How To File Bir Form 2551q Quarterly Percentage Tax 2nd Quarter 2025 Deadline July 25 2025

Bir Form 2551q Quarterly Percentage Tax Download Free Pdf Initial Public Offering Stocks Deadline to file your quarterly percentage tax is on the 25th day following the close of the quarter. percentage tax is computed as 3% of your gross sales or receipts (net of sales. Filing for 2551q. after calculating your tax, you need to file form 2551q with the bureau of internal revenue (bir). this form is filed quarterly—every 3 months, so 4 times in a taxable year—and must be submitted on or before the 25th day following the close of each taxable quarter.

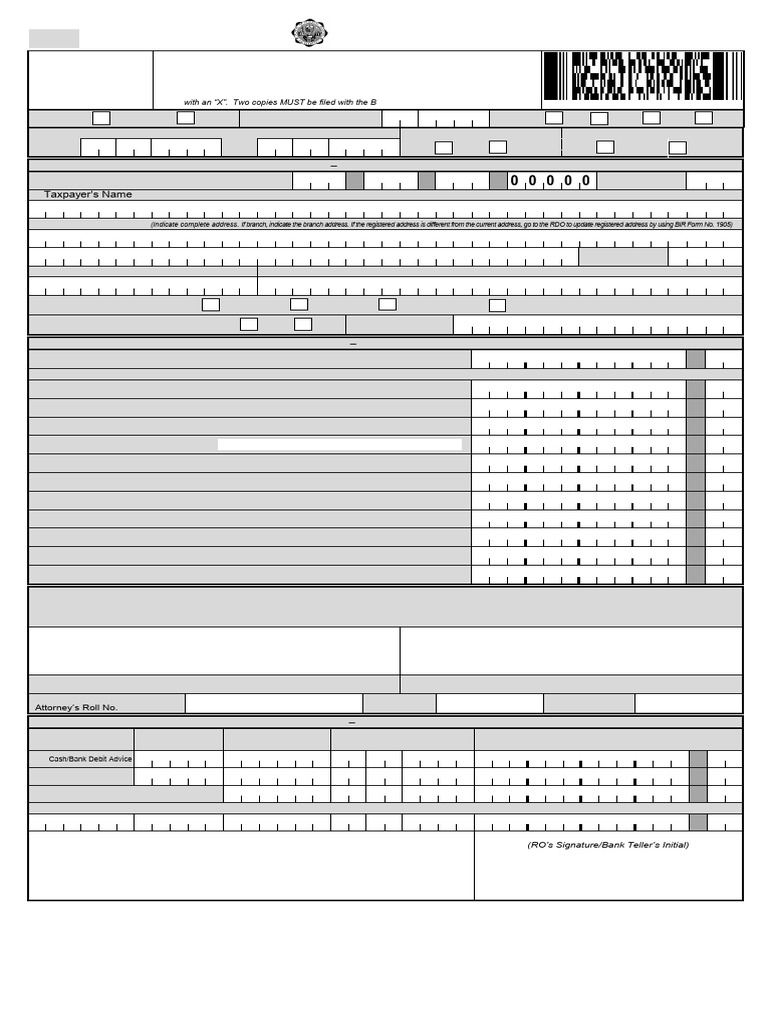

How To File Quarterly Percentage Tax Return Bir Form 2551q Tax Return Percentage Encs Bir form 2551q is for businesses in the philippines with annual sales under 3,000,000 php to file quarterly percentage taxes. the form is due on the 25th day following the end of each taxable quarter, with penalties for late submissions. Prior to the passing of the law, businesses were required to file for percentage taxes monthly. with this in effect, percentage taxes will only have to be filed quarterly, saving you a few trips to your local regional district office (rdo). To stay ahead of the game, you can file form 2551q online, a convenient option that allows you to fill out and transmit the form electronically to the bir. don’t forget that the electronic doors close at 9 pm on the due date. The bir form 2551q is a quarterly tax return used for reporting percentage tax liabilities in the philippines. this form must be filled out with accurate taxpayer information and payment details. it is essential for both individuals and non individual taxpayers who meet the criteria.

Bir Form 2551q Quarterly Percentage Tax Return To stay ahead of the game, you can file form 2551q online, a convenient option that allows you to fill out and transmit the form electronically to the bir. don’t forget that the electronic doors close at 9 pm on the due date. The bir form 2551q is a quarterly tax return used for reporting percentage tax liabilities in the philippines. this form must be filled out with accurate taxpayer information and payment details. it is essential for both individuals and non individual taxpayers who meet the criteria. Bir form 2551q is used for filing quarterly percentage taxes on sales not exceeding 3,000,000 php. it applies to resident and non resident citizens, aliens, and estate managers in the philippines. the form must be submitted within 10 days after each quarter ends to avoid penalties. In the realm of tax compliance in the philippines, bir form 2551q, known as the quarterly percentage tax return, plays a crucial role for self employed individuals, professionals, and businesses. this guide delves into what bir form 2551q entails, who needs to file it, and how to accurately compute and submit this essential document. Under republic act no. 10963, also known as the tax reform for acceleration and inclusion (also known as train law), 2551q forms shall be filed every 25th day after the taxable quarter. please take note that your tax forms will be sent electronically to the bir until 9pm. E filing filing & e payment payment of bir form 2551q (quarterly percentage tax return). —for the quarter ending june 30, 2025 (original deadline: july 25, 2025) e filing filing & e payment payment of bir form 2550ds (value added tax for non resident digital service provider) —for the quarter ending june 30, 2025.

Bir Form 2550q 2551q Pdf Value Added Tax Taxes Bir form 2551q is used for filing quarterly percentage taxes on sales not exceeding 3,000,000 php. it applies to resident and non resident citizens, aliens, and estate managers in the philippines. the form must be submitted within 10 days after each quarter ends to avoid penalties. In the realm of tax compliance in the philippines, bir form 2551q, known as the quarterly percentage tax return, plays a crucial role for self employed individuals, professionals, and businesses. this guide delves into what bir form 2551q entails, who needs to file it, and how to accurately compute and submit this essential document. Under republic act no. 10963, also known as the tax reform for acceleration and inclusion (also known as train law), 2551q forms shall be filed every 25th day after the taxable quarter. please take note that your tax forms will be sent electronically to the bir until 9pm. E filing filing & e payment payment of bir form 2551q (quarterly percentage tax return). —for the quarter ending june 30, 2025 (original deadline: july 25, 2025) e filing filing & e payment payment of bir form 2550ds (value added tax for non resident digital service provider) —for the quarter ending june 30, 2025.

A Guide To Filing Quarterly Percentage Tax Bir Form 2551q Under republic act no. 10963, also known as the tax reform for acceleration and inclusion (also known as train law), 2551q forms shall be filed every 25th day after the taxable quarter. please take note that your tax forms will be sent electronically to the bir until 9pm. E filing filing & e payment payment of bir form 2551q (quarterly percentage tax return). —for the quarter ending june 30, 2025 (original deadline: july 25, 2025) e filing filing & e payment payment of bir form 2550ds (value added tax for non resident digital service provider) —for the quarter ending june 30, 2025.

Comments are closed.