Irs Where S My Refund

Irs Where S My Refund Pdf See your personalized refund date as soon as the irs processes your tax return and approves your refund. see your status starting around 24 hours after you e file or 4 weeks after you mail a paper return. Get refund status please enter your social security number, tax year, your filing status, and the refund amount as shown on your tax return. all fields marked with an asterisk ( * ) are required.

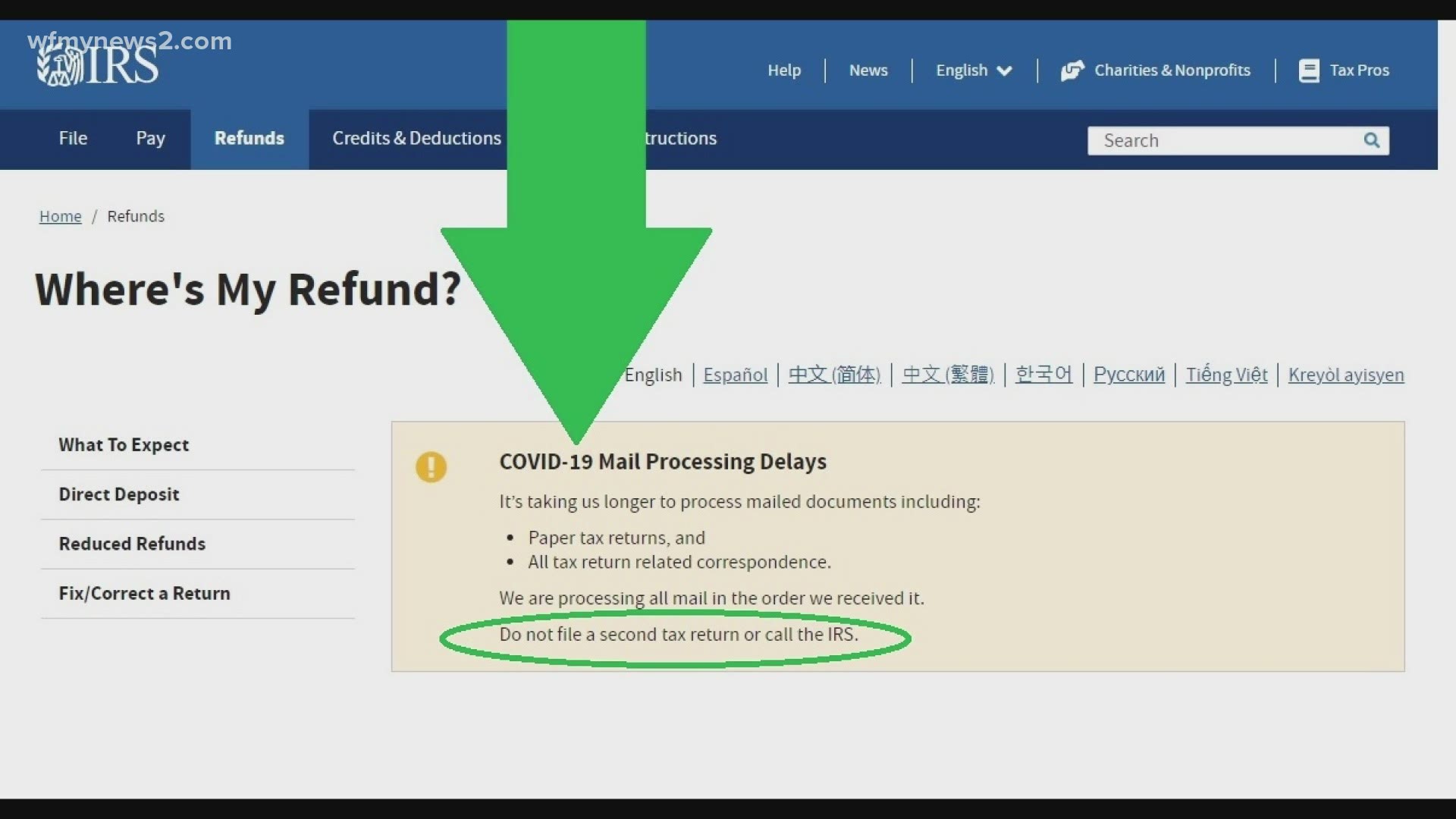

Irs Where S My Refund Where's my refund has the latest information on your return. if you don't have internet, call the automated refund hotline at 800 829 1954 for a current year refund or 866 464 2050 for an amended return. if you think we made a mistake with your refund, check where's my refund or your online account for details. file your return pay taxes on. Check your refund status online in english or spanish. where's my refund?, one of irs's most popular online features, gives you information about your federal income tax refund. the tool tracks your refund's progress through 3 stages: return received; refund approved; refund sent. Where's my refund? find the status of your last return and check on your refund. To use where's my refund?, taxpayers must enter their social security number or individual taxpayer identification number, their filing status and the exact whole dollar amount of their refund. the irs updates the tool once a day, usually overnight, so there's no need to check more often.

Irs Where S My Refund Where's my refund? find the status of your last return and check on your refund. To use where's my refund?, taxpayers must enter their social security number or individual taxpayer identification number, their filing status and the exact whole dollar amount of their refund. the irs updates the tool once a day, usually overnight, so there's no need to check more often. Taxpayers who file electronically can typically use the where’s my refund? tool to check the status of a tax refund within 24 hours of filing. it takes about four weeks for the same information to be available for those filing paper returns. Taxpayers can check the status of their refund easily and conveniently with the irs where's my refund tool at irs.gov refunds. refund status is available within 24 hours after the taxpayer e filed their current year return. Find out how to track your federal or state tax refund online or by phone through the irs or your state. know when to expect your federal tax refund. The irs has an online tool called "where's my refund" that allows you to check on the status of your refund. click here. you can start checking the status of your refund within 24 hours after you.

Comments are closed.