Kyc Verification Explained Checkout

Kyc Verification Explained Checkout Know your client (kyc) are a set of standards used in the investment services industry to verify customers and their risk and financial profiles. Know your customer (kyc) guidelines and regulations in financial services require professionals to verify the identity, suitability, and risks involved with maintaining a business relationship with a customer.

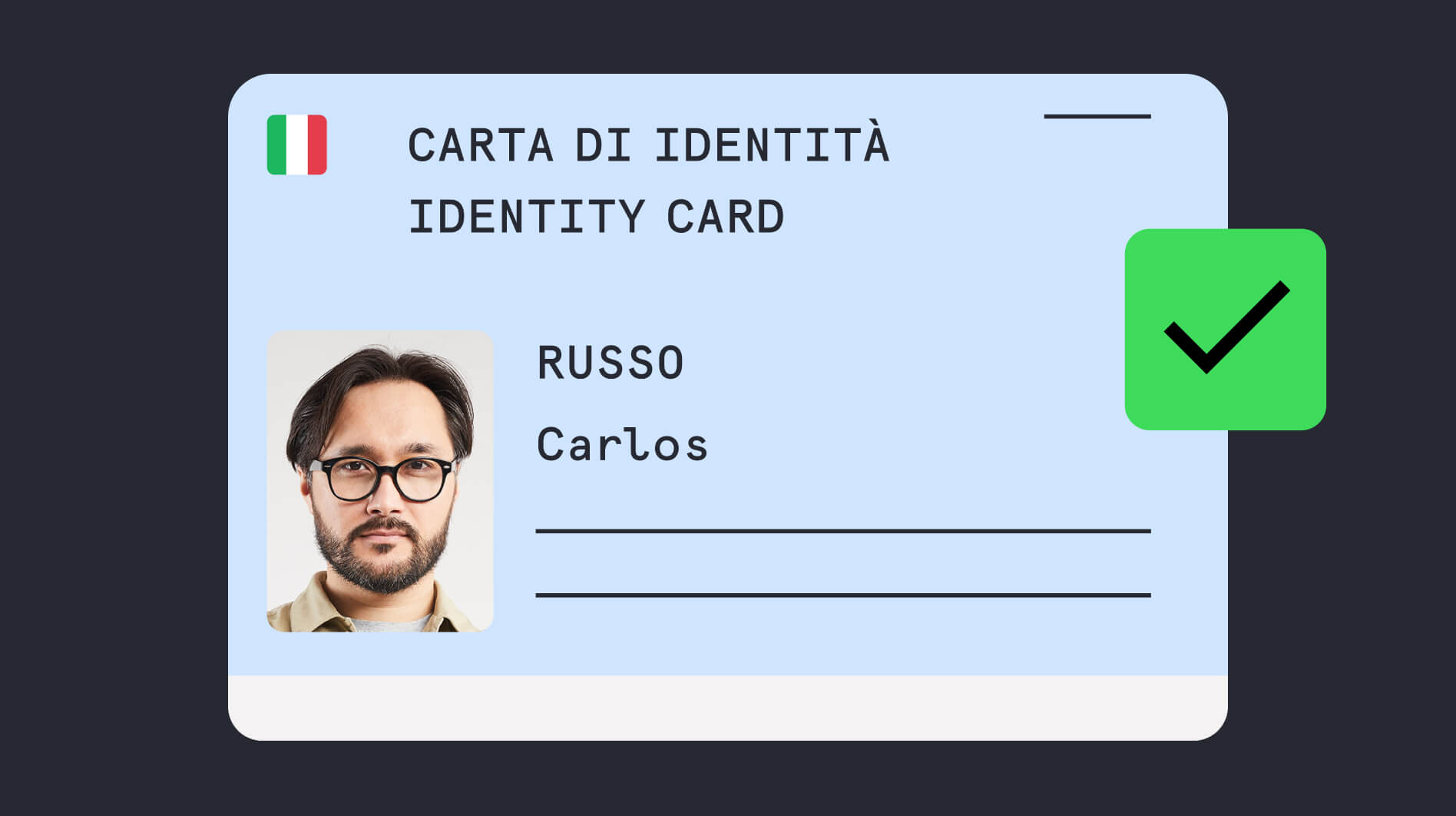

Kyc Verification Explained Checkout Kyc is an acronym for know your customer. financial institutions and businesses often use the kyc process to lower the risk of financial loss, prevent criminal activity, and stay compliant with local laws. Know your customer (kyc) is a key compliance process that verifies customer identity, prevents fraud, and ensures secure onboarding for banks and financial services. Kyc (know your customer) is a regulatory process that financial institutions and other businesses use to confirm the identities of their clients. Kyc stands for know your customer, a process that helps banks verify clients' identities during account opening and periodically after that. it ensures the information shared by clients is genuine.

Kyc Verification Explained Checkout Kyc (know your customer) is a regulatory process that financial institutions and other businesses use to confirm the identities of their clients. Kyc stands for know your customer, a process that helps banks verify clients' identities during account opening and periodically after that. it ensures the information shared by clients is genuine. What is the full kyc meaning in a business context? kyc, or the know your customer process, refers to the process of verifying the identity and background of clients.

Kyc Verification Explained Checkout What is the full kyc meaning in a business context? kyc, or the know your customer process, refers to the process of verifying the identity and background of clients.

Kyc Verification Explained Checkout

Comments are closed.