Net Present Value Npv In Excel Explained Should You Accept The Project

Npv Formula For Net Present Value Excel Formula Exceljet When it comes to calculating the net present value (npv) of a project in excel, it is essential to set up a well structured spreadsheet. this section will guide you through the process, providing insights from different perspectives to ensure accuracy and clarity. In today’s post, we’ll walk through the concept of net present value (npv) and how to calculate it accurately in excel. if you’ve ever wondered how to measure whether an investment is worth it, npv is one of the most practical tools you can use.

Excel Npv Function To Calculate Net Present Value In this article, i'll walk you through what npv is, how the npv formula excel works, and how to use it effectively with step by step examples. when working with financial data, calculating the net present value (npv) is a crucial step in assessing the profitability of an investment. Net present value (npv) is a financial metric used to assess the profitability of an investment or project. it calculates the difference between the present value of cash inflows and the present value of cash outflows over a period of time. Calculating the net present value (npv) is a vital skill for anyone dealing with financial analysis or business planning. whether you're assessing the viability of a new project or investment, understanding npv can help you make better decisions. Master excel's npv function with our comprehensive guide covering syntax, examples, and practical applications for investment analysis and financial decision making.

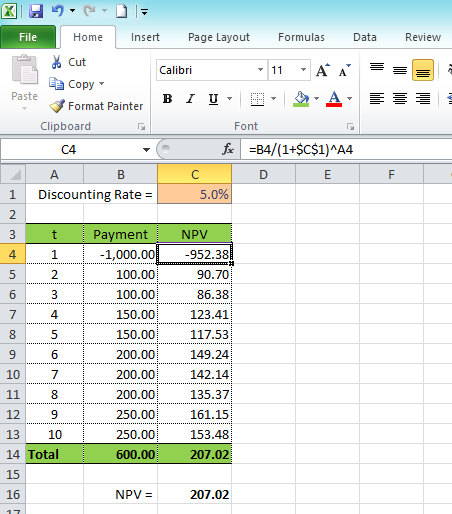

Calculating Net Present Value Npv Using Excel Excel Vba Templates Calculating the net present value (npv) is a vital skill for anyone dealing with financial analysis or business planning. whether you're assessing the viability of a new project or investment, understanding npv can help you make better decisions. Master excel's npv function with our comprehensive guide covering syntax, examples, and practical applications for investment analysis and financial decision making. We will explain the npv concept, walk through excel’s function step by step, and provide actionable tips to avoid common mistakes. by the end, you’ll be equipped to make more informed, data driven decisions. In this tutorial, we explain how to calculate the net present value (npv) of an investment project using the npv and xnpv functions in excel. we’ll show how to compute the npv without using these functions as well. "master the calculation of net present value (npv) in excel with our comprehensive guide. learn to use excel’s npv function and other tools to assess investment opportunities and make informed financial decisions.". To calculate the npv, we will use the formula below: we get the result below: the npv formula is based on future cash flows. if the first cash flow occurs at the start of the first period, the first value must be added to the npv result, not included in the values arguments.

Comments are closed.