Key Differences Between Ach And Wire Transfers

Key Differences Between Ach And Wire Transfers On the other hand, wire transfers are direct transfers of money from one institution to another. they're faster and usually cost a larger fee. an ach transfer is an electronic transfer of. Compare ach vs. wire transfer methods based on speed, cost, and security differences to learn how to decide which method is best for any situation.

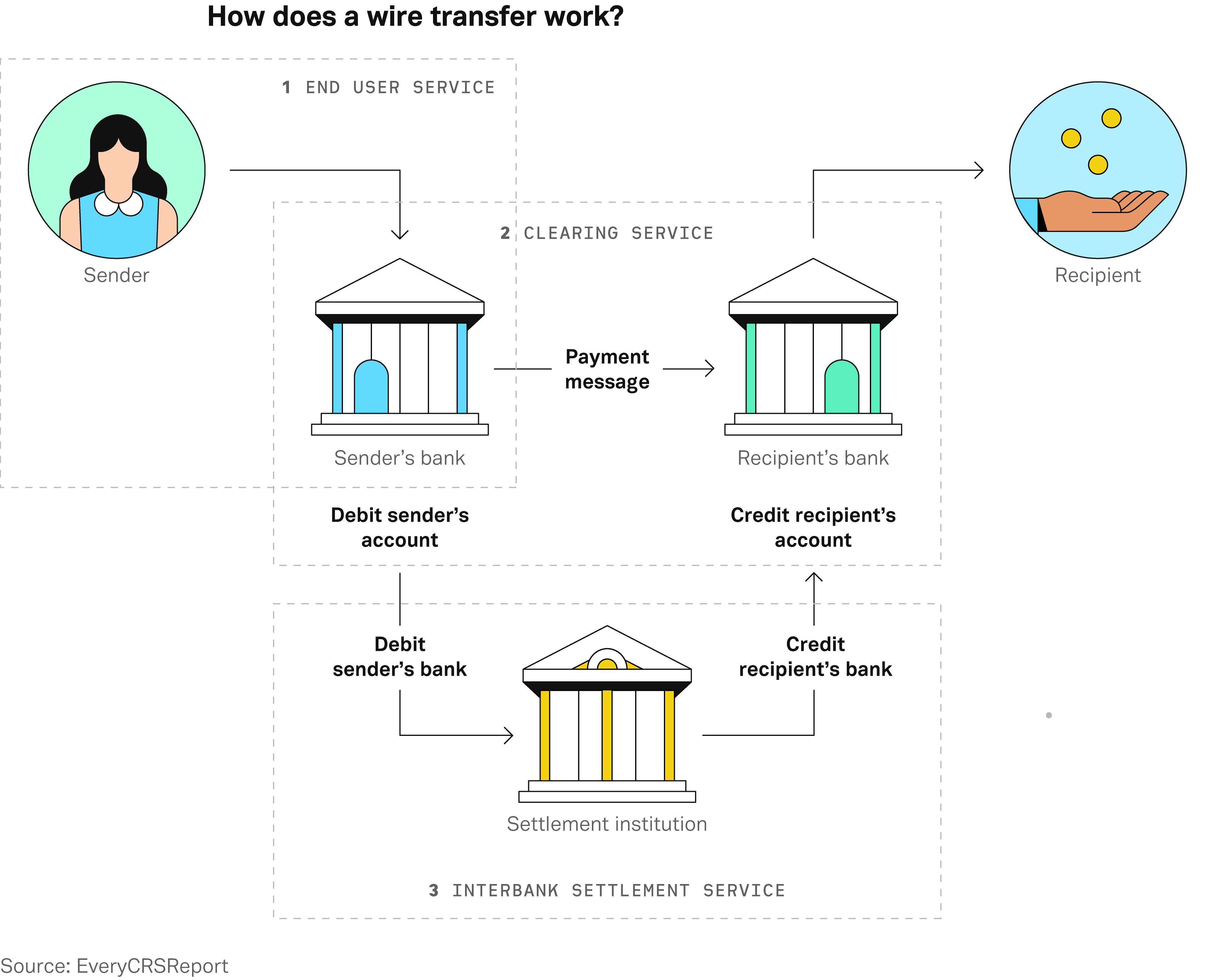

Key Differences Between Ach And Wire Transfers In this post, we have discussed the differences between ach and wire transfer. also, you will get to know their meanings in a clear way. Explore the differences between ach and wire transfers, including costs, speed, and security, to find the best option for your transactions. Wire transfers are direct, generally immediate transfers between two financial institutions. ach transfers, meanwhile, pass through the automated clearing house and can take up to a few business days. there are seven major differences between ach transfers and wire transfers, which we explore in detail below. Ach and wire transfer both describe different ways of sending money electronically. ach is more common, as it’s used for paying bills, receiving paychecks or sending money to someone. they’re also less costly, and are easier to reverse in the event of an error.

