Intro To Pension Plans

Pension Plans 101 Discover the world of pensions with our comprehensive guide. from the basics to choosing the right plan and accessing your funds, we've got you covered. plan your financial future today!. Pension plans are financial arrangements designed to provide individuals with a steady income after retirement. they are typically funded through contributions made by employees, employers, or both, and are intended to ensure financial security in one’s later years.

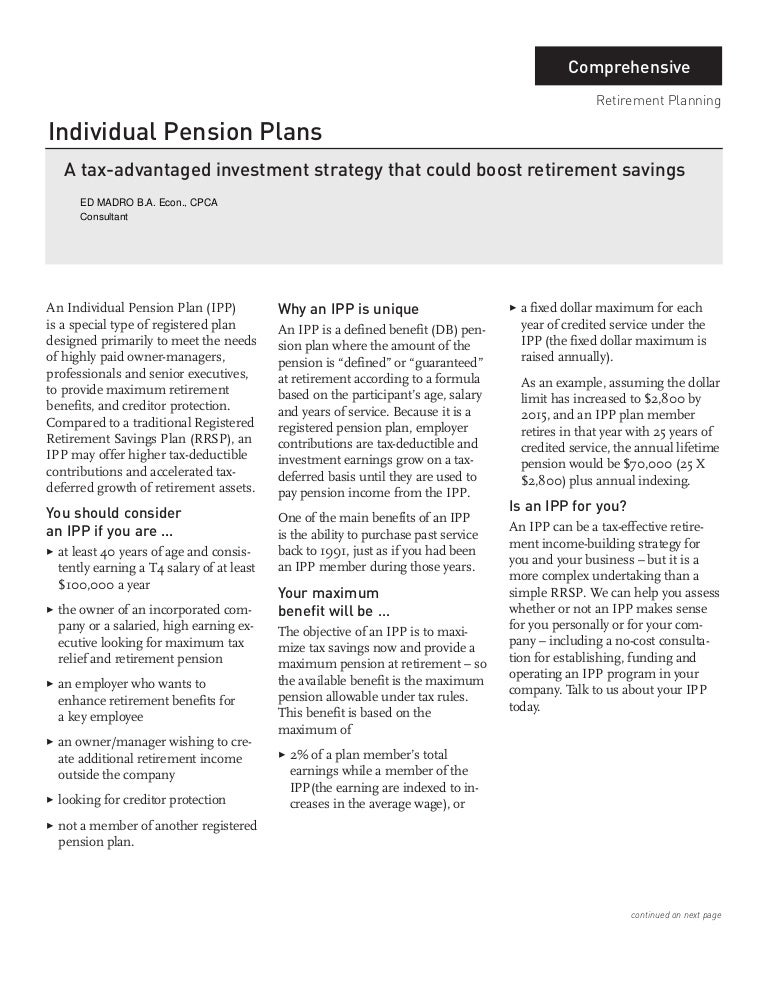

Individual Pension Plans Irp breaks down key features of retirement plan operations in an easy to understand way. irp is comprised of two interactive online modules which introduce the learners to concepts and language within the retirement industry. Learn about pension plans, including types, how they work, and the key benefits of securing your financial future for retirement. This chapter provides an overview of the two major types of pension plan: defined benefit (db) plans and defined contribution (dc) plans. the chapter introduces both plan types, and it also introduces terminology that will be used throughout the rest of the book. Think of a pension plan as a promise between you and your employer about your financial security after retirement. it’s essentially a structured way to save money during your working years so you can maintain your lifestyle when you stop earning a regular salary.

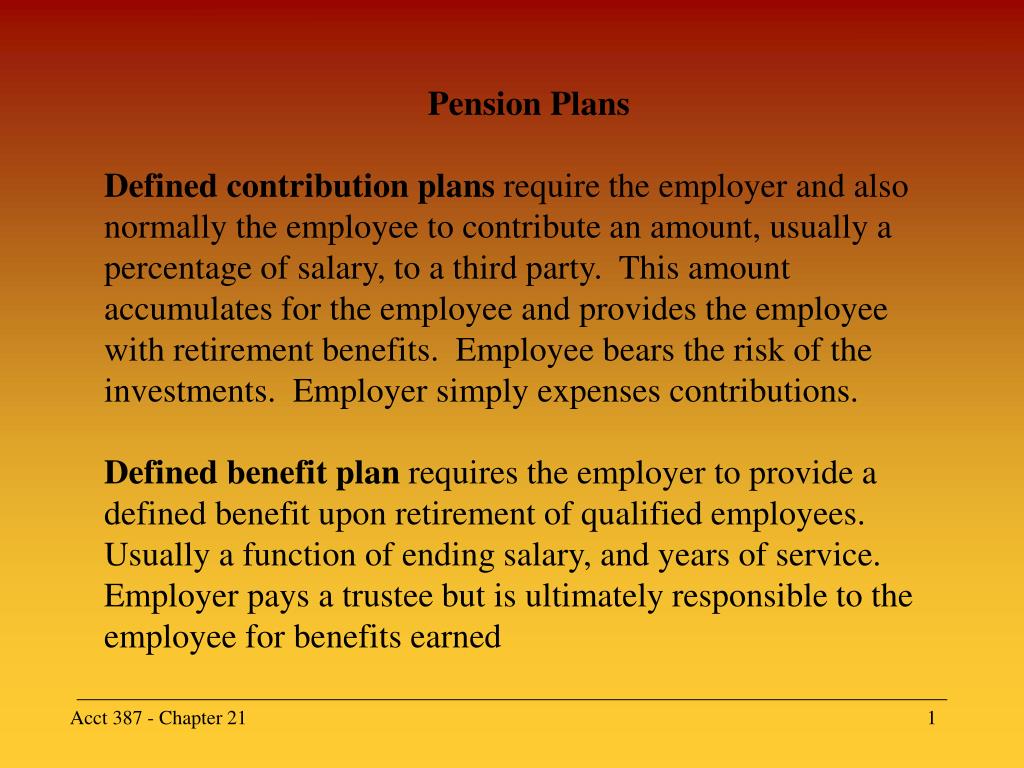

Individual Pension Plans This chapter provides an overview of the two major types of pension plan: defined benefit (db) plans and defined contribution (dc) plans. the chapter introduces both plan types, and it also introduces terminology that will be used throughout the rest of the book. Think of a pension plan as a promise between you and your employer about your financial security after retirement. it’s essentially a structured way to save money during your working years so you can maintain your lifestyle when you stop earning a regular salary. The two types of pension plans that private sector employers can offer are defined contribution (dc) plans, in which participants have individual accounts that can provide a source of income in retirement, and defined benefit (db) plans, in which participants receive regular monthly benefit payments in retirement (which some refer to as a "tradi. Pension plans are retirement plans that pay out guaranteed income. most pension plans are now only offered by public sector employers. updated jan 13, 2025 fact checked. smart money’s content is backed by a thorough review process. At its core, a pension plan is a type of retirement plan where an employer promises a specified monthly benefit upon retirement. this monthly benefit is typically a function of factors such as the employee’s salary, years of service, and age.

Ppt Pension Plans Powerpoint Presentation Free Download Id 2898705 The two types of pension plans that private sector employers can offer are defined contribution (dc) plans, in which participants have individual accounts that can provide a source of income in retirement, and defined benefit (db) plans, in which participants receive regular monthly benefit payments in retirement (which some refer to as a "tradi. Pension plans are retirement plans that pay out guaranteed income. most pension plans are now only offered by public sector employers. updated jan 13, 2025 fact checked. smart money’s content is backed by a thorough review process. At its core, a pension plan is a type of retirement plan where an employer promises a specified monthly benefit upon retirement. this monthly benefit is typically a function of factors such as the employee’s salary, years of service, and age.

Pension Plans Part 1 What Are They And How Do They Work Pharma Tax At its core, a pension plan is a type of retirement plan where an employer promises a specified monthly benefit upon retirement. this monthly benefit is typically a function of factors such as the employee’s salary, years of service, and age.

Pension Plans Compare Buy Best Retirement Plans Online Insurejoy

Comments are closed.