How To Use The Tables To Calculate Present Value

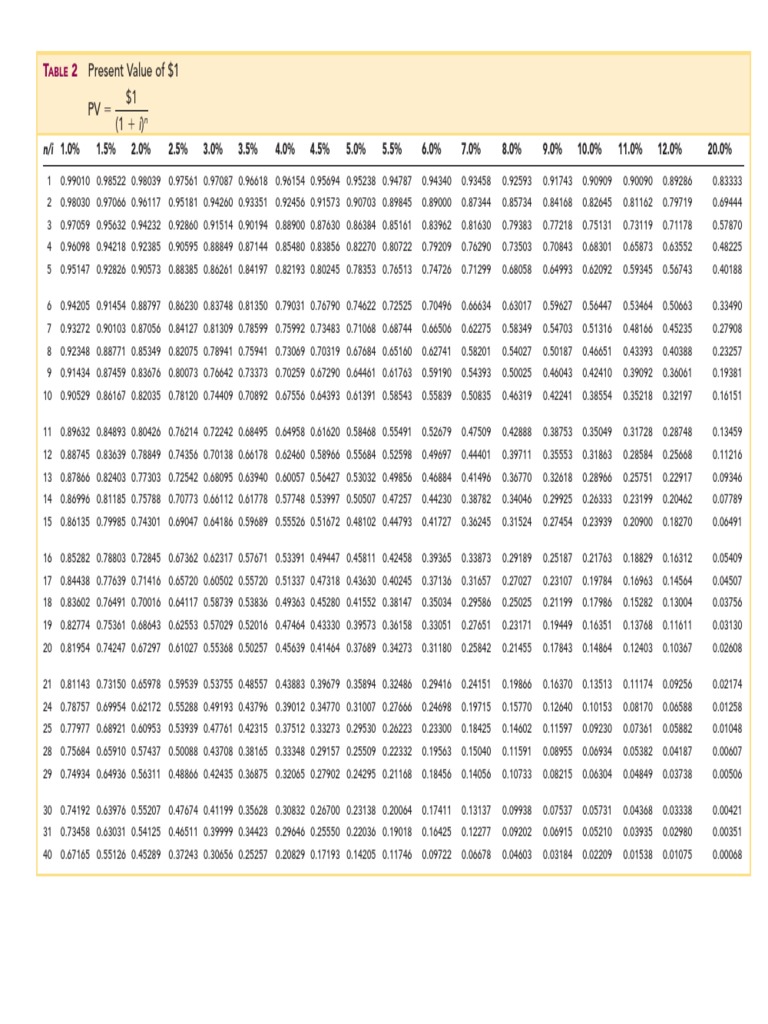

Present Value Tables Pdf Present Value Mathematical And Quantitative Methods Economics To get the present value, we multiply the amount for which the present value has to be calculated with the required coefficient on the table. a present value table includes different coefficients depending on the discount rate and the period. I show you how easy it is to use the tables to calculate the present value when you know the future value, the interest rate, and the number of compounding p.

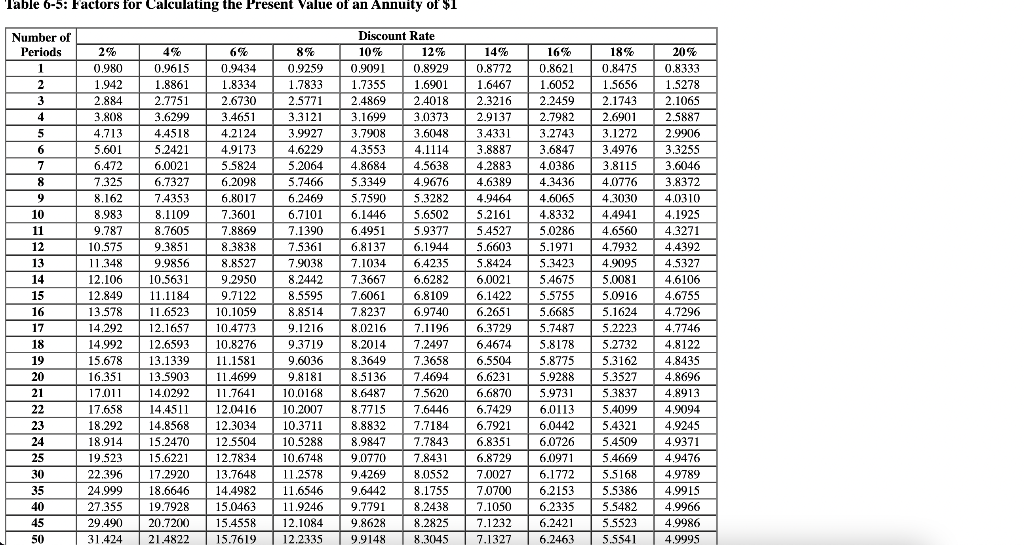

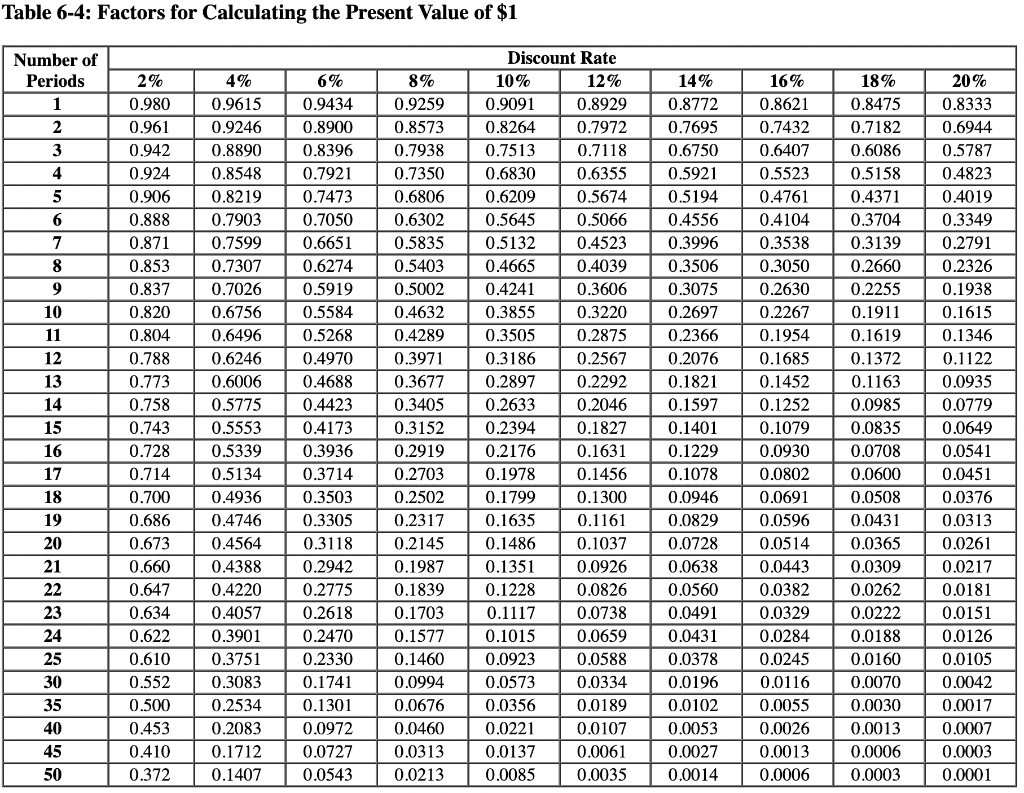

Present Value Table Pdf And the present value table allows you to measure how much. a present value (pv) table is a simple grid that tells you what $1 in the future is worth today, depending on two things: the discount rate (an interest rate representing time, inflation, and risk). here’s a quick glimpse of what one looks like:. Present value is calculated using three data points: the expected future value, the interest rate that the money might earn between now and then if invested, and number of payment periods,. Present value tables are used to calculate the present value of future amounts using the formula pv=fv (1 i)^n. free pdf download available. Next, calculate the present value for each cash flow by dividing the future cash flow (step 1) by one plus the discount rate (step 2) raised to the number of periods (step 3). pvi = ci (1 r) ni. pv = c1 (1 r) n1 c2 (1 r) n2 c3 (1 r) n3 ……. ck (1 r) nk.

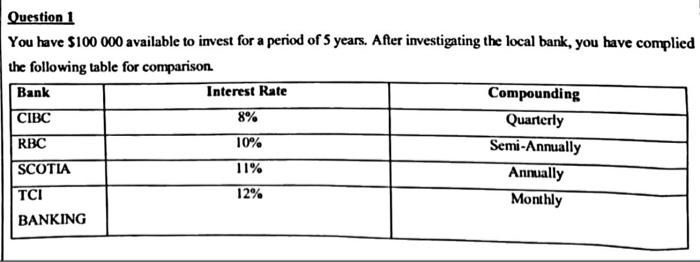

Solved You Have 100000 Available To Invest For A Period Of Chegg Present value tables are used to calculate the present value of future amounts using the formula pv=fv (1 i)^n. free pdf download available. Next, calculate the present value for each cash flow by dividing the future cash flow (step 1) by one plus the discount rate (step 2) raised to the number of periods (step 3). pvi = ci (1 r) ni. pv = c1 (1 r) n1 c2 (1 r) n2 c3 (1 r) n3 ……. ck (1 r) nk. Each cell represents the present value factor for that specific period and rate. then, to find the present value, we multiply the future value by the table factor. example: suppose you know you will receive $10,000 five years from now, and the discount rate is 8%. Create a table of present value interest factors for $1, one dollar, based on compounding interest calculations. present value of a future value of $1. compound interest formula to find present values pv = $1 (1 i)^n. How to use a present value table? a present value table simplifies the calculation process. it provides you with the present value factors for various interest rates (r) and periods (n). to use the table, you simply identify the intersection of the appropriate interest rate and period. In excel, you will find the pv function is quite the handy present value calculator. the type and nature of investment will however determine the variables for the pv function. the three broad categories we'll cover for calculating the present value are annuities, perpetuities, and one time payouts. are you confusing present value with net.

Solved Using The Following Present Value Tables Calculate Chegg Each cell represents the present value factor for that specific period and rate. then, to find the present value, we multiply the future value by the table factor. example: suppose you know you will receive $10,000 five years from now, and the discount rate is 8%. Create a table of present value interest factors for $1, one dollar, based on compounding interest calculations. present value of a future value of $1. compound interest formula to find present values pv = $1 (1 i)^n. How to use a present value table? a present value table simplifies the calculation process. it provides you with the present value factors for various interest rates (r) and periods (n). to use the table, you simply identify the intersection of the appropriate interest rate and period. In excel, you will find the pv function is quite the handy present value calculator. the type and nature of investment will however determine the variables for the pv function. the three broad categories we'll cover for calculating the present value are annuities, perpetuities, and one time payouts. are you confusing present value with net.

Solved Using The Following Present Value Tables Calculate Chegg How to use a present value table? a present value table simplifies the calculation process. it provides you with the present value factors for various interest rates (r) and periods (n). to use the table, you simply identify the intersection of the appropriate interest rate and period. In excel, you will find the pv function is quite the handy present value calculator. the type and nature of investment will however determine the variables for the pv function. the three broad categories we'll cover for calculating the present value are annuities, perpetuities, and one time payouts. are you confusing present value with net.

Comments are closed.