Npv Irr Calculator Excel Template Irr Excel Spreadsheet

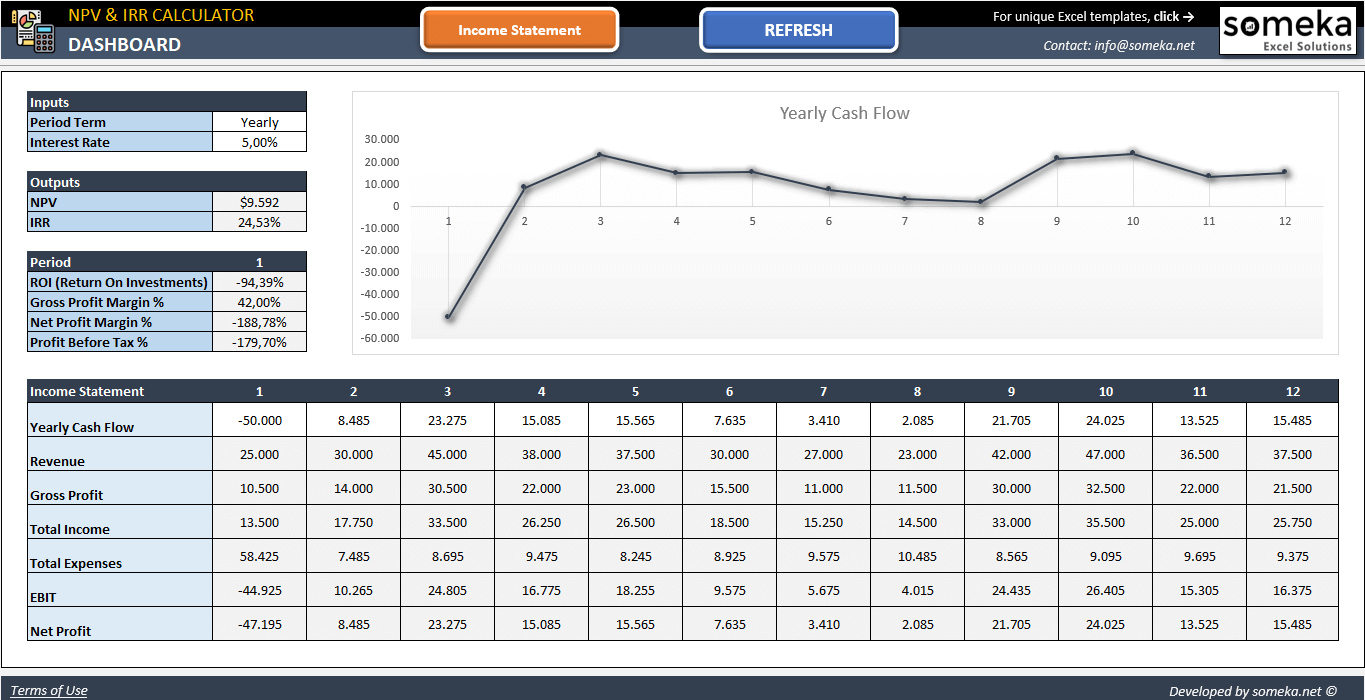

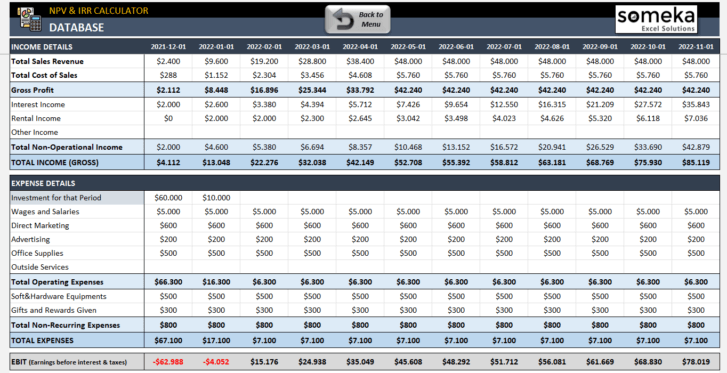

Npv Irr Calculator Excel Template This capital investment model template will help you calculate key valuation metrics of a capital investment including the cash flows, net present value (npv), internal rate of return (irr), and payback period. Npv and irr calculator is a ready to use excel template and provided as is. if you need customization on your reports or need more complex templates, please refer to our custom services.

Npv Irr Calculator Excel Template Irr Excel Spreadsheet 51 Off Download net present value calculator excel template for free. it is your investment profitability based on net present value. Running the npv function is not the only way to come down to the net present value for a given series of cashflows in excel. you can also run a manually devised formula to do that. in this section, i will show you how can you calculate npv in excel manually. We have created a simple and easy npv and xirr calculator excel template with predefined formulas. you can compare two different projects investments based on a given time and provided projected cash flows. enter a few details and the template automatically calculates the npv and xirr for you. Generally, the easiest way to calculate irr is using an excel spreadsheet. the download below allows you to work out the internal rate of return of a series of cash flows so that the npv is discounted to $0. click here to download the irr template.

Npv Calculator Template Free Npv Irr Calculator Excel Template We have created a simple and easy npv and xirr calculator excel template with predefined formulas. you can compare two different projects investments based on a given time and provided projected cash flows. enter a few details and the template automatically calculates the npv and xirr for you. Generally, the easiest way to calculate irr is using an excel spreadsheet. the download below allows you to work out the internal rate of return of a series of cash flows so that the npv is discounted to $0. click here to download the irr template. Our plug and play template simplify the process for users to quickly and accurately make this calculation. all companies and businesses have a common goal, and that is to expand and generate increasing profit and returns on the investments that are made into them. The npv and irr template for excel calculates the net present value (npv) and internal rate of return (irr) percentages for regular period cash flows. Determine the modified internal rate of return using cash flows that occur at regular intervals, such as monthly or annually, and consider both the cost of investment and the interest that is received on the reinvestment of cash.

Npv Calculator Template Free Npv Irr Calculator Excel Vrogue Co Our plug and play template simplify the process for users to quickly and accurately make this calculation. all companies and businesses have a common goal, and that is to expand and generate increasing profit and returns on the investments that are made into them. The npv and irr template for excel calculates the net present value (npv) and internal rate of return (irr) percentages for regular period cash flows. Determine the modified internal rate of return using cash flows that occur at regular intervals, such as monthly or annually, and consider both the cost of investment and the interest that is received on the reinvestment of cash.

Npv Irr Calculator Excel Template Irr Excel Spreadsheet Determine the modified internal rate of return using cash flows that occur at regular intervals, such as monthly or annually, and consider both the cost of investment and the interest that is received on the reinvestment of cash.

Comments are closed.