How To Comply With Ccpa Requirements

Ccpa Requirements California Consumer Privacy Act How can comply can help? to help address the unique regulatory requirements of fund advisers, we recently released a customized version of our industry leading myriacompliance® online ria compliance software platform to better service fund advisers. The leading regulatory compliance conference get a front row seat to the latest news and trends shaping compliance, risk and governance. learn more about our conference here. have questions? please reach out to hello@complyconnectexpo . subscribe to comply's email updates.

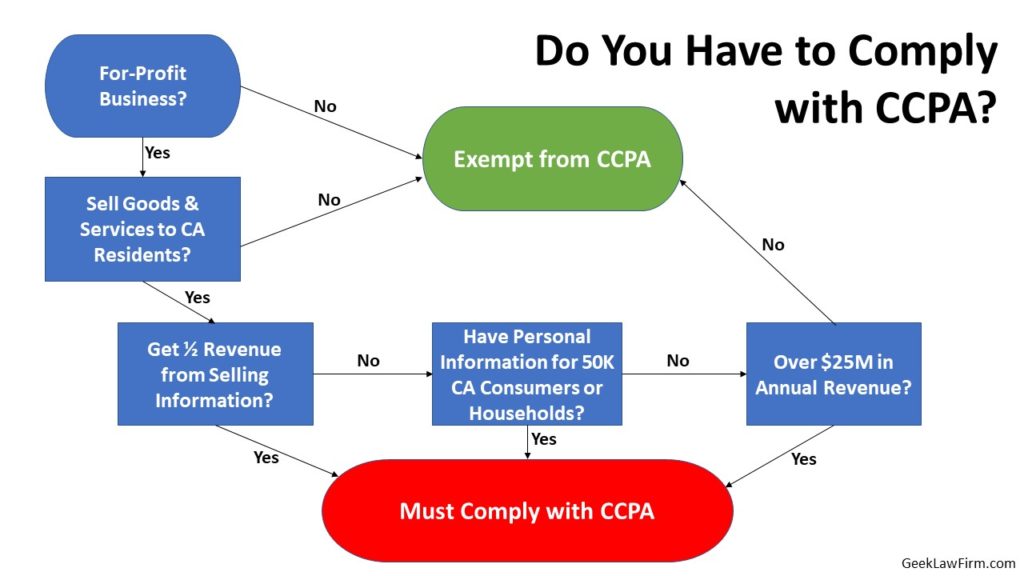

Do You Have To Comply With Ccpa Geek Law Firm Join comply and a panel of leading regulatory experts as we break down what was withdrawn, why it matters, and — most importantly — what your firm should still be doing to protect itself. During a recent webinar comply and iaa experts shared their perspectives on how the new administration will impact regulatory compliance. Discover what the 2025 sec rule withdrawals mean for rias. learn how to adapt your compliance strategy in a principles based oversight era. Rule 203a 2(c) allows an ria firm to be eligible for sec registration if it has a reasonable expectation it will reach $100 million of aum within 120 days.

Ccpa Requirements You Should Know About With Interview Discover what the 2025 sec rule withdrawals mean for rias. learn how to adapt your compliance strategy in a principles based oversight era. Rule 203a 2(c) allows an ria firm to be eligible for sec registration if it has a reasonable expectation it will reach $100 million of aum within 120 days. By: michael rasmussen grc analyst & pundit at grc 20 20 research, llc navigating risk is no small task, whether it’s staying ahead of financial crimes, managing third party relationships, or keeping up with the constant ebb an the stakes are high, and the need for smarter, more efficient solutions has never been greater. enter artificial intelligence […]. Comply is transforming compliance with ai powered automation, seamlessly connecting compliance data across multiple sources. ai driven capabilities streamline regulatory task management, real time insights, and employee support, allowing firms to stay ahead of shifting regulations. The sec expects firms’ ccos to establish and maintain effective compliance programs, which includes providing training to employees to ensure they understand and comply with applicable laws and regulations. Comply offers various solutions for investment advisers to streamline their compliance tasks and efficiently meet the securities and exchange commission’s (sec) requirements.

What You Must Know About Ccpa Compliance Requirements By: michael rasmussen grc analyst & pundit at grc 20 20 research, llc navigating risk is no small task, whether it’s staying ahead of financial crimes, managing third party relationships, or keeping up with the constant ebb an the stakes are high, and the need for smarter, more efficient solutions has never been greater. enter artificial intelligence […]. Comply is transforming compliance with ai powered automation, seamlessly connecting compliance data across multiple sources. ai driven capabilities streamline regulatory task management, real time insights, and employee support, allowing firms to stay ahead of shifting regulations. The sec expects firms’ ccos to establish and maintain effective compliance programs, which includes providing training to employees to ensure they understand and comply with applicable laws and regulations. Comply offers various solutions for investment advisers to streamline their compliance tasks and efficiently meet the securities and exchange commission’s (sec) requirements.

Comments are closed.