Kyc Verification Using Blockchain

Kyc Verification Using Blockchain Technology Pdf Information Technology Management Computing The blockchain architecture and the dlt allow us to collect information from various service providers into one cryptographically secure and unchanging database that does not need a third party to verify the authenticity of the knowledge. Regulatory compliance: kyc verification is a regulatory requirement for financial institutions and businesses operating in regulated industries. blockchain based kyc solutions provide an immutable audit trail, ensuring transparency and facilitating compliance verification for regulatory authorities.

Kyc Verification Software And Identity Verification In India Blockchain kyc is an upgrade to traditional kyc procedures. blockchain based kyc adequately addresses common challenges with traditional kyc, such as high costs, time inefficiencies, redundancy, and data security risks. Blockchain based kyc leverages blockchain technology’s decentralised and immutable nature to create a secure and transparent system for identity verification. this system allows for the storage, sharing, and verification of kyc data in a manner that ensures data integrity and privacy. Kyc verification is the straightforward process of authenticating a client, employee, vendor, or stakeholder’s identity using validating factors. these factors could include photo based ids, facial features, answers to randomized questions, etc which gets easier via blockchain kyc. Blockchain technology enhances kyc by providing a secure, decentralized platform for storing and verifying customer data, reducing the risk of fraud, and improving efficiency in the verification process.

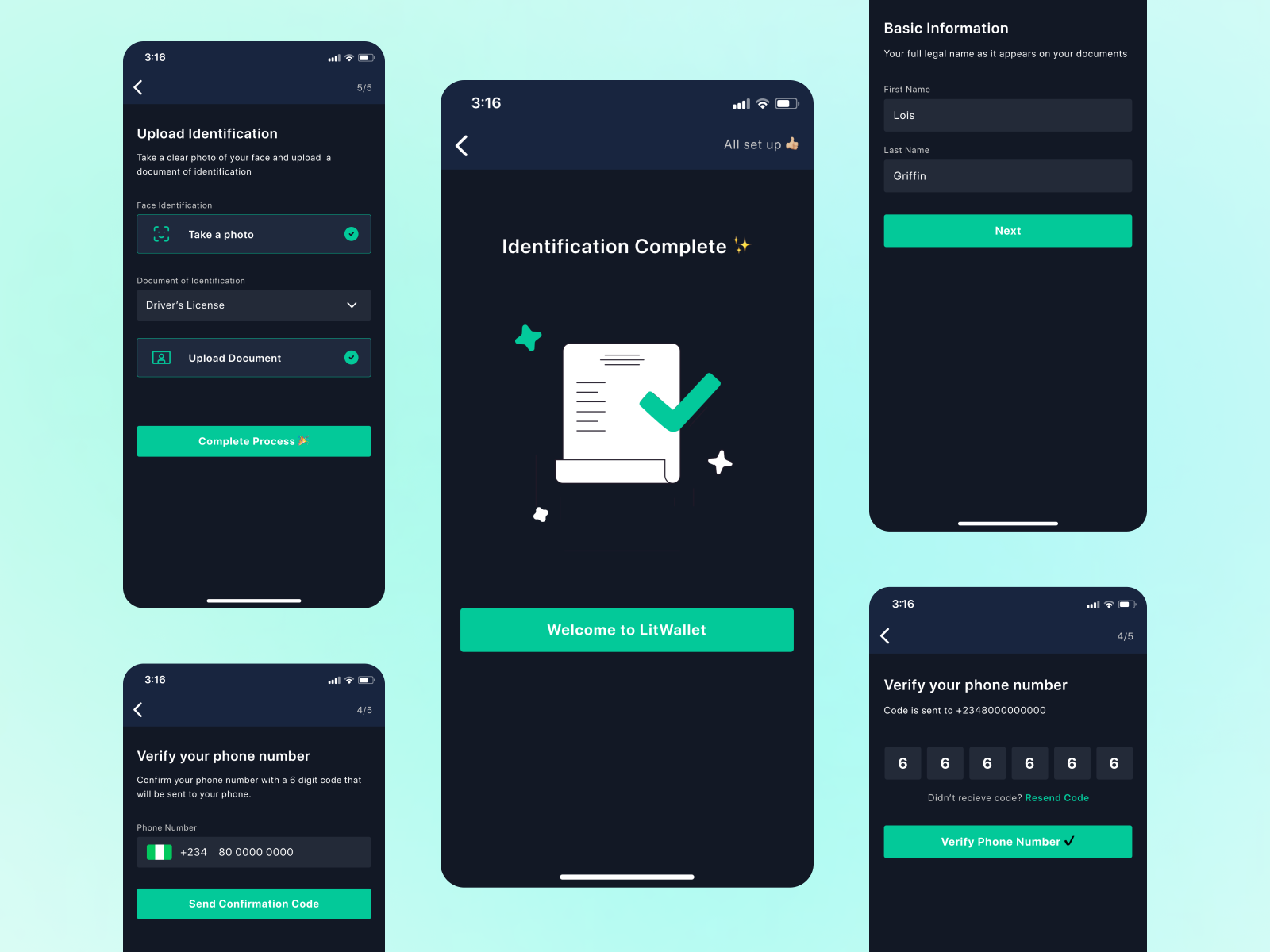

Kyc Verification Process By House On Dribbble Kyc verification is the straightforward process of authenticating a client, employee, vendor, or stakeholder’s identity using validating factors. these factors could include photo based ids, facial features, answers to randomized questions, etc which gets easier via blockchain kyc. Blockchain technology enhances kyc by providing a secure, decentralized platform for storing and verifying customer data, reducing the risk of fraud, and improving efficiency in the verification process. So, to address this issue, we propose a solution where, before storing the user’s data on the ipfs, it is encrypted using the aes encryption algorithm, and the hash of the encrypted data is provided to the user and stored on the blockchain. Kyc processes with blockchain have the potential to redefine the realm of customer verification in the financial industry. by integrating blockchain technology, institutions can create a decentralized and immutable record of customer data, ensuring its authenticity and security. Since blockchain offers features like decentralization, immutability and security, these limitations can be eliminated by using blockchain based kyc verification. in this paper, we have proposed decentralized kyc verification process using ethereum blockchain platform. Fi deploys a blockchain based kyc platform, which users complete as a one time setup using their identity documents. once uploaded, the data becomes accessible to the fi1 for verification purposes. there are multiple options when it comes to storing the users’ data: dlt platform.

Comments are closed.