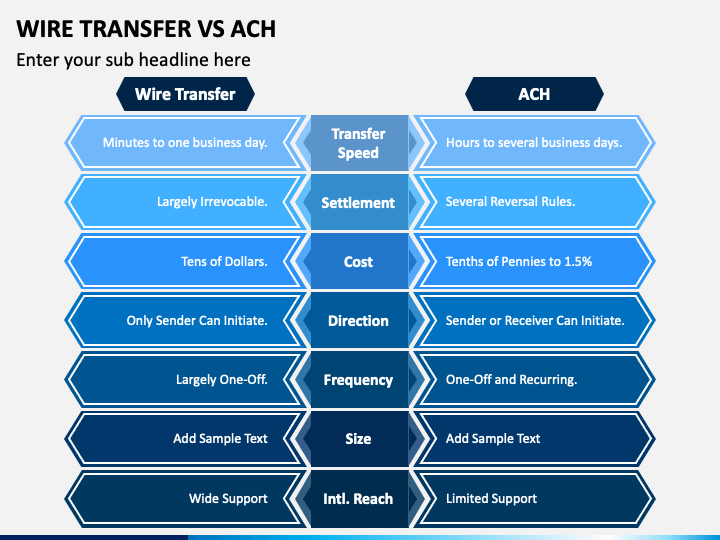

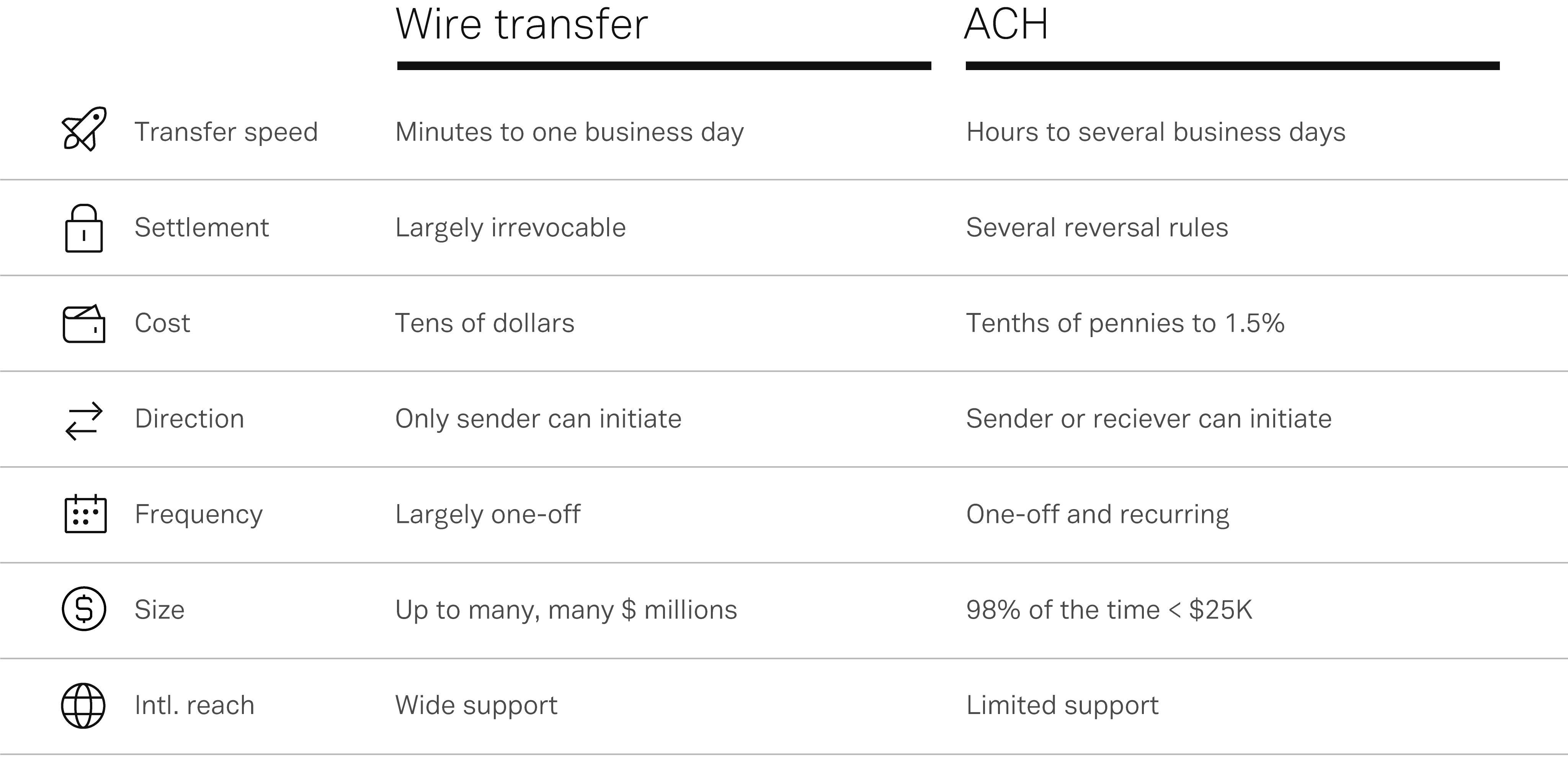

Key Differences Between Ach And Wire Transfers Wire transfers are direct, generally immediate transfers between two financial institutions. ach transfers, meanwhile, pass through the automated clearing house and can take up to a few business days. there are seven major differences between ach transfers and wire transfers, which we explore in detail below. Ach and wire transfer both describe different ways of sending money electronically. ach is more common, as it’s used for paying bills, receiving paychecks or sending money to someone. they’re also less costly, and are easier to reverse in the event of an error. The difference between ach and wire transfers often comes down to factors like cost, transaction time, and security considerations. ach transfers are cheaper, more secure, and best for everyday transactions, but can be slower to complete and limited to domestic fund transfers. Understanding these differences is crucial for making informed decisions about which method to use for your specific needs. in this article, we will delve into the key differences between ach vs wire transfer, helping you choose the best option for your financial transactions. Ach transfers: lower cost, wider use, suitable for recurring and non urgent transactions. wire transfers: higher cost, faster, ideal for high value and urgent payments. automated clearing house (ach) and wire transfers are the backbone of money movement in the u.s. Ach transfers are slower, typically taking 1 3 business days, but are more cost effective, while wire transfers are faster, often completed within hours, but come with higher fees. understanding the key differences between ach and wire transfers is essential when deciding which method to use:.

