Important Differences Between Tds And Tcs Chapter 11 Tcs

Important Differences Between Tds And Tcs Chapter 11 Tcs Important differences between tds and tcs last updated at dec. 16, 2024 by teachoo. Tds represents the tax deducted by the payer from payments made when the amount exceeds a set limit. conversely, tcs refers to the tax collected by the sellers during transactions with buyers. however, taxpayers often mix up these terms and use them interchangeably.

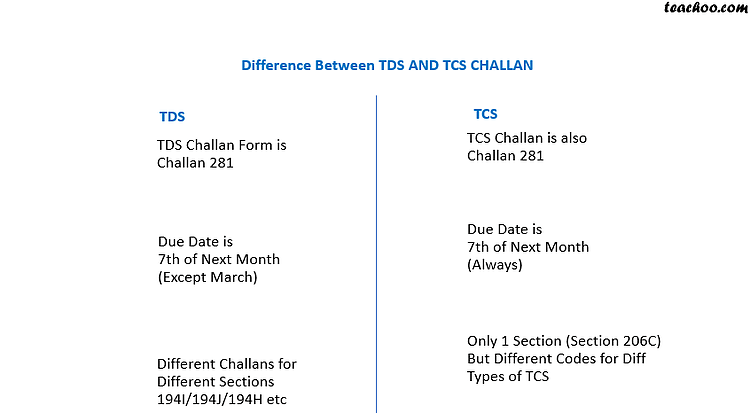

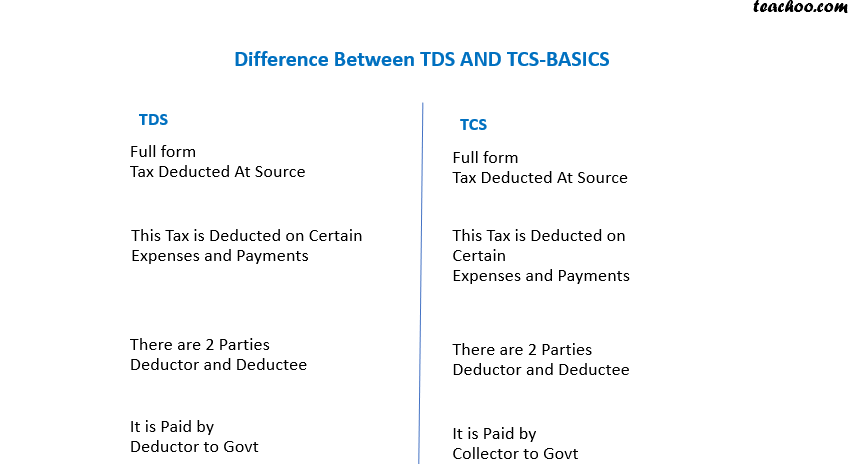

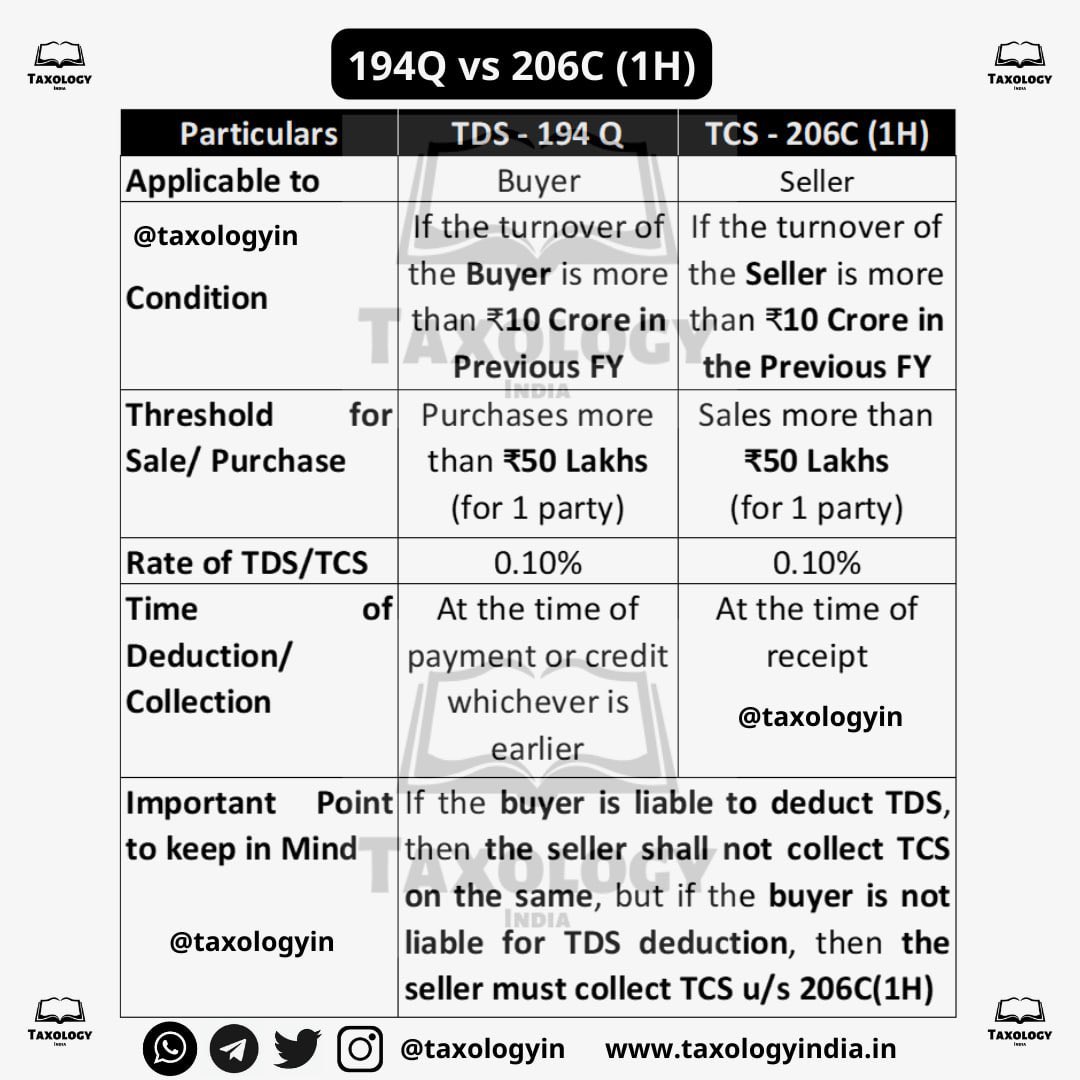

Important Differences Between Tds And Tcs Chapter 11 Tcs In this blog, we’ll explain what tds and tcs mean, how they work, where they apply, the key differences between them, and the latest applicable rates for 2025. Key differences between tds (tax deducted at source) and tcs (tax collected at source) in terms of their applicability, calculation, and compliance requirements. While tds is an expense, tcs is an income. tds stands for tax deduction at source, tcs expands to tax collection at source. these are not taxes but are an obligation, which is deducted at the time of payment or received more and deposited to the income tax department. Tcs (tax collected at source): tcs applies when a seller collects tax at the time of sale of goods or provision of services, typically for specific items or services. both mechanisms help in reducing tax evasion, ensuring tax is collected at an early stage, and making the tax system more transparent and efficient.

Important Differences Between Tds And Tcs Chapter 11 Tcs While tds is an expense, tcs is an income. tds stands for tax deduction at source, tcs expands to tax collection at source. these are not taxes but are an obligation, which is deducted at the time of payment or received more and deposited to the income tax department. Tcs (tax collected at source): tcs applies when a seller collects tax at the time of sale of goods or provision of services, typically for specific items or services. both mechanisms help in reducing tax evasion, ensuring tax is collected at an early stage, and making the tax system more transparent and efficient. The distinction between tds vs tcs deviates at the tax deduction and collection level, as well as who is responsible and who is applicable. in this blog, we will evaluate tds and tcs and discover the key differences between