tells you how much a series of investments will be worth in the future, present value takes the opposite approach. it calculates the current amount of money you’d need to. On this page, you can calculate future value of annuity (fva) of both simple as well as complex annuities. use this calculator for financial goal planning and to estimate the returns from regular savings or investments. Future value is the value of a sum of cash to be paid on a specific date in the future. therefore, the formula for the future value of an ordinary annuity refers to the value on a specific future date of a series of periodic payments, where each payment is made at the end of a period. You can use the following formula to calculate the future value of an annuity: p=pmt× ( ( (1 r)n−1) r) . when you sit down to plan for retirement, more likely than not, you will calculate the future value of an annuity.

Comments are closed.