Index Funds Tracking Error And Tracking Difference Dec 2023

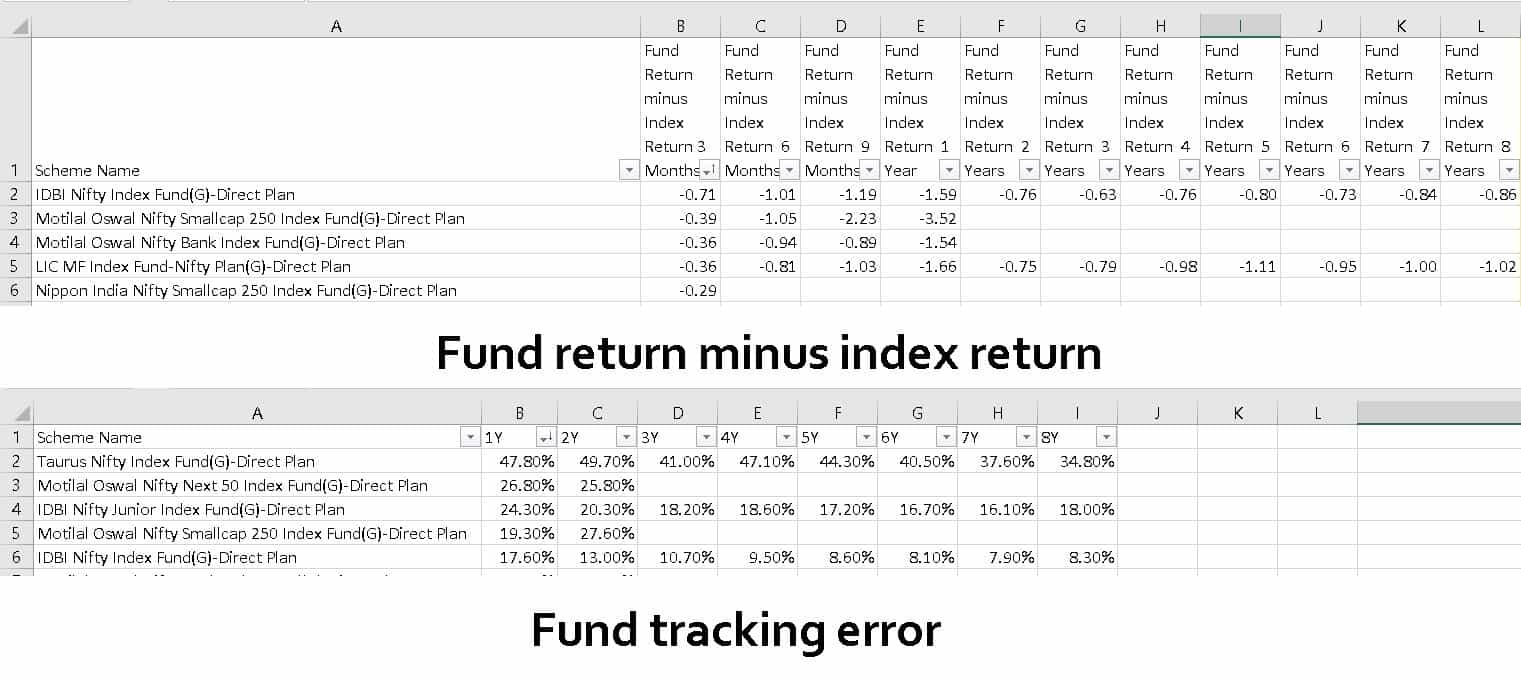

Index Funds Tracking Error And Tracking Difference Dec 2023 Find the latest data of all the index funds tracking error and tracking difference in dec 2023. you will also find the aum and expense ratio of regular and direct funds. This index fund screener is based on tracking error and returns difference wrt benchmarks (aka tracking difference). the screener will help users evaluate how efficiently an index fund has tracked its underlying benchmark.

