Income Tax Brackets Uk 2025 Paul Russell

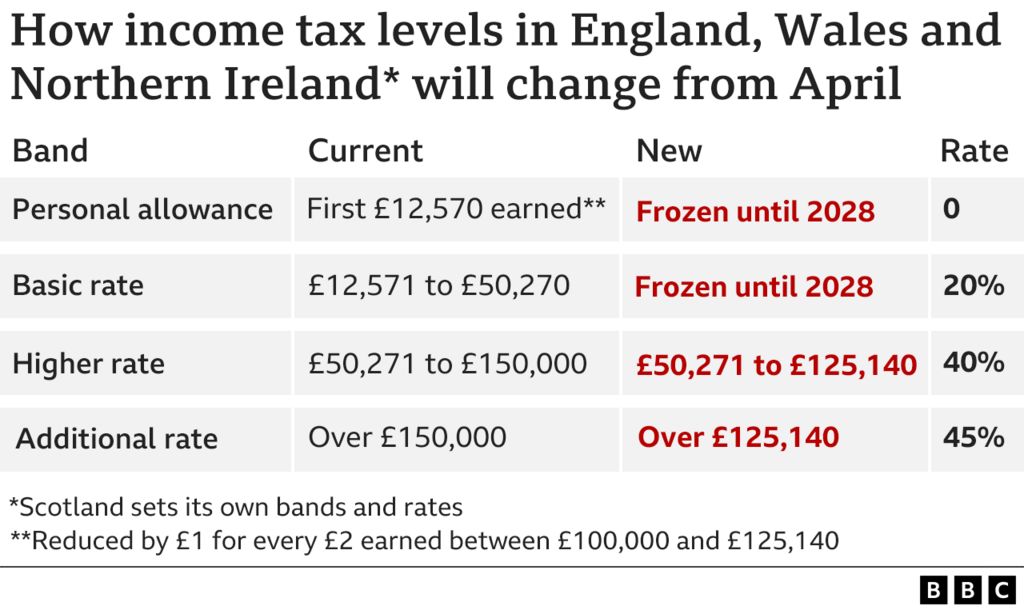

Income Tax Brackets Uk 2025 Paul Russell How much income tax you pay in each tax year depends on: how much of your income is above your personal allowance; how much of your income falls within each tax band; some income is tax free. (3) the individual income tax rates and bands for scotland and wales for 2025 26 were announced in the scottish budget and the draft welsh budget on 4 december 2024 and 10 december 2024, respectively, but the legislation to give them effect has not been enacted as at january 2025.

Income Tax Brackets 2025 Rami Leena Discover the united kingdom tax tables for 2025, including tax rates and income thresholds. stay informed about tax regulations and calculations in united kingdom in 2025. For the 2025 26 tax year, if you live in england, wales or northern ireland, there are three marginal income tax bands which set the rate of tax you pay – the 20% basic rate, the 40% higher rate and the 45% additional rate (also remember your personal allowance starts to shrink once earnings hit £100,000). Tax bands 2025 2026 tax year tax free allowance 0% tax, £1048 per month, £12,576 per year basic tax rate 20% on annual earnings above the tax free allowance threshold and up to £37,700 higher tax rate 40% on annual earnings from £37,701 to £87,440 additional tax rate 45% on annual earnings above £87,441 emergency tax code 1257l m1 the. The 2025 26 tax calculator provides a full payroll, salary and tax calculations for the 2025 26 tax year including employers nic payments, p60 analysis, salary sacrifice, pension calculations and more.

Income Tax Brackets 2025 Australia Uk Gavin Rivera Tax bands 2025 2026 tax year tax free allowance 0% tax, £1048 per month, £12,576 per year basic tax rate 20% on annual earnings above the tax free allowance threshold and up to £37,700 higher tax rate 40% on annual earnings from £37,701 to £87,440 additional tax rate 45% on annual earnings above £87,441 emergency tax code 1257l m1 the. The 2025 26 tax calculator provides a full payroll, salary and tax calculations for the 2025 26 tax year including employers nic payments, p60 analysis, salary sacrifice, pension calculations and more. In england and northern ireland, income rates of tax are applied progressively, with different portions of your income falling into distinct bands. wondering what the tax rates are for 2025 26? see a list of uk salaries from £500 to £300,000, in the 2025 2026 tax year, gross and net after taxation. the table below outlines the. If you live in england, wales or northern ireland there are three income tax bands and rates above the tax free personal allowance; the basic rate (20%), the higher rate (40%), and the additional rate (45%). The scottish parliament set the rates of income tax and the limits at which these rates apply for scottish residents on non savings and non dividend income. income tax is devolved to wales on non savings and non dividend income. Annual allowance charge on excess is at applicable tax rate(s) on earnings *reduced by £1 for every £2 of adjusted income over £260,000 to a minimum of £10,000, subject to threshold income being over £200,000.

Income Tax Brackets Uk 2025 Samantha C Watkin In england and northern ireland, income rates of tax are applied progressively, with different portions of your income falling into distinct bands. wondering what the tax rates are for 2025 26? see a list of uk salaries from £500 to £300,000, in the 2025 2026 tax year, gross and net after taxation. the table below outlines the. If you live in england, wales or northern ireland there are three income tax bands and rates above the tax free personal allowance; the basic rate (20%), the higher rate (40%), and the additional rate (45%). The scottish parliament set the rates of income tax and the limits at which these rates apply for scottish residents on non savings and non dividend income. income tax is devolved to wales on non savings and non dividend income. Annual allowance charge on excess is at applicable tax rate(s) on earnings *reduced by £1 for every £2 of adjusted income over £260,000 to a minimum of £10,000, subject to threshold income being over £200,000.

Income Tax Brackets Uk 2025 Samantha C Watkin The scottish parliament set the rates of income tax and the limits at which these rates apply for scottish residents on non savings and non dividend income. income tax is devolved to wales on non savings and non dividend income. Annual allowance charge on excess is at applicable tax rate(s) on earnings *reduced by £1 for every £2 of adjusted income over £260,000 to a minimum of £10,000, subject to threshold income being over £200,000.

Comments are closed.