Moving Average Model Maxq Technologies

Maxq Technologies Linkedin Information technology consulting services; maxq products. acumatica products; microsoft dynamics sl products; solutions. acumatica the cloud erp; microsoft dynamics sl; körber wms; lynq; cloud solutions; industries; support. technical support; support plans; maxq product’s latest releases; resources. maxq blog; events; about. about maxq. Information technology consulting services; maxq products. acumatica products; microsoft dynamics sl products; solutions. acumatica the cloud erp; microsoft dynamics sl; körber wms; lynq; cloud solutions; industries; support. technical support; support plans; maxq product’s latest releases; resources. maxq blog; events; about. about maxq.

Maxq Technologies Linkedin Maxq technologies, inc. (maxq) is a leading value added reseller and independent software vendor specializing in business solutions to the consumer goods, manufacturing, distribution, and professional service industries. In time series analysis, the moving average model (ma model), also known as moving average process, is a common approach for modeling univariate time series. [1] [2] the moving average model specifies that the output variable is cross correlated with a non identical to itself random variable. The ma model works a a finite impulse model, which means that the current noise value affects the present value of the model as well as "q" further values, as the moving average models only depend on q terms in the past. The advanced analytics module is part of maxq’s advanced revenue management (arm), a subscription management suite.

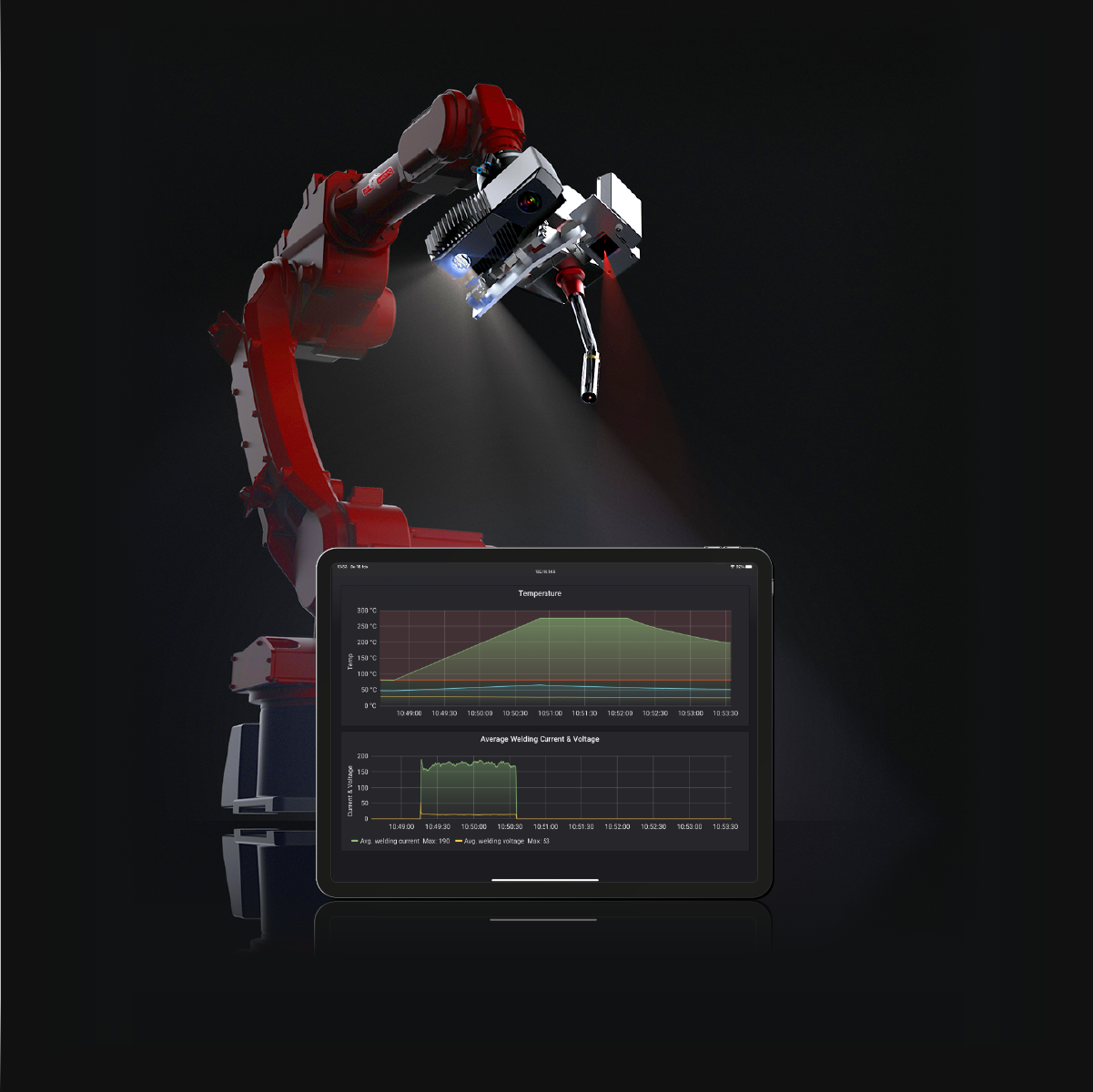

Maxq For Robot Robotic Welding Equipment For High Quality Waam The ma model works a a finite impulse model, which means that the current noise value affects the present value of the model as well as "q" further values, as the moving average models only depend on q terms in the past. The advanced analytics module is part of maxq’s advanced revenue management (arm), a subscription management suite. First order moving average models a rst order moving average process, written as ma(1), has the general equation x t = w t bw t 1 where w t is a white noise series distributed with constant variance ˙2 w. al nosedal university of toronto the moving average models ma(1) and ma(2) february 5, 2019 2 47. In conclusion, moving average ma(q) models offer a powerful framework for analyzing time series data and extracting valuable insights that drive informed decision making. We refer to this as an ma (q q) model, a moving average model of order q q. of course, we do not observe the values of εt ε t, so it is not really a regression in the usual sense. notice that each value of yt y t can be thought of as a weighted moving average of the past few forecast errors. It’s intuitively plausible that a moving average model might be superior to the mean model in adapting to the cyclical pattern and also superior to the random walk model in not being too sensitive to random shocks from one period to the next.

Maxq Sensor Suite Waam Weld And Repair High Quality Parts First order moving average models a rst order moving average process, written as ma(1), has the general equation x t = w t bw t 1 where w t is a white noise series distributed with constant variance ˙2 w. al nosedal university of toronto the moving average models ma(1) and ma(2) february 5, 2019 2 47. In conclusion, moving average ma(q) models offer a powerful framework for analyzing time series data and extracting valuable insights that drive informed decision making. We refer to this as an ma (q q) model, a moving average model of order q q. of course, we do not observe the values of εt ε t, so it is not really a regression in the usual sense. notice that each value of yt y t can be thought of as a weighted moving average of the past few forecast errors. It’s intuitively plausible that a moving average model might be superior to the mean model in adapting to the cyclical pattern and also superior to the random walk model in not being too sensitive to random shocks from one period to the next.

Comments are closed.