Key Differences Between Ach And Wire Transfers The difference between ach and wire transfers often comes down to factors like cost, transaction time, and security considerations. ach transfers are cheaper, more secure, and best for everyday transactions, but can be slower to complete and limited to domestic fund transfers. Understanding these differences is crucial for making informed decisions about which method to use for your specific needs. in this article, we will delve into the key differences between ach vs wire transfer, helping you choose the best option for your financial transactions. Ach transfers: lower cost, wider use, suitable for recurring and non urgent transactions. wire transfers: higher cost, faster, ideal for high value and urgent payments. automated clearing house (ach) and wire transfers are the backbone of money movement in the u.s. Ach transfers are slower, typically taking 1 3 business days, but are more cost effective, while wire transfers are faster, often completed within hours, but come with higher fees. understanding the key differences between ach and wire transfers is essential when deciding which method to use:.

Key Differences Between Ach And Wire Transfers Ach transfers: lower cost, wider use, suitable for recurring and non urgent transactions. wire transfers: higher cost, faster, ideal for high value and urgent payments. automated clearing house (ach) and wire transfers are the backbone of money movement in the u.s. Ach transfers are slower, typically taking 1 3 business days, but are more cost effective, while wire transfers are faster, often completed within hours, but come with higher fees. understanding the key differences between ach and wire transfers is essential when deciding which method to use:.

Comments are closed.