them. What are tds and tcs? explore the key differences between tds and tcs, two important tax collection mechanisms in india. read on!. In the indian tax system, two important mechanisms ensure the timely collection of taxes: tax deducted at source (tds) and tax collected at source (tcs). these concepts, though closely related, differ significantly in their purpose, applicability, and implementation. In conclusion, tds and tcs are two important mechanisms of collecting tax at the source of income. while tds is applicable on various types of income and is deducted by the person making the payment, tcs is applicable on the sale of specified goods or services and is collected by the seller.

Important Differences Between Tds And Tcs Chapter 11 Tcs The distinction between tds vs tcs deviates at the tax deduction and collection level, as well as who is responsible and who is applicable. in this blog, we will evaluate tds and tcs and discover the key differences between them. What are tds and tcs? explore the key differences between tds and tcs, two important tax collection mechanisms in india. read on!. In the indian tax system, two important mechanisms ensure the timely collection of taxes: tax deducted at source (tds) and tax collected at source (tcs). these concepts, though closely related, differ significantly in their purpose, applicability, and implementation. In conclusion, tds and tcs are two important mechanisms of collecting tax at the source of income. while tds is applicable on various types of income and is deducted by the person making the payment, tcs is applicable on the sale of specified goods or services and is collected by the seller.

Tds Vs Tcs Difference Between Tds And Tcs What Is Tds And Tcs Tds And Hot Sex Picture In the indian tax system, two important mechanisms ensure the timely collection of taxes: tax deducted at source (tds) and tax collected at source (tcs). these concepts, though closely related, differ significantly in their purpose, applicability, and implementation. In conclusion, tds and tcs are two important mechanisms of collecting tax at the source of income. while tds is applicable on various types of income and is deducted by the person making the payment, tcs is applicable on the sale of specified goods or services and is collected by the seller.

Difference Between Tds And Tcs With Comparison Chart Key Differences

Comments are closed.