Irs Reveals Shocking 2025 Tax Changes You Need To Know

Tax Changes For 2025 Invested Md The one big beautiful bill act of 2025 has a significant effect on federal taxes, credits and deductions. it was signed into law on july 4, 2025, as public law 119 21. The internal revenue service (irs) has released its full list of changing tax rules for 2025, and americans are likely to see major updates to standard deductions and certain tax.

The Whitlock Co Federal Taxes Changes For 2025 President donald trump’s "big beautiful bill" includes key tax changes that are effective for 2025. here is how they could impact you. Big changes could be coming for your tax situation. here's a full rundown on tax rates, tax brackets, credits, and more for tax year 2025. Complete guide to the 2025 tax act (p.l. 119 21): permanent tax cuts, enhanced deductions, new worker benefits, and business incentives explained. On july 4, 2025, sweeping new tax legislation, officially titled the “one big beautiful bill” (obbb), was signed into law, marking one of the most significant overhauls to the tax code in recent years.

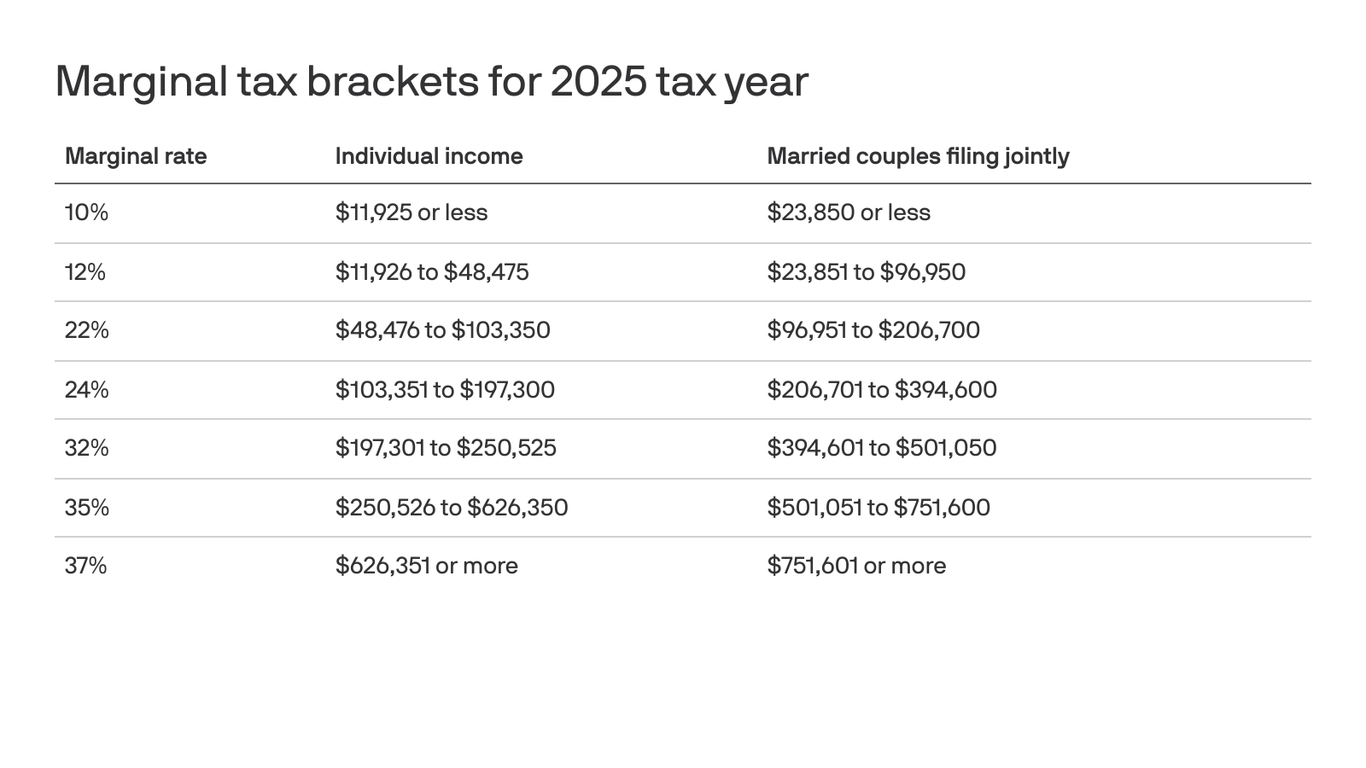

Irs Tax Deadlines In 2025 Everything You Need To Know Philtranco Complete guide to the 2025 tax act (p.l. 119 21): permanent tax cuts, enhanced deductions, new worker benefits, and business incentives explained. On july 4, 2025, sweeping new tax legislation, officially titled the “one big beautiful bill” (obbb), was signed into law, marking one of the most significant overhauls to the tax code in recent years. Here’s how federal income tax brackets shape up for 2025: retirement contribution limits. alternative minimum tax (amt) adjustments. the amt exemption amounts for 2025: earned income tax credit (eitc) for 2025. for families with three or more qualifying children, the max eitc is now $8,046. pre tax benefit adjustments. The one big beautiful bill act (obbba), signed into law on july 4, 2025, makes permanent many key provisions of the 2017 tax cuts and jobs act (tcja) and introduces new measures affecting high income taxpayers. notable changes include a permanent increase in the estate and gift tax exemption to $15 million, a more generous (although temporary) salt deduction cap, and a tiered exclusion for. From increased retirement contribution limits to adjusted standard deductions and expanded tax credits, these changes offer new opportunities for financial planning—and highlight the importance of staying informed. here’s a breakdown of the most significant tax updates for 2025:. Explore key tax changes in the 2025 'one big beautiful bill act' affecting businesses and individuals, including permanent tcja provisions, modified deductions, and international tax reforms.

The Irs Reveals Your 2025 Tax Brackets As Trump S Tax Cuts Are Set To Expire Here’s how federal income tax brackets shape up for 2025: retirement contribution limits. alternative minimum tax (amt) adjustments. the amt exemption amounts for 2025: earned income tax credit (eitc) for 2025. for families with three or more qualifying children, the max eitc is now $8,046. pre tax benefit adjustments. The one big beautiful bill act (obbba), signed into law on july 4, 2025, makes permanent many key provisions of the 2017 tax cuts and jobs act (tcja) and introduces new measures affecting high income taxpayers. notable changes include a permanent increase in the estate and gift tax exemption to $15 million, a more generous (although temporary) salt deduction cap, and a tiered exclusion for. From increased retirement contribution limits to adjusted standard deductions and expanded tax credits, these changes offer new opportunities for financial planning—and highlight the importance of staying informed. here’s a breakdown of the most significant tax updates for 2025:. Explore key tax changes in the 2025 'one big beautiful bill act' affecting businesses and individuals, including permanent tcja provisions, modified deductions, and international tax reforms.

2025 Tax Brackets Irs Releases Inflation Adjustments Standard Deduction From increased retirement contribution limits to adjusted standard deductions and expanded tax credits, these changes offer new opportunities for financial planning—and highlight the importance of staying informed. here’s a breakdown of the most significant tax updates for 2025:. Explore key tax changes in the 2025 'one big beautiful bill act' affecting businesses and individuals, including permanent tcja provisions, modified deductions, and international tax reforms.

Comments are closed.