Index Fund Tracking Error Screener May 2023 Finansdirekt24 Se This etf screener is based on tracking errors and tracking differences (etf return minus index return). the screener will help users evaluate how efficiently an etf has tracked its underlying benchmark. Tracking difference and error indicate how well an index fund follows its intended path. here's how to avoid common analytical mistakes. download the report now. While tracking difference measures the amount by which an etf’s return differs from that of its benchmark over a specific period, tracking error measures the variability of tracking difference over time. Looking for an index fund with minimal tracking error? read on to learn more about index funds and find out which ones have the lowest tracking error, allowing you to achieve better returns.

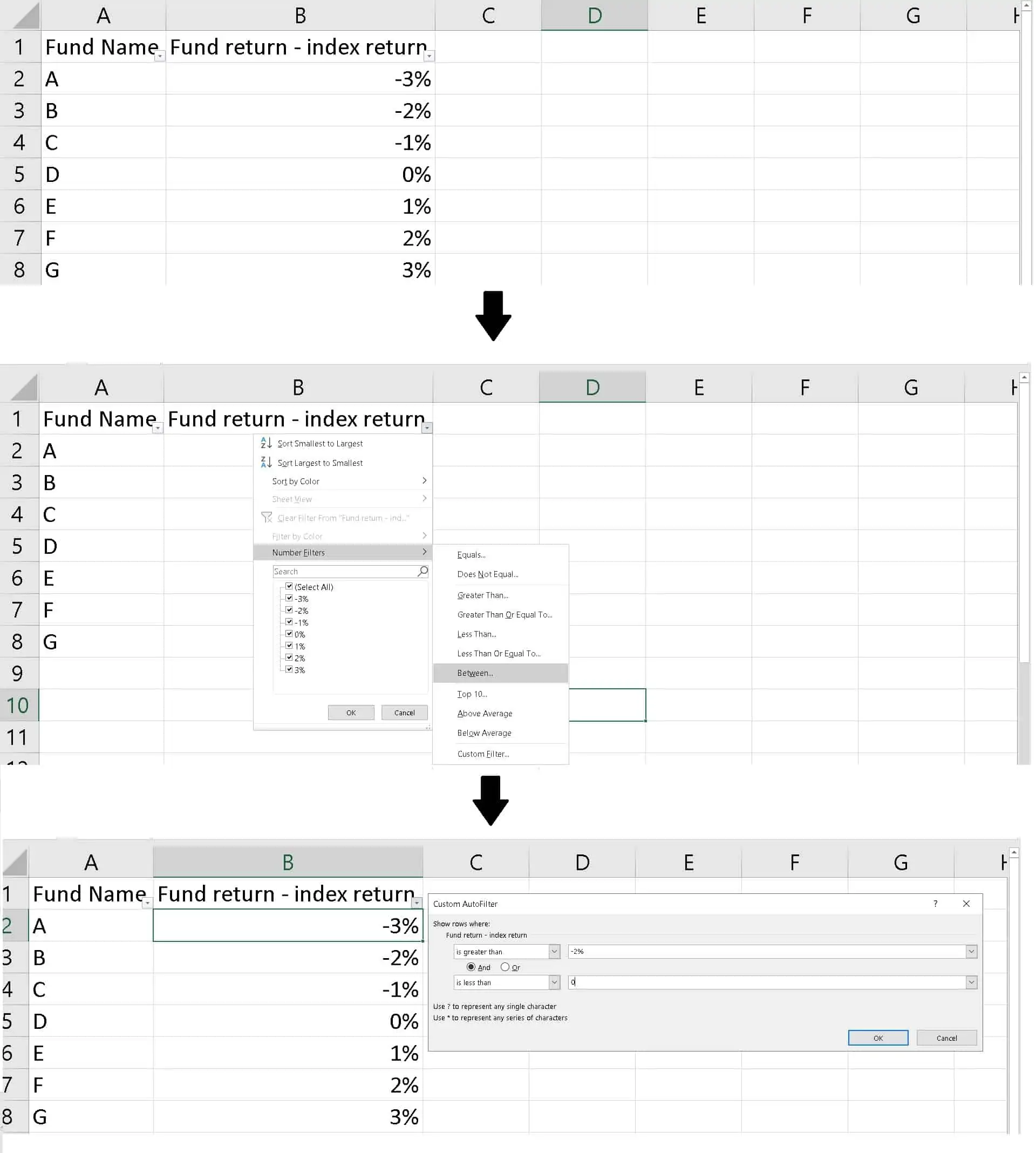

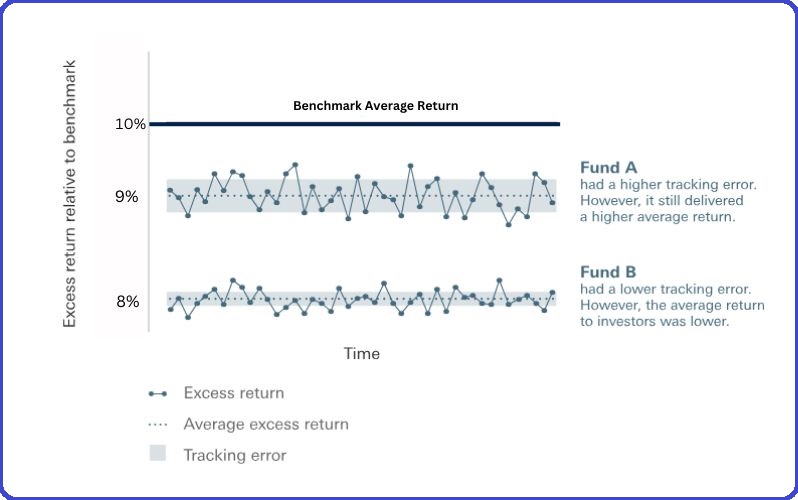

Index Fund Tracking Error Screener June 2023 While tracking difference measures the amount by which an etf’s return differs from that of its benchmark over a specific period, tracking error measures the variability of tracking difference over time. Looking for an index fund with minimal tracking error? read on to learn more about index funds and find out which ones have the lowest tracking error, allowing you to achieve better returns. Investors need to consider tracking difference and error to understand a fund’s performance comprehensively. by considering these factors, investors can better evaluate the effectiveness of different passive fund options tracking the same index and make appropriate investment choices. Tracking error vs tracking difference are two critical components used to analyze the performance of an index fund relative to its underlying benchmark index. they provide insights into how closely the fund is able to replicate the performance of the index it aims to track. Etfs that track indexes with many securities, illiquid securities, or that rebalance frequently by design (like an equal weighted index) will incur greater transaction and rebalancing costs, which will increase tracking difference. There is a misconception, even among experts, that a low tracking error for a passive fund (index fund or etf) implies the fund’s returns closely match the benchmark. this is not true. what is a tracking difference? this is the fund return minus the benchmark total return over a period.

Tracking Error Vs Tracking Difference In Index Fund Quick Guide Investors need to consider tracking difference and error to understand a fund’s performance comprehensively. by considering these factors, investors can better evaluate the effectiveness of different passive fund options tracking the same index and make appropriate investment choices. Tracking error vs tracking difference are two critical components used to analyze the performance of an index fund relative to its underlying benchmark index. they provide insights into how closely the fund is able to replicate the performance of the index it aims to track. Etfs that track indexes with many securities, illiquid securities, or that rebalance frequently by design (like an equal weighted index) will incur greater transaction and rebalancing costs, which will increase tracking difference. There is a misconception, even among experts, that a low tracking error for a passive fund (index fund or etf) implies the fund’s returns closely match the benchmark. this is not true. what is a tracking difference? this is the fund return minus the benchmark total return over a period.

Comments